5 Tips First Health PPO

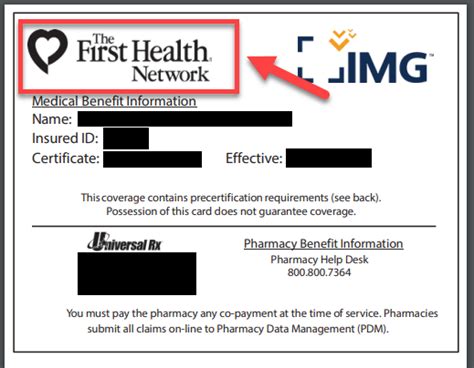

Introduction to First Health PPO

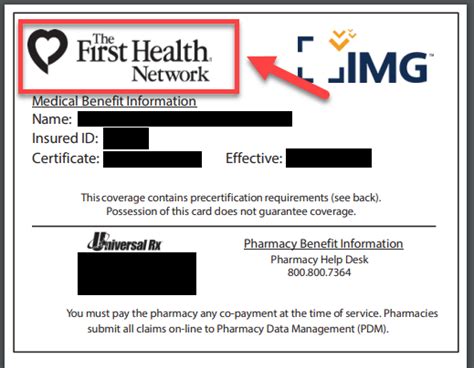

The First Health PPO (Preferred Provider Organization) is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide medical services at discounted rates. This plan allows individuals to receive medical care from any healthcare provider, both in-network and out-of-network, with varying levels of coverage and cost-sharing. In this article, we will discuss five tips to help individuals make the most of their First Health PPO plan.

Understanding the Network

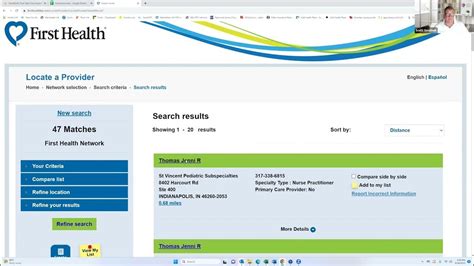

One of the most important aspects of a First Health PPO plan is the network of healthcare providers. In-network providers have contracted with the insurance company to provide medical services at discounted rates, resulting in lower out-of-pocket costs for the insured individual. On the other hand, out-of-network providers do not have a contract with the insurance company, resulting in higher out-of-pocket costs. It is essential to understand the network and choose in-network providers whenever possible to minimize costs.

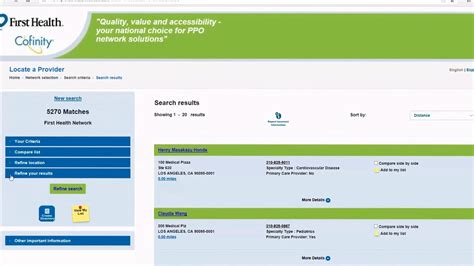

Tip 1: Choose In-Network Providers

To maximize the benefits of a First Health PPO plan, it is crucial to choose in-network providers for medical care. This can be done by: * Checking the insurance company’s website for a list of in-network providers * Contacting the insurance company’s customer service department for assistance * Asking for referrals from primary care physicians or other healthcare providers By choosing in-network providers, individuals can reduce their out-of-pocket costs and receive higher levels of coverage.

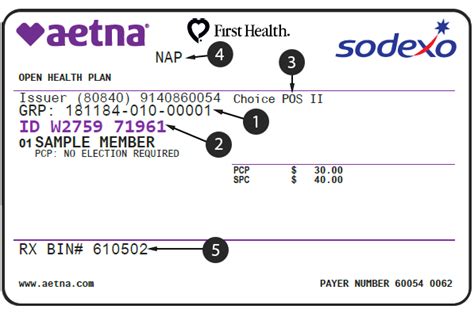

Tip 2: Understand the Coverage and Cost-Sharing

First Health PPO plans typically have varying levels of coverage and cost-sharing, depending on the specific plan and the healthcare provider. Deductibles, copays, and coinsurance are common cost-sharing mechanisms used in these plans. It is essential to understand the coverage and cost-sharing structure of the plan to avoid unexpected medical bills. Individuals should review their plan documents and ask questions if they are unsure about any aspect of the plan.

Tip 3: Take Advantage of Preventive Care Services

First Health PPO plans often cover preventive care services, such as routine check-ups, screenings, and vaccinations, at no additional cost to the insured individual. These services can help prevent illnesses and detect health problems early, reducing the need for more costly medical interventions. Individuals should take advantage of these services to maintain their health and reduce their healthcare costs.

Tip 4: Keep Track of Medical Expenses

It is essential to keep track of medical expenses, including receipts, invoices, and explanations of benefits (EOBs). This can help individuals: * Monitor their out-of-pocket costs and ensure they are not exceeding their out-of-pocket maximum * Identify any errors or discrepancies in their medical bills * Submit claims and appeals to the insurance company if necessary By keeping track of medical expenses, individuals can ensure they are receiving the correct level of coverage and reimbursement.

Tip 5: Review and Update the Plan Annually

First Health PPO plans and healthcare needs can change over time. It is essential to review and update the plan annually to ensure it continues to meet individual healthcare needs. This can involve: * Reviewing the plan’s coverage and cost-sharing structure * Checking the network of healthcare providers * Evaluating the plan’s premium and out-of-pocket costs By reviewing and updating the plan annually, individuals can ensure they have the right coverage and are maximizing the benefits of their First Health PPO plan.

💡 Note: It is essential to carefully review the plan documents and ask questions if unsure about any aspect of the plan to avoid unexpected medical bills and ensure maximum benefits.

In summary, a First Health PPO plan can provide individuals with flexibility and choice in their healthcare providers, but it is essential to understand the network, coverage, and cost-sharing structure to maximize the benefits. By following these five tips, individuals can make the most of their First Health PPO plan and reduce their healthcare costs.

What is a Preferred Provider Organization (PPO) plan?

+

A PPO plan is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide medical services at discounted rates.

What is the difference between in-network and out-of-network providers?

+

In-network providers have contracted with the insurance company to provide medical services at discounted rates, resulting in lower out-of-pocket costs. Out-of-network providers do not have a contract with the insurance company, resulting in higher out-of-pocket costs.

How can I find in-network providers?

+

You can find in-network providers by checking the insurance company’s website, contacting the insurance company’s customer service department, or asking for referrals from primary care physicians or other healthcare providers.

Related Terms:

- First Health PPO Aetna

- First Health Network phone number

- Aetna First Health Network

- First Health Network payer ID

- first health ppo customer service

- first health ppo network providers