5 Ways FSA Beats HSA

Introduction to FSA and HSA

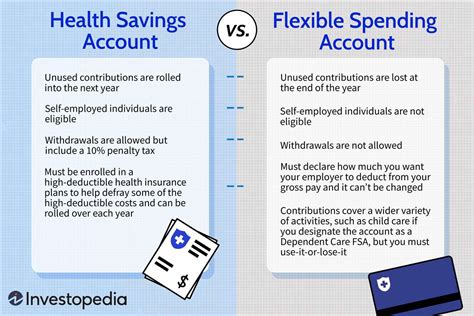

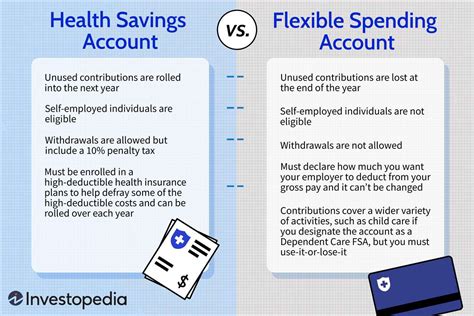

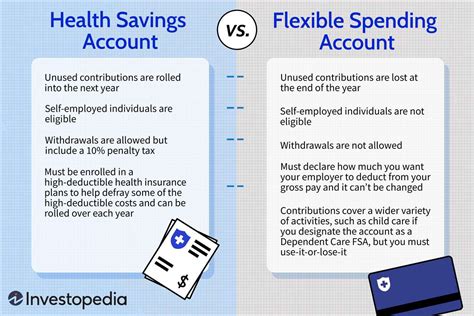

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are both tax-advantaged accounts designed to help individuals save for medical expenses. While both accounts offer tax benefits, there are key differences between them. In this article, we will explore five ways FSAs beat HSAs, highlighting the advantages of FSAs over HSAs.

What are FSAs and HSAs?

Before diving into the comparison, let’s define what FSAs and HSAs are. A Flexible Spending Account (FSA) is an employer-sponsored account that allows employees to set aside pre-tax dollars for medical expenses, childcare costs, or other eligible expenses. A Health Savings Account (HSA), on the other hand, is a savings account available to individuals with high-deductible health plans (HDHPs), allowing them to save pre-tax dollars for medical expenses.

5 Ways FSA Beats HSA

Here are five ways FSAs have an edge over HSAs:

- No Requirement for High-Deductible Health Plan: FSAs do not require participants to have a high-deductible health plan (HDHP), whereas HSAs are only available to individuals with HDHPs. This makes FSAs more accessible to a wider range of people.

- Broader Eligibility: FSAs are available to anyone whose employer offers them, regardless of their health plan or income level. HSAs, however, are only available to individuals with HDHPs and are subject to income limits.

- More Flexible Contribution Limits: FSA contribution limits are set by the employer, but the annual limit is typically higher than the HSA contribution limit. For example, in 2022, the annual FSA contribution limit was 2,850, while the HSA contribution limit was 3,650 for individual coverage and $7,300 for family coverage.

- Less Restrictive Eligible Expenses: FSAs have a more comprehensive list of eligible expenses, including childcare costs, adoption expenses, and even some over-the-counter medications. HSAs, on the other hand, are more restrictive, only covering medical expenses.

- Easier to Use: FSAs often come with debit cards or reimbursement processes, making it easier to pay for expenses directly from the account. HSAs typically require participants to pay out-of-pocket and then submit receipts for reimbursement.

Key Differences Between FSA and HSA

The following table highlights the key differences between FSAs and HSAs:

| Feature | FSA | HSA |

|---|---|---|

| Eligibility | Employer-sponsored, no HDHP required | Requires HDHP, subject to income limits |

| Contribution Limits | Typically higher, set by employer | Limited to $3,650 (individual) or $7,300 (family) |

| Eligible Expenses | Broad range, including childcare and adoption expenses | Medical expenses only |

| Portability | Typically not portable, must be used within plan year | Portable, can be taken to new employer |

💡 Note: It's essential to review the specific terms and conditions of your FSA or HSA plan, as they may vary depending on your employer or provider.

In summary, while both FSAs and HSAs offer tax advantages for medical expenses, FSAs have a more flexible and broader range of benefits, making them a more attractive option for many individuals. By understanding the differences between these two accounts, you can make informed decisions about which one is right for you.

What is the main difference between FSA and HSA?

+

The main difference between FSA and HSA is that FSA does not require a high-deductible health plan (HDHP), whereas HSA is only available to individuals with HDHPs.

Can I have both FSA and HSA?

+

Yes, you can have both FSA and HSA, but you must meet the eligibility requirements for each account, and you cannot use both accounts for the same expenses.

How do I choose between FSA and HSA?

+

To choose between FSA and HSA, consider your individual circumstances, including your health plan, income level, and medical expenses. You may also want to consult with a financial advisor or tax professional to determine which account is best for you.

In the end, it’s crucial to weigh the pros and cons of each account and consider your individual needs and circumstances before making a decision. By doing so, you can make the most of your tax-advantaged savings and ensure you’re prepared for any medical expenses that may arise.

Related Terms:

- FSA vs HSA eligible expenses

- HSA vs HRA

- FSA HSA Medicaid

- FSA vs HRA

- health equity fsa

- flexible savings account vs hsa