5 Fractyl Health Stock Tips

Introduction to Fractyl Health Stock

Fractyl Health is a company that has been making waves in the medical technology sector with its innovative approach to treating metabolic diseases. As a potential investor, it’s essential to understand the company’s background, mission, and values before making any investment decisions. Fractyl Health’s primary focus is on developing groundbreaking treatments for type 2 diabetes and other metabolic disorders. With a strong team of experts in the field, the company has been able to make significant strides in its research and development efforts.

Understanding Fractyl Health’s Technology

One of the key factors that set Fractyl Health apart from its competitors is its unique approach to treating metabolic diseases. The company’s technology is based on a revolutionary procedure that aims to restore the body’s natural ability to regulate blood sugar levels. This procedure has shown promising results in clinical trials, and as such, has garnered significant attention from investors and medical professionals alike. To better understand the company’s technology, it’s crucial to delve into the science behind it. Fractyl Health’s procedure involves a minimally invasive technique that targets the duodenum, a part of the small intestine that plays a critical role in glucose metabolism.

Fractyl Health Stock Performance

When it comes to investing in Fractyl Health stock, it’s essential to analyze the company’s past performance and future prospects. The stock has shown significant volatility in recent months, making it a high-risk, high-reward investment opportunity. However, with the company’s promising technology and strong team of experts, there is potential for long-term growth. To make informed investment decisions, it’s crucial to stay up-to-date with the latest news and developments regarding Fractyl Health’s stock performance.

5 Fractyl Health Stock Tips

For those considering investing in Fractyl Health stock, here are five valuable tips to keep in mind: * Conduct thorough research: Before making any investment decisions, it’s essential to conduct thorough research on Fractyl Health’s technology, financials, and competitive landscape. * Diversify your portfolio: To minimize risk, it’s crucial to diversify your investment portfolio by investing in a range of assets, including stocks, bonds, and other securities. * Stay up-to-date with news and developments: Staying informed about the latest news and developments regarding Fractyl Health’s stock performance is vital for making informed investment decisions. * Set clear investment goals: Before investing in Fractyl Health stock, it’s essential to set clear investment goals and risk tolerance levels to ensure that you’re making informed decisions that align with your financial objectives. * Consult with a financial advisor: If you’re new to investing or unsure about the risks and rewards associated with Fractyl Health stock, it’s recommended that you consult with a financial advisor who can provide personalized guidance and support.

Risks and Challenges

While Fractyl Health’s technology shows significant promise, there are also risks and challenges associated with investing in the company’s stock. Some of the potential risks include: * Regulatory hurdles: Fractyl Health’s technology is subject to regulatory approvals, which can be a lengthy and uncertain process. * Competition from established players: The medical technology sector is highly competitive, and Fractyl Health faces competition from established players with significant resources and expertise. * Financial risks: Investing in Fractyl Health stock carries financial risks, including the potential for significant losses if the company’s technology fails to gain traction or if the stock market experiences a downturn.

📝 Note: It's essential to carefully consider these risks and challenges before making any investment decisions regarding Fractyl Health stock.

Future Prospects

Despite the risks and challenges, Fractyl Health’s technology has significant potential for long-term growth. The company’s innovative approach to treating metabolic diseases has garnered significant attention from medical professionals and investors alike. With a strong team of experts and a revolutionary procedure that has shown promising results in clinical trials, Fractyl Health is well-positioned to make a significant impact in the medical technology sector. To illustrate the company’s future prospects, the following table provides an overview of the potential market size and growth opportunities for Fractyl Health’s technology:

| Market Segment | Potential Market Size | Growth Opportunities |

|---|---|---|

| Type 2 Diabetes | 10 billion</td> <td>High demand for innovative treatments</td> </tr> <tr> <td>Metabolic Disorders</td> <td>5 billion | Increasing prevalence of metabolic diseases |

| Medical Technology | $50 billion | Rapid advancements in medical technology |

In summary, Fractyl Health’s stock offers a high-risk, high-reward investment opportunity for those who are willing to take on the challenges and uncertainties associated with investing in a medical technology company. By conducting thorough research, diversifying your portfolio, and staying up-to-date with the latest news and developments, you can make informed investment decisions that align with your financial objectives. As the company continues to advance its technology and navigate the regulatory landscape, it’s essential to keep a close eye on Fractyl Health’s stock performance and future prospects.

What is Fractyl Health’s primary focus?

+

Fractyl Health’s primary focus is on developing groundbreaking treatments for type 2 diabetes and other metabolic disorders.

What are the potential risks associated with investing in Fractyl Health stock?

+

The potential risks associated with investing in Fractyl Health stock include regulatory hurdles, competition from established players, and financial risks.

What is the potential market size for Fractyl Health’s technology?

+

The potential market size for Fractyl Health’s technology is significant, with estimates ranging from 10 billion to 50 billion across various market segments.

Related Terms:

- NYSE RDDT

- NASDAQ NDAQ

- NASDAQ HOLO

- NYSE ANRO

- nasdaq guts burlington massachusetts amerika

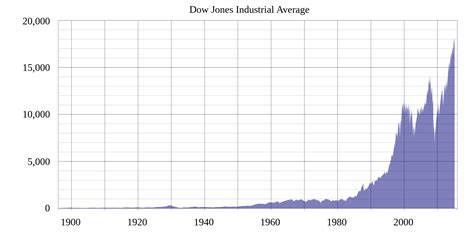

- Dow Jones Industrial Average