Health

Maximize Your Further Health Savings Account

Introduction to Health Savings Accounts

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses. The funds contributed to an HSA are not subject to federal income tax, and the interest earned on the account is tax-free as well. Additionally, the money in an HSA can be used to pay for a wide range of medical expenses, including doctor visits, hospital stays, prescriptions, and more. In this article, we will explore the benefits of HSAs and provide tips on how to maximize your further health savings account.

Benefits of Health Savings Accounts

There are several benefits to having an HSA, including: * Tax-free contributions: The money you contribute to an HSA is not subject to federal income tax, which can help reduce your taxable income. * Tax-free earnings: The interest earned on your HSA is tax-free, which means you won’t have to pay taxes on the investment gains. * Tax-free withdrawals: The money you withdraw from an HSA to pay for qualified medical expenses is tax-free, which means you won’t have to pay taxes on the withdrawals. * Portability: HSAs are portable, which means you can take them with you if you change jobs or retire. * Investment options: Many HSAs offer investment options, such as mutual funds or stocks, which can help your money grow over time.

How to Maximize Your Health Savings Account

To get the most out of your HSA, follow these tips: * Contribute as much as possible: The more you contribute to your HSA, the more you can save on taxes and the more you’ll have available to pay for medical expenses. * Choose the right investment options: If your HSA offers investment options, choose the ones that align with your investment goals and risk tolerance. * Keep your receipts: Keep receipts for all of your medical expenses, as you’ll need them to prove that you used your HSA funds for qualified expenses. * Consider a high-deductible health plan: If you’re eligible for an HDHP, consider enrolling in one, as it can help you qualify for an HSA. * Use your HSA for preventive care: Use your HSA to pay for preventive care, such as annual check-ups and screenings, to help prevent health problems from arising.

Qualified Medical Expenses

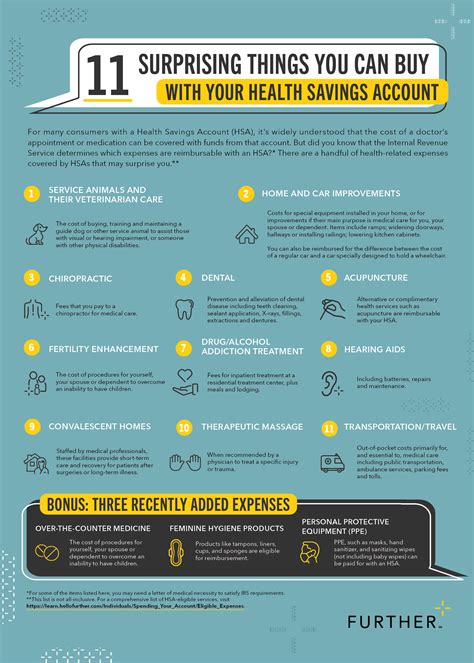

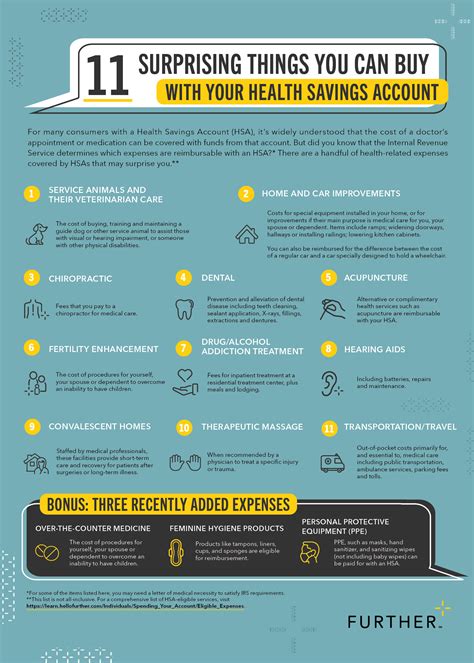

HSAs can be used to pay for a wide range of qualified medical expenses, including: * Doctor visits * Hospital stays * Prescriptions * Dental care * Vision care * Medical equipment and supplies * Transportation costs related to medical care

📝 Note: It's essential to keep receipts for all of your medical expenses, as you'll need them to prove that you used your HSA funds for qualified expenses.

Investment Options for Health Savings Accounts

Many HSAs offer investment options, such as: * Mutual funds * Stocks * Bonds * Exchange-traded funds (ETFs) * Real estate investment trusts (REITs)

| Investment Option | Risk Level | Potential Return |

|---|---|---|

| Mutual Funds | Medium | 4-8% |

| Stocks | High | 8-12% |

| Bonds | Low | 2-4% |

Conclusion and Final Thoughts

In summary, a Health Savings Account is a valuable tool for saving money on medical expenses and reducing your taxable income. By contributing as much as possible, choosing the right investment options, keeping your receipts, considering a high-deductible health plan, and using your HSA for preventive care, you can maximize your further health savings account. Remember to keep your receipts and use your HSA funds for qualified medical expenses to get the most out of your account.

What is a Health Savings Account?

+

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses.

How do I contribute to an HSA?

+

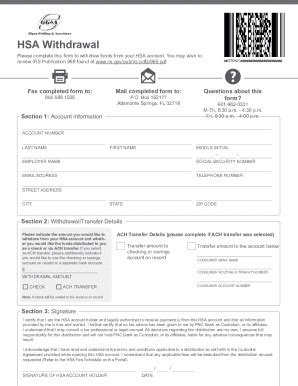

You can contribute to an HSA through payroll deductions or by making individual contributions. The contributions are tax-deductible, and the money grows tax-free.

What are qualified medical expenses?

+

Qualified medical expenses include doctor visits, hospital stays, prescriptions, dental care, vision care, medical equipment and supplies, and transportation costs related to medical care.

Related Terms:

- Further employer login

- Further HSA phone number

- Further HSA customer service

- Further HSA eligible expenses

- Further HSA card balance

- Further health equity