Gap Coverage Health Insurance

Understanding Gap Coverage Health Insurance

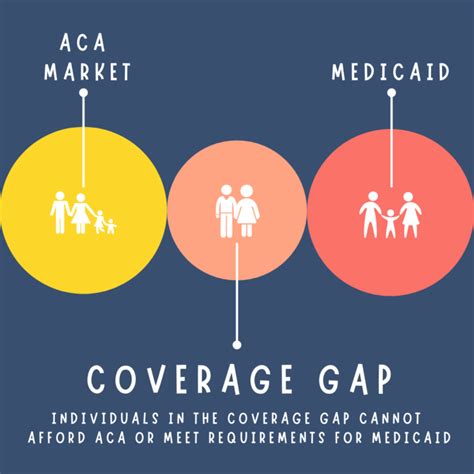

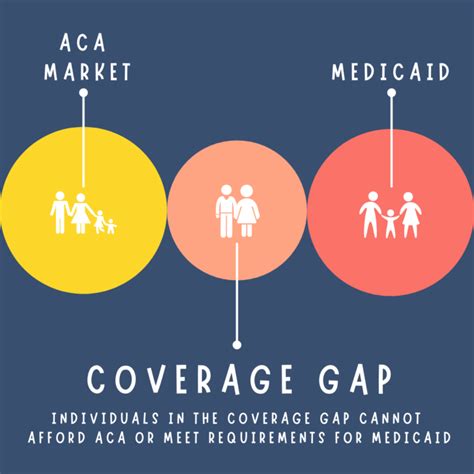

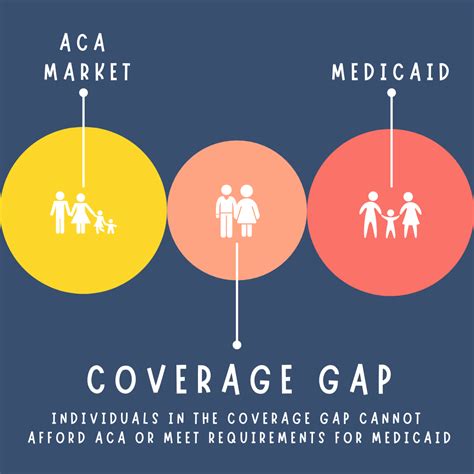

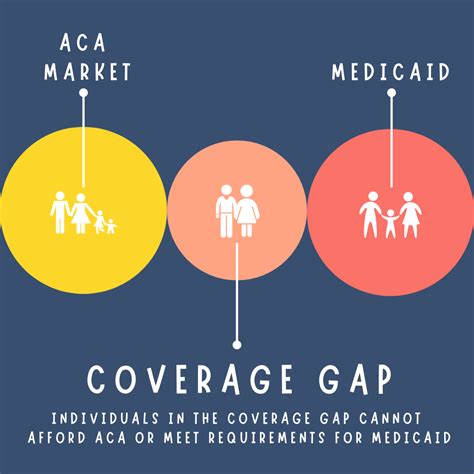

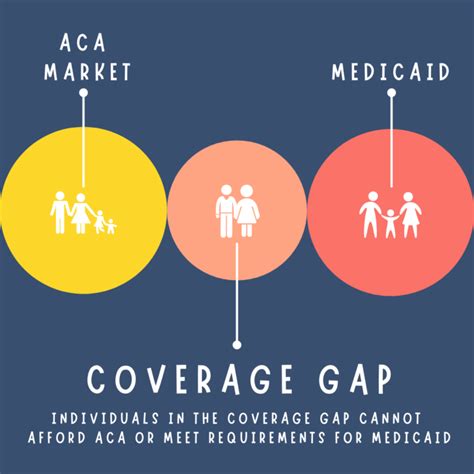

Gap coverage health insurance is a type of insurance plan that helps bridge the gap between the medical expenses covered by a primary health insurance plan and the actual costs incurred by an individual. This type of insurance is designed to provide additional financial protection to individuals who have a primary health insurance plan but still face significant out-of-pocket expenses due to deductibles, copayments, and coinsurance. Gap insurance can be especially useful for individuals who have a high-deductible health plan (HDHP) or a plan with significant cost-sharing provisions.

How Gap Coverage Health Insurance Works

Gap coverage health insurance typically works by reimbursing the insured individual for a portion of the medical expenses that are not covered by the primary health insurance plan. The gap insurance plan may pay a fixed percentage of the medical expenses or a fixed amount per day, depending on the terms of the policy. For example, if an individual has a primary health insurance plan with a $1,000 deductible and a 20% coinsurance provision, the gap insurance plan may reimburse the individual for 50% of the deductible amount and 10% of the coinsurance amount. This can help reduce the individual’s out-of-pocket expenses significantly.

Types of Gap Coverage Health Insurance

There are several types of gap coverage health insurance plans available, including: * Supplemental insurance plans: These plans provide additional coverage for specific medical expenses, such as hospital stays, surgical procedures, or doctor visits. * Indemnity plans: These plans reimburse the insured individual for a fixed amount per day or per incident, regardless of the actual medical expenses incurred. * Critical illness plans: These plans provide a lump-sum payment to the insured individual if they are diagnosed with a critical illness, such as cancer or heart disease. * Accident plans: These plans provide a lump-sum payment to the insured individual if they are injured in an accident.

Benefits of Gap Coverage Health Insurance

Gap coverage health insurance can provide several benefits to individuals who have a primary health insurance plan, including: * Reduced out-of-pocket expenses: Gap insurance can help reduce the amount of money that an individual must pay out of pocket for medical expenses. * Financial protection: Gap insurance can provide financial protection against unexpected medical expenses, which can help prevent financial hardship. * Peace of mind: Gap insurance can provide peace of mind to individuals who are concerned about the potential costs of medical care.

Eligibility and Enrollment

To be eligible for gap coverage health insurance, an individual must typically have a primary health insurance plan that meets certain requirements. For example, the primary plan may need to have a deductible of at least $1,000 or a coinsurance provision of at least 20%. Eligibility requirements may vary depending on the gap insurance plan and the insurance company. Individuals who are interested in enrolling in a gap insurance plan should contact their primary health insurance company or a licensed insurance agent to determine their eligibility and to learn more about the available plans.

Cost of Gap Coverage Health Insurance

The cost of gap coverage health insurance can vary widely depending on the type of plan, the insurance company, and the individual’s eligibility. In general, gap insurance plans are designed to be affordable, with premium costs ranging from 20 to 100 per month. However, the actual cost of the plan may be higher or lower, depending on the individual’s circumstances. Individuals who are interested in purchasing a gap insurance plan should carefully review the plan’s terms and conditions, including the premium cost, deductible, and coverage limits.

| Plan Type | Premium Cost | Deductible | Coverage Limits |

|---|---|---|---|

| Supplemental insurance plan | $50-$100 per month | $500-$1,000 | $10,000-$20,000 per year |

| Indemnity plan | $20-$50 per month | $0-$500 | $5,000-$10,000 per year |

| Critical illness plan | $100-$200 per month | $1,000-$2,000 | $20,000-$50,000 per year |

📝 Note: The cost of gap coverage health insurance can vary widely depending on the individual's circumstances and the insurance company. Individuals should carefully review the plan's terms and conditions before purchasing a policy.

Conclusion and Final Thoughts

In conclusion, gap coverage health insurance can provide valuable financial protection to individuals who have a primary health insurance plan but still face significant out-of-pocket expenses. By understanding the different types of gap insurance plans available and carefully reviewing the plan’s terms and conditions, individuals can make informed decisions about their health insurance coverage. It is essential to note that gap insurance is not a substitute for primary health insurance, but rather a supplement to help bridge the gap between the primary plan and the actual costs incurred. As the healthcare landscape continues to evolve, gap coverage health insurance is likely to play an increasingly important role in helping individuals manage their medical expenses.

What is gap coverage health insurance?

+

Gap coverage health insurance is a type of insurance plan that helps bridge the gap between the medical expenses covered by a primary health insurance plan and the actual costs incurred by an individual.

How does gap coverage health insurance work?

+

Gap coverage health insurance typically works by reimbursing the insured individual for a portion of the medical expenses that are not covered by the primary health insurance plan.

What are the benefits of gap coverage health insurance?

+

The benefits of gap coverage health insurance include reduced out-of-pocket expenses, financial protection, and peace of mind.

Related Terms:

- Best medical gap insurance

- Gap health insurance Reddit

- What is gap insurance

- Short term health insurance

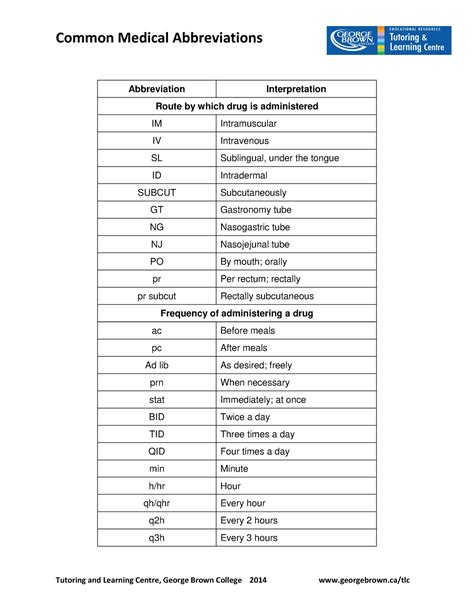

- GAP Medical Abbreviation

- Transamerica GAP Insurance