Gap Health Insurance Coverage

Introduction to Gap Health Insurance Coverage

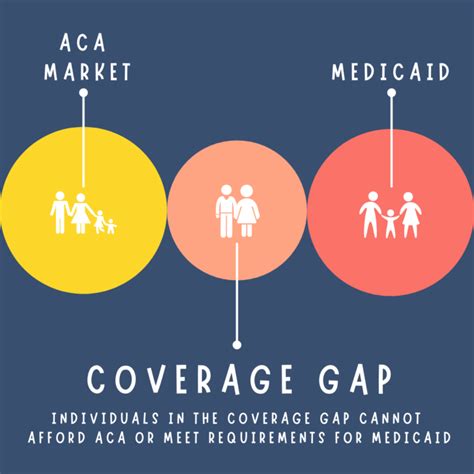

Gap health insurance coverage is a type of insurance plan that helps to fill the gaps in traditional health insurance policies. It is designed to provide additional protection against unexpected medical expenses that may not be covered by a standard health insurance plan. Gap insurance can be especially useful for individuals who have high-deductible health plans (HDHPs) or those who are at risk of incurring significant out-of-pocket medical expenses. In this article, we will delve into the world of gap health insurance coverage, exploring its benefits, how it works, and what to consider when purchasing a gap insurance plan.

How Gap Health Insurance Coverage Works

Gap health insurance coverage is typically purchased as a supplement to a traditional health insurance plan. It is designed to kick in when the insured individual or family incurs medical expenses that exceed the deductible or out-of-pocket limits of their primary health insurance plan. Gap insurance plans can be structured in various ways, but they often provide a lump sum payment or reimbursement for medical expenses incurred during a specific period. This payment can be used to help cover expenses such as hospital stays, surgical procedures, or other medical treatments.

Benefits of Gap Health Insurance Coverage

There are several benefits to purchasing gap health insurance coverage. Some of the key advantages include: * Financial protection: Gap insurance can help protect individuals and families from financial ruin in the event of unexpected medical expenses. * Reduced out-of-pocket costs: By providing a lump sum payment or reimbursement, gap insurance can help reduce the amount of money that individuals and families must pay out of pocket for medical expenses. * Increased peace of mind: Knowing that they have additional protection against unexpected medical expenses can provide individuals and families with increased peace of mind and reduced stress.

Types of Gap Health Insurance Coverage

There are several types of gap health insurance coverage available, including: * Supplemental insurance plans: These plans provide additional protection against unexpected medical expenses and can be purchased as a supplement to a traditional health insurance plan. * Critical illness insurance plans: These plans provide a lump sum payment if the insured individual is diagnosed with a critical illness, such as cancer or heart disease. * Accident insurance plans: These plans provide a lump sum payment if the insured individual is involved in an accident and incurs medical expenses as a result.

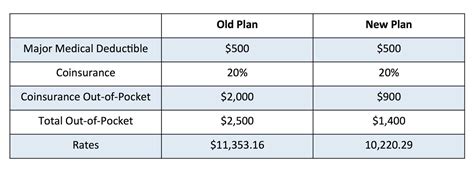

What to Consider When Purchasing Gap Health Insurance Coverage

When purchasing gap health insurance coverage, there are several factors to consider. Some of the key considerations include: * Premium costs: The premium costs of gap insurance plans can vary significantly, so it is essential to shop around and compare prices. * Coverage limits: The coverage limits of gap insurance plans can also vary, so it is crucial to consider the level of protection that is needed. * Pre-existing conditions: Some gap insurance plans may not cover pre-existing conditions, so it is essential to carefully review the plan’s terms and conditions.

| Plan Type | Coverage Limits | Premium Costs |

|---|---|---|

| Supplemental Insurance Plan | $5,000 - $10,000 | $50 - $100 per month |

| Critical Illness Insurance Plan | $10,000 - $20,000 | $100 - $200 per month |

| Accident Insurance Plan | $5,000 - $10,000 | $50 - $100 per month |

💡 Note: The coverage limits and premium costs listed in the table are examples and may vary depending on the insurance provider and the specific plan.

Conclusion and Final Thoughts

In summary, gap health insurance coverage can provide valuable protection against unexpected medical expenses. By understanding how gap insurance works, the benefits it provides, and the types of plans available, individuals and families can make informed decisions about their health insurance needs. When purchasing gap health insurance coverage, it is essential to consider factors such as premium costs, coverage limits, and pre-existing conditions. By carefully evaluating these factors and selecting the right plan, individuals and families can enjoy increased peace of mind and reduced financial stress in the event of unexpected medical expenses.

What is gap health insurance coverage?

+

Gap health insurance coverage is a type of insurance plan that helps to fill the gaps in traditional health insurance policies. It is designed to provide additional protection against unexpected medical expenses that may not be covered by a standard health insurance plan.

How does gap health insurance coverage work?

+

Gap health insurance coverage is typically purchased as a supplement to a traditional health insurance plan. It is designed to kick in when the insured individual or family incurs medical expenses that exceed the deductible or out-of-pocket limits of their primary health insurance plan.

What are the benefits of gap health insurance coverage?

+

The benefits of gap health insurance coverage include financial protection, reduced out-of-pocket costs, and increased peace of mind. By providing a lump sum payment or reimbursement, gap insurance can help reduce the financial burden of unexpected medical expenses.

Related Terms:

- Best medical gap insurance

- Gap health insurance Reddit

- Short term health insurance

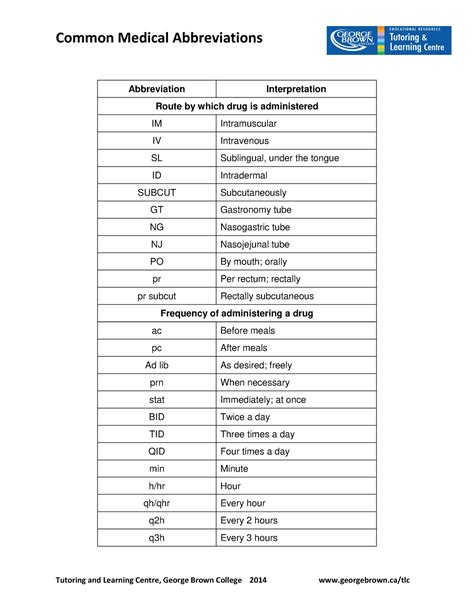

- GAP Medical Abbreviation

- What is a gap plan

- Supplemental health insurance