Gatech Health Insurance GRA Deduction 2023

Introduction to Gatech Health Insurance GRA Deduction 2023

The Georgia Institute of Technology, commonly referred to as Georgia Tech, offers various health insurance plans to its employees and students. One of the benefits provided to Graduate Research Assistants (GRAs) is health insurance. In this context, understanding the Gatech Health Insurance GRA deduction for 2023 is crucial for those who are or will be part of the program. This post aims to delve into the specifics of the health insurance deductions for GRAs at Georgia Tech, including what they can expect, how the deductions work, and any changes or updates relevant to the 2023 calendar year.

Understanding Gatech Health Insurance for GRAs

Georgia Tech’s health insurance for Graduate Research Assistants is designed to support their well-being while they are engaged in their research and academic pursuits. The university recognizes the importance of health insurance in ensuring that GRAs can focus on their work without worrying about medical expenses. The health insurance plan covers a range of services, including doctor visits, hospital stays, prescriptions, and more, aiming to provide comprehensive coverage.

GRA Deduction 2023: What to Expect

For the 2023 year, GRAs at Georgia Tech can expect their health insurance deductions to be managed through the university’s payroll system. These deductions are typically taken out on a pre-tax basis, which can help reduce the GRA’s taxable income. The exact amount deducted may vary based on the insurance plan chosen and the GRA’s individual circumstances, such as marital status or number of dependents.

How the Deductions Work

The deductions for Gatech health insurance for GRAs are usually spread out over the pay periods throughout the year. This means that instead of paying the full premium at once, GRAs pay a portion of it with each paycheck. This approach helps make the insurance more affordable by breaking down the cost into manageable, regular payments.

Importance of Health Insurance for GRAs

Health insurance is crucial for GRAs as it provides financial protection against medical expenses that can arise unexpectedly. Given the demanding nature of research work, having comprehensive health insurance can alleviate a significant source of stress, allowing GRAs to focus on their research and academic goals.

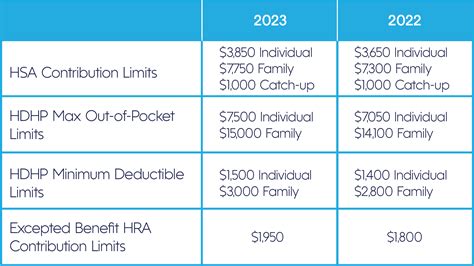

Changes and Updates for 2023

For the 2023 calendar year, it’s essential for GRAs to stay informed about any changes to the health insurance plan, including premium rates, coverage, and deductibles. The university typically communicates these updates through official channels, such as email or the Georgia Tech website. GRAs should also be aware of any open enrollment periods, during which they can make changes to their insurance plan or enroll in a new plan if they are not already covered.

Key Points to Consider

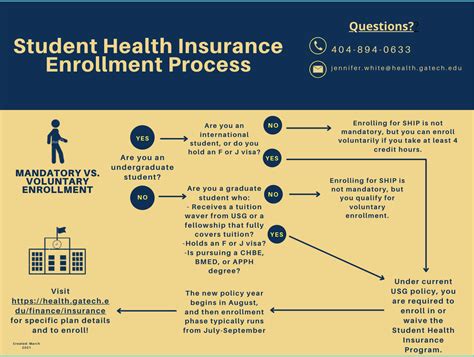

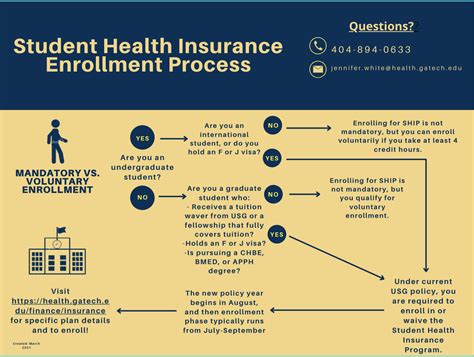

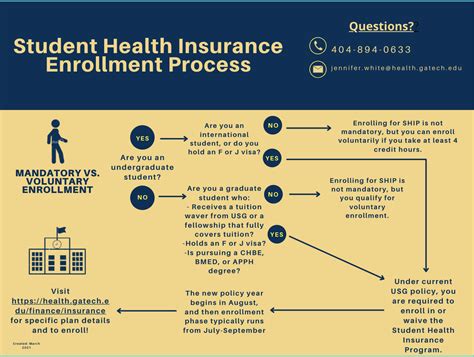

When considering the Gatech Health Insurance GRA deduction for 2023, keep the following points in mind: - Eligibility: Understand who is eligible for the health insurance plan. - Coverage: Know what is covered under the plan and what is not. - Deductibles and Premiums: Be aware of how much you will pay for premiums and any deductibles associated with the plan. - Enrollment Process: Familiarize yourself with the enrollment process, including any deadlines.

💡 Note: It's essential to review the plan documents or consult with the university's benefits administration for the most current and detailed information regarding the health insurance plan and deductions.

Conclusion and Future Outlook

In summary, the Gatech Health Insurance GRA deduction for 2023 is an important aspect of the overall compensation and benefits package for Graduate Research Assistants at Georgia Tech. Understanding the details of the health insurance plan, including deductions, coverage, and any changes or updates, is vital for making informed decisions about one’s health insurance needs. As the academic and research landscape continues to evolve, it’s crucial for GRAs to stay informed and take advantage of the benefits provided to support their well-being and academic success.

What is the purpose of health insurance for GRAs at Georgia Tech?

+

The purpose of health insurance for GRAs is to provide financial protection against medical expenses, ensuring they can focus on their research and academic pursuits without worrying about health care costs.

How are health insurance deductions managed for GRAs?

+

Health insurance deductions for GRAs are typically managed through the university’s payroll system, with deductions taken out on a pre-tax basis over the pay periods throughout the year.

Where can GRAs find more information about their health insurance plan and deductions?

+

GRAs can find more information about their health insurance plan and deductions by reviewing the plan documents, consulting with the university’s benefits administration, or visiting the Georgia Tech website.

Related Terms:

- UHCSR gatech

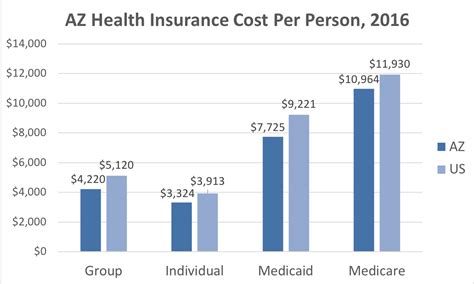

- Georgia Tech health insurance cost

- United Healthcare gatech login

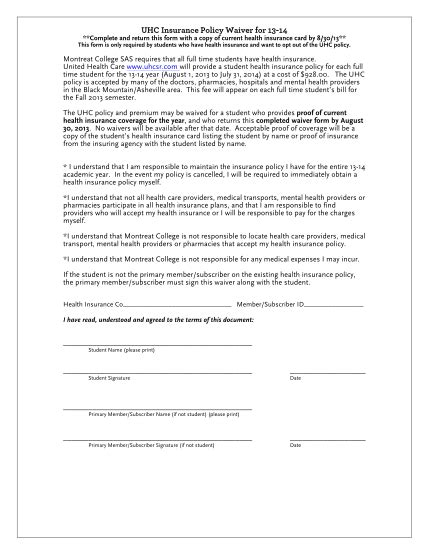

- Gatech health insurance waiver

- Gatech insurance

- Gatech dental insurance