Health

5 GRA Deduction Tips

Introduction to GRA Deduction

In today’s complex financial landscape, understanding and managing deductions is crucial for both individuals and businesses. One aspect of this is the General Revenue Administration (GRA) deduction, which plays a significant role in tax management. The GRA deduction is designed to help reduce taxable income, thereby lowering the amount of tax owed to the government. However, navigating the rules and regulations surrounding GRA deductions can be challenging. This article aims to provide insights and tips on how to effectively utilize GRA deductions to minimize tax liabilities.

Understanding GRA Deductions

Before diving into the tips, it’s essential to have a clear understanding of what GRA deductions are and how they work. GRA deductions are expenses that can be subtracted from taxable income to reduce the amount of tax payable. These deductions can include a wide range of expenses, from business operating costs to personal expenditures that qualify under tax laws. The key to benefiting from GRA deductions is to ensure that all eligible expenses are claimed accurately and in accordance with tax regulations.

5 Key Tips for GRA Deduction

To maximize the benefits of GRA deductions, consider the following tips:

- Keep Accurate Records: Maintaining detailed and accurate records of all expenses is crucial. This includes receipts, invoices, bank statements, and any other documentation that supports the deduction claims. Organized records make it easier to identify eligible expenses and to substantiate claims in case of an audit.

- Understand Eligible Expenses: Not all expenses qualify for GRA deductions. It’s vital to understand what expenses are eligible under the tax laws. This includes expenses directly related to business operations, charitable donations, and certain personal expenses like medical costs or education expenses, where applicable.

- Consult a Tax Professional: Tax laws and regulations are complex and subject to change. Consulting with a tax professional can provide valuable insights into maximizing GRA deductions. They can help identify all eligible expenses, ensure compliance with tax laws, and navigate any changes in regulations.

- Claim Deductions Timely: There are deadlines for claiming GRA deductions. Missing these deadlines can result in forfeiting the deduction for that tax year. Timely filing of tax returns and ensuring all deductions are claimed on time is essential.

- Review and Adjust: Tax situations can change from year to year. It’s important to review deduction strategies annually and adjust as necessary. This might involve reassessing business expenses, personal financial situations, or changes in tax laws that could impact deduction eligibility.

Importance of Compliance

While maximizing GRA deductions is beneficial, it’s equally important to ensure compliance with tax laws. Incorrect or fraudulent claims can lead to severe penalties, including fines and even legal action. Always ensure that deductions are legitimate and supported by adequate documentation.

Utilizing Technology for Deduction Management

Technology can play a significant role in managing GRA deductions. Tax software and digital record-keeping tools can help track expenses, identify eligible deductions, and streamline the tax filing process. These tools can also provide updates on changes in tax laws and regulations, helping to ensure compliance and maximize deductions.

📝 Note: Regularly reviewing and understanding updates to tax laws and regulations is crucial for effectively managing GRA deductions and ensuring compliance.

Conclusion and Future Planning

In summary, managing GRA deductions effectively requires a combination of understanding tax laws, maintaining accurate records, and potentially consulting with tax professionals. By following these strategies and staying informed about changes in tax regulations, individuals and businesses can minimize their tax liabilities and maximize their financial savings. As the financial landscape continues to evolve, staying proactive and adaptable in managing GRA deductions will be key to navigating future challenges and opportunities.

What are GRA deductions?

+

GRA deductions refer to expenses that can be subtracted from taxable income to reduce the amount of tax payable.

How do I maximize GRA deductions?

+

To maximize GRA deductions, keep accurate records, understand eligible expenses, consult a tax professional, claim deductions timely, and review and adjust your strategy annually.

Why is compliance with tax laws important for GRA deductions?

+

Compliance with tax laws is crucial to avoid penalties, fines, and legal action that can result from incorrect or fraudulent deduction claims.

Related Terms:

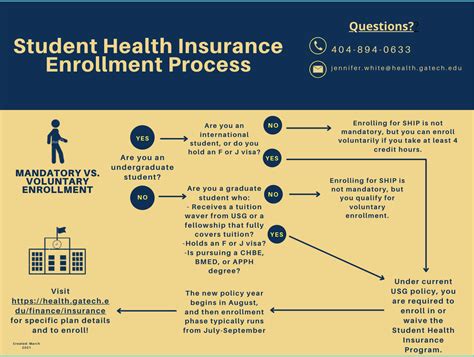

- Georgia Tech health insurance cost

- United Healthcare gatech login

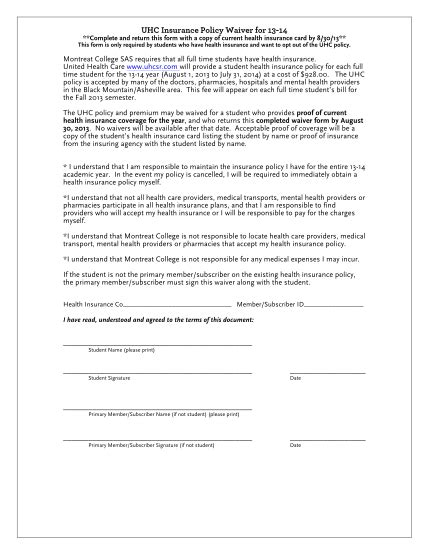

- Gatech health insurance waiver

- UHCSR gatech

- Gatech insurance

- Gatech dental insurance