5 Insurance Options

Introduction to Insurance Options

When it comes to protecting oneself and loved ones from unforeseen circumstances, insurance plays a vital role. There are numerous types of insurance available, each designed to cover different aspects of life. Understanding the various insurance options can help individuals make informed decisions about their financial security and well-being. In this article, we will delve into five essential insurance options that everyone should consider.

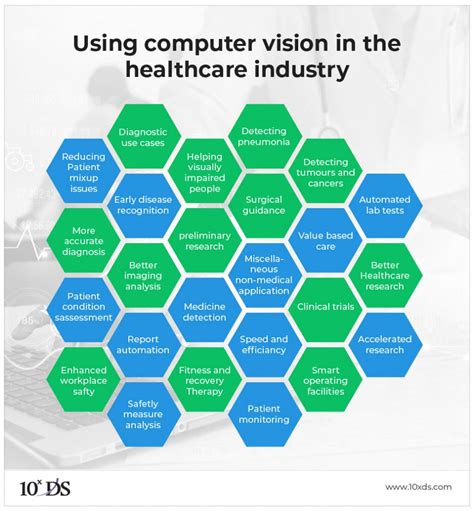

1. Health Insurance

Health insurance is one of the most critical types of insurance. It provides financial protection against medical expenses that may arise due to illness, injury, or accident. With health insurance, individuals can receive necessary medical treatment without incurring significant out-of-pocket costs. There are various types of health insurance plans, including individual, family, and group plans, each with its own set of benefits and limitations. Some key features of health insurance include: * Coverage for hospital stays * Outpatient care and treatment * Prescription medication coverage * Preventive care services

2. Life Insurance

Life insurance provides a financial safety net for loved ones in the event of one’s passing. It can help pay for funeral expenses, outstanding debts, and ongoing living costs, ensuring that family members are not burdened with these costs. There are two primary types of life insurance: term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, while whole life insurance offers lifetime coverage. Some key features of life insurance include: * Death benefit payout * Cash value accumulation * Optional riders for additional coverage * Tax-free benefits

3. Auto Insurance

Auto insurance is a must-have for vehicle owners. It protects against financial losses resulting from accidents, theft, or damage to one’s vehicle. Auto insurance policies typically include liability coverage, collision coverage, and comprehensive coverage. Some key features of auto insurance include: * Liability coverage for bodily injury and property damage * Collision coverage for vehicle damage * Comprehensive coverage for non-collision damage * Optional coverage for roadside assistance and rental cars

4. Home Insurance

Home insurance provides financial protection for homeowners against damage or loss to their property. It can help cover the cost of repairs or rebuilding in the event of natural disasters, fires, or other unforeseen circumstances. Home insurance policies typically include coverage for the dwelling, personal property, and liability. Some key features of home insurance include: * Coverage for dwelling and personal property * Liability coverage for accidents and injuries * Optional coverage for floods, earthquakes, and other natural disasters * Coverage for additional living expenses

5. Disability Insurance

Disability insurance provides financial protection in the event that an individual becomes unable to work due to illness or injury. It can help replace a portion of one’s income, ensuring that essential expenses are covered. There are two primary types of disability insurance: short-term disability insurance and long-term disability insurance. Some key features of disability insurance include: * Replacement of a portion of one’s income * Coverage for both short-term and long-term disabilities * Optional riders for additional coverage * Tax-free benefits

💡 Note: It is essential to carefully review and understand the terms and conditions of each insurance policy before making a purchase.

In summary, these five insurance options – health, life, auto, home, and disability – can provide individuals with comprehensive financial protection against various risks and uncertainties. By understanding the benefits and features of each type of insurance, individuals can make informed decisions about their insurance needs and ensure that they and their loved ones are adequately protected.

What is the primary purpose of health insurance?

+

The primary purpose of health insurance is to provide financial protection against medical expenses that may arise due to illness, injury, or accident.

What is the difference between term life insurance and whole life insurance?

+

Term life insurance provides coverage for a specified period, while whole life insurance offers lifetime coverage. Term life insurance is generally less expensive than whole life insurance, but it does not accumulate a cash value over time.

What is the importance of having auto insurance?

+

Having auto insurance is essential because it protects against financial losses resulting from accidents, theft, or damage to one’s vehicle. It can also provide liability coverage in the event of an accident, which can help protect one’s assets.

Related Terms:

- Grace Family Health portal

- Grace Health schedule appointment

- Grace Health facebook

- Programmer Grace Health

- Grace patient Portal

- Family Health Center Battle Creek