Grace Health Insurance Accepted Plans

Understanding Health Insurance Plans

When it comes to navigating the complex world of health insurance, understanding the different types of plans and their coverage is crucial. At Grace Health, we strive to provide our patients with a comprehensive range of insurance options to ensure they receive the best possible care. In this article, we will delve into the various health insurance plans accepted by Grace Health, highlighting their benefits, limitations, and what you need to know to make an informed decision.

Accepted Insurance Plans at Grace Health

At Grace Health, we accept a wide range of insurance plans from reputable providers. These include but are not limited to:

- Medicare: A federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease.

- Medicaid: A joint federal and state program that helps with medical costs for some people with limited income and resources.

- Private Insurance Plans: Such as UnitedHealthcare, Blue Cross Blue Shield, and Aetna, offering a variety of coverage options for individuals, families, and employers.

- Children’s Health Insurance Program (CHIP): Provides low-cost health coverage to children in families who earn too much money to qualify for Medicaid.

Navigating Your Insurance Plan

To ensure a smooth experience with your healthcare provider, it’s crucial to understand the basics of your insurance plan. Here are some key aspects to consider:

- Network Providers: Check if your healthcare provider, in this case, Grace Health, is within your plan’s network. Seeing an in-network provider typically reduces your out-of-pocket costs.

- Preventive Care: Most plans cover preventive care services like annual physicals, vaccinations, and screenings without charging a copay or coinsurance.

- Specialist Referrals: Some plans require a referral from your primary care physician to see a specialist. Understand if this applies to your plan and the process for obtaining a referral.

- Prescription Coverage: Check which medications are covered under your plan and if there are any restrictions or requirements for prior authorization.

Choosing the Right Plan for You

With the myriad of options available, selecting the right health insurance plan can be overwhelming. Here are some factors to consider:

- Premium Costs: The monthly cost of your plan. Balancing premium costs with the level of coverage and out-of-pocket expenses is key.

- Coverage and Benefits: Ensure the plan covers the services you need, including any ongoing treatments or medications.

- Provider Network: If you have a preferred healthcare provider or hospital, verify they are part of the plan’s network.

- Maximum Out-of-Pocket: Understand the maximum amount you could pay annually for healthcare expenses, excluding premiums.

What to Expect at Grace Health

At Grace Health, our commitment is to provide compassionate, high-quality care to all our patients. When you choose us as your healthcare provider, you can expect:

- Personalized Care: Our team of dedicated professionals is here to listen, understand your needs, and tailor a care plan that’s right for you.

- State-of-the-Art Facilities: Our facilities are equipped with the latest technology and equipment, ensuring you receive the most advanced care possible.

- Accessibility and Convenience: We strive to make healthcare accessible and convenient, with flexible appointment scheduling and a patient portal for easy communication and record access.

💡 Note: It's always a good idea to verify with your insurance provider and Grace Health to confirm the specifics of your coverage and any changes to accepted plans.

In the end, having the right health insurance plan is about finding a balance between cost, coverage, and care. By understanding your options and what each plan offers, you can make informed decisions about your health and wellbeing. At Grace Health, we are dedicated to guiding you through this process and providing you with the care you deserve.

What insurance plans are accepted at Grace Health?

+

Grace Health accepts a variety of insurance plans, including Medicare, Medicaid, private insurance plans like UnitedHealthcare, Blue Cross Blue Shield, and Aetna, as well as the Children’s Health Insurance Program (CHIP).

How do I know which healthcare services are covered under my plan?

+

To understand which services are covered, review your plan’s documentation or contact your insurance provider directly. They can provide detailed information on covered services, copays, coinsurance, and deductibles.

Can I see any healthcare provider I choose with my insurance plan?

+

It depends on your plan. Some plans have a network of providers, and seeing an in-network provider can significantly reduce your out-of-pocket costs. Check your plan’s network before scheduling an appointment.

Related Terms:

- Grace Health facebook

- Grace Health schedule appointment

- Programmer Grace Health

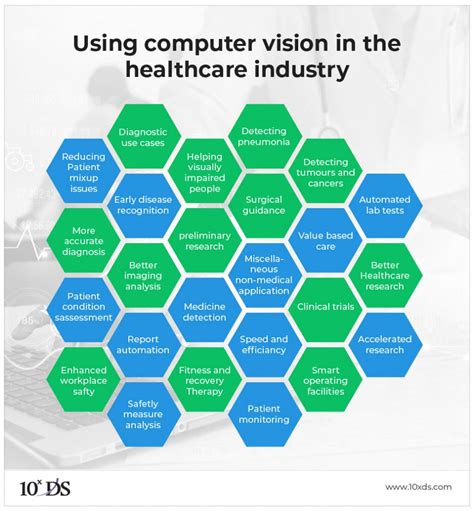

- Healthcare vision

- Grace Health dental

- Family Health Center Battle Creek