Health

5 Tips Group Health Anderson

Introduction to Group Health

Group health insurance is a type of coverage that is offered to a group of people, usually employees of a company or members of an organization. This type of insurance is often more affordable than individual health insurance plans, as the risk is spread out among a larger group of people. In Anderson, group health insurance is a popular option for businesses and organizations looking to provide health benefits to their employees.

Benefits of Group Health Insurance

There are several benefits to group health insurance, including: * Lower premiums: Group health insurance plans are often less expensive than individual plans, as the risk is spread out among a larger group of people. * Broader coverage: Group health insurance plans often offer more comprehensive coverage than individual plans, including coverage for pre-existing conditions and a wider range of medical services. * Tax benefits: Employers may be able to deduct the cost of group health insurance premiums from their taxes, which can help reduce their taxable income. * Increased employee satisfaction: Offering group health insurance can be a valuable benefit to employees, which can help increase job satisfaction and reduce turnover. * Simplified administration: Group health insurance plans are often easier to administer than individual plans, as the employer or organization can handle the paperwork and premium payments on behalf of the employees.

5 Tips for Choosing a Group Health Plan in Anderson

Choosing the right group health plan can be a daunting task, especially for small businesses or organizations with limited resources. Here are 5 tips to consider when choosing a group health plan in Anderson: * Assess your group’s needs: Consider the size and demographics of your group, as well as their health needs and preferences. This will help you choose a plan that provides the right level of coverage and benefits for your group. * Compare plan options: Research and compare different group health insurance plans, including their coverage, premiums, and out-of-pocket costs. Consider factors such as deductibles, copays, and coinsurance. * Check the network: Make sure the plan’s network includes a range of healthcare providers, including primary care physicians, specialists, and hospitals. * Consider the cost: Calculate the total cost of the plan, including premiums, deductibles, and out-of-pocket costs. Consider whether the plan is affordable for your group and whether it fits within your budget. * Read reviews and ask for referrals: Research the insurance company’s reputation and read reviews from other customers. Ask for referrals from other businesses or organizations in Anderson to get a sense of their experiences with the plan.

Types of Group Health Plans

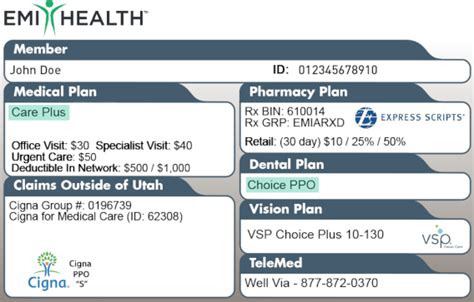

There are several types of group health plans available in Anderson, including: * Preferred Provider Organization (PPO) plans: These plans offer a network of healthcare providers, but also allow employees to see providers outside of the network at a higher cost. * Health Maintenance Organization (HMO) plans: These plans require employees to receive care from a specific network of providers, except in emergency situations. * Exclusive Provider Organization (EPO) plans: These plans offer a network of healthcare providers, but do not cover care received from providers outside of the network, except in emergency situations. * Point of Service (POS) plans: These plans combine elements of HMO and PPO plans, allowing employees to choose between receiving care from a network provider or paying more to see a provider outside of the network.

📝 Note: It's essential to carefully review and compare different group health plans to ensure you choose the best option for your group's needs and budget.

Conclusion and Final Thoughts

In conclusion, choosing the right group health plan in Anderson requires careful consideration of several factors, including the group’s needs, plan options, network, cost, and reviews. By following these 5 tips and considering the different types of group health plans available, you can make an informed decision and provide your employees with valuable health benefits. Ultimately, the right group health plan can help increase employee satisfaction, reduce turnover, and improve overall health and well-being.

What is group health insurance?

+

Group health insurance is a type of coverage that is offered to a group of people, usually employees of a company or members of an organization.

What are the benefits of group health insurance?

+

The benefits of group health insurance include lower premiums, broader coverage, tax benefits, increased employee satisfaction, and simplified administration.

How do I choose the right group health plan for my business?

+

To choose the right group health plan, assess your group’s needs, compare plan options, check the network, consider the cost, and read reviews and ask for referrals.

Related Terms:

- group health anderson ferry

- group health anderson doctors

- trihealth five mile anderson

- group health anderson pharmacy

- group health anderson cincinnati

- group health associates mychart