Health

5 Tips Group Health

Introduction to Group Health

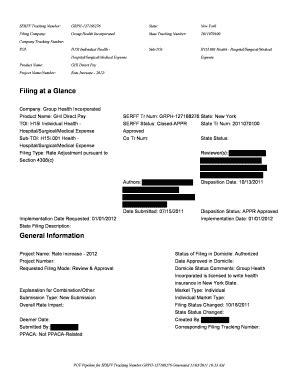

Group health insurance is a type of coverage that is offered to a group of people, usually employees of a company or members of an organization. It is a cost-effective way for employers to provide health benefits to their employees, as the risk is spread across a larger pool of people. In this article, we will discuss the importance of group health insurance and provide tips on how to choose the right plan for your organization.

Benefits of Group Health Insurance

Group health insurance offers several benefits to both employers and employees. Some of the key benefits include: * Cost savings: Group health insurance is often less expensive than individual health insurance plans. * Broader coverage: Group health insurance plans often offer more comprehensive coverage than individual plans. * Tax benefits: Employers can deduct the cost of group health insurance premiums as a business expense, reducing their taxable income. * Employee attraction and retention: Offering group health insurance can be a valuable tool for attracting and retaining top talent.

5 Tips for Choosing a Group Health Insurance Plan

Choosing the right group health insurance plan can be a daunting task, especially for small businesses or organizations with limited resources. Here are five tips to help you choose the right plan for your organization: * Tip 1: Assess Your Organization’s Needs: Before selecting a group health insurance plan, it’s essential to assess your organization’s needs. Consider the size and demographics of your workforce, as well as any specific health needs or concerns. * Tip 2: Compare Plan Options: Once you have a clear understanding of your organization’s needs, compare plan options from different insurance providers. Consider factors such as premium costs, deductibles, copays, and coverage limits. * Tip 3: Consider Network Options: Make sure to consider the network options offered by each plan. A plan with a strong network of providers can offer more flexibility and convenience for your employees. * Tip 4: Evaluate Additional Benefits: In addition to basic health coverage, consider additional benefits such as dental, vision, and life insurance. These benefits can enhance your overall compensation package and help attract and retain top talent. * Tip 5: Review Plan Administration: Finally, review the plan administration and customer service offered by each insurance provider. Look for providers that offer easy-to-use online portals, prompt claims processing, and dedicated customer support.

Common Group Health Insurance Plan Types

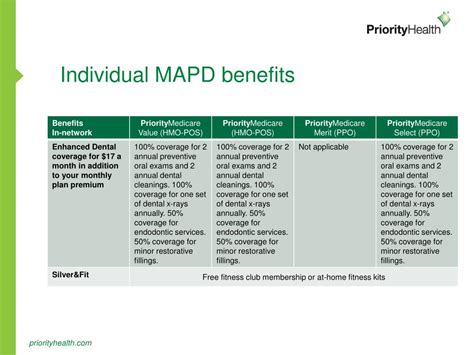

There are several types of group health insurance plans available, including: * Health Maintenance Organization (HMO) plans: These plans require employees to receive care from a specific network of providers. * Preferred Provider Organization (PPO) plans: These plans offer a network of preferred providers, but also allow employees to see providers outside of the network at a higher cost. * Point of Service (POS) plans: These plans combine elements of HMO and PPO plans, allowing employees to choose between a network of providers and out-of-network care. * Exclusive Provider Organization (EPO) plans: These plans offer a network of providers, but do not cover out-of-network care except in emergency situations.

| Plan Type | Network Requirements | Out-of-Network Coverage |

|---|---|---|

| HMO | Required | No |

| PPO | Preferred | Yes, at higher cost |

| POS | Choice between network and out-of-network | Yes, at higher cost |

| EPO | Required | No, except in emergency situations |

💡 Note: It's essential to carefully review the terms and conditions of each plan type to ensure you choose the best option for your organization.

In summary, choosing the right group health insurance plan requires careful consideration of your organization’s needs, plan options, network requirements, and additional benefits. By following these tips and evaluating different plan types, you can provide valuable health benefits to your employees while controlling costs and enhancing your overall compensation package. The key to success lies in finding a balance between cost, coverage, and convenience, and selecting a plan that meets the unique needs of your organization.

Related Terms:

- emblem hip vs ghi

- group health incorporated phone number

- who is emblem health through

- emblem health log in

- group health incorporated insurance

- united health group incorporated stock