5 Ways Hawaii Health Insurance

Introduction to Hawaii Health Insurance

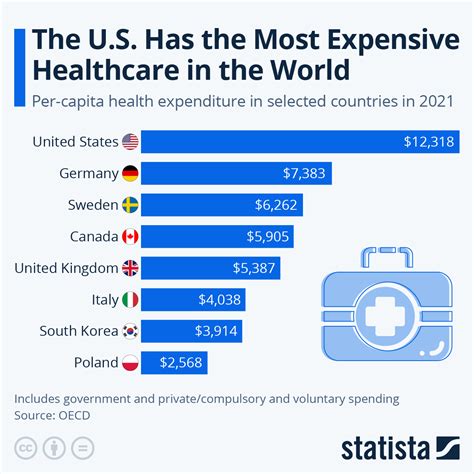

The state of Hawaii is known for its beautiful beaches, lush greenery, and active volcanoes. However, like any other state, Hawaii also has its own set of healthcare challenges. With the rising cost of medical care, it’s essential for residents to have a reliable health insurance plan. In this article, we’ll explore the 5 ways Hawaii health insurance can benefit residents and provide them with the necessary protection against unexpected medical expenses.

Understanding Hawaii Health Insurance

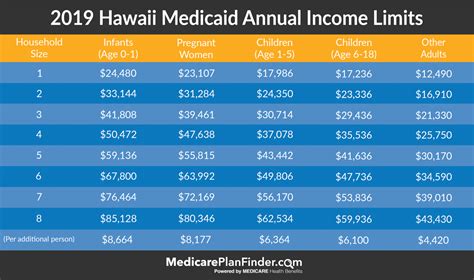

Before we dive into the benefits of Hawaii health insurance, it’s crucial to understand the different types of plans available. Individual and family plans are designed for those who are not covered by their employer or are self-employed. Group plans are offered by employers to their employees, while Medicaid and CHIP (Children’s Health Insurance Program) provide coverage for low-income individuals and families. Medicare is a federal program that offers health insurance to seniors and people with disabilities.

Benefits of Hawaii Health Insurance

Here are 5 ways Hawaii health insurance can benefit residents: * Protection against unexpected medical expenses: With a health insurance plan, residents can avoid financial ruin in case of unexpected medical emergencies. * Access to preventive care: Many health insurance plans cover preventive care services, such as annual check-ups, vaccinations, and screenings, which can help prevent illnesses and detect health problems early. * Coverage for chronic conditions: Hawaii health insurance plans can provide coverage for chronic conditions, such as diabetes, heart disease, and cancer, which can be expensive to manage without insurance. * Mental health and substance abuse coverage: Many health insurance plans in Hawaii cover mental health and substance abuse services, which can help residents struggling with these issues. * Discounts and cost-sharing: Some health insurance plans in Hawaii offer discounts and cost-sharing arrangements, which can help reduce out-of-pocket expenses for residents.

Types of Hawaii Health Insurance Plans

There are several types of Hawaii health insurance plans available, including: * HMO (Health Maintenance Organization) plans: These plans require residents to receive medical care from a specific network of providers. * PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing residents to receive medical care from both in-network and out-of-network providers. * EPO (Exclusive Provider Organization) plans: These plans combine elements of HMO and PPO plans, offering a network of providers and some out-of-network coverage. * Catastrophic plans: These plans are designed for young adults and others who are exempt from the ACA requirement, offering limited coverage at a lower cost.

How to Choose the Right Hawaii Health Insurance Plan

With so many options available, choosing the right Hawaii health insurance plan can be overwhelming. Here are some tips to consider: * Assess your health needs: Consider your medical history, current health status, and any ongoing health conditions when selecting a plan. * Compare plan options: Research and compare different plans, considering factors such as premium cost, deductible, copayment, and coinsurance. * Check the network: Make sure your preferred healthcare providers are part of the plan’s network. * Read reviews and ask questions: Research the insurance company’s reputation and ask questions about the plan’s coverage and benefits.

📝 Note: When selecting a Hawaii health insurance plan, it's essential to carefully review the plan's benefits, limitations, and exclusions to ensure you're getting the right coverage for your needs.

Conclusion and Final Thoughts

In conclusion, Hawaii health insurance is a crucial aspect of protecting one’s health and financial well-being. By understanding the different types of plans available and considering individual health needs, residents can choose the right plan for themselves and their families. With the right coverage, Hawaii residents can enjoy peace of mind, knowing they’re protected against unexpected medical expenses and have access to quality healthcare services.

What is the difference between an HMO and PPO plan?

+

An HMO plan requires residents to receive medical care from a specific network of providers, while a PPO plan offers more flexibility, allowing residents to receive medical care from both in-network and out-of-network providers.

How do I choose the right Hawaii health insurance plan for my needs?

+

When selecting a Hawaii health insurance plan, consider your health needs, compare plan options, check the network, read reviews, and ask questions about the plan’s coverage and benefits.

What is Medicaid, and who is eligible for coverage?

+

Medicaid is a federal program that provides health insurance to low-income individuals and families. Eligibility varies by state, but in general, it’s available to those with limited income and resources.

Related Terms:

- Hawaii health insurance Marketplace

- Hawaii health insurance cost

- hawaii health insurance buka sekarang

- Hawaii health insurance requirements

- Hawaii health insurance for unemployed

- Free health insurance Hawaii