HealthAde Financial Statements Review

Introduction to HealthAde Financial Statements Review

When analyzing the financial health and potential of a company, one of the most critical steps is to review its financial statements. For HealthAde, a company known for its kombucha and other health-related products, understanding its financial position, performance, and cash flows is essential for investors, stakeholders, and anyone interested in the company’s financial well-being. This review aims to delve into the key components of HealthAde’s financial statements, providing insights into its financial health and future prospects.

Understanding Financial Statements

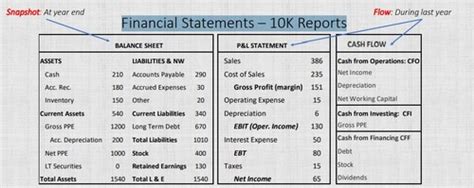

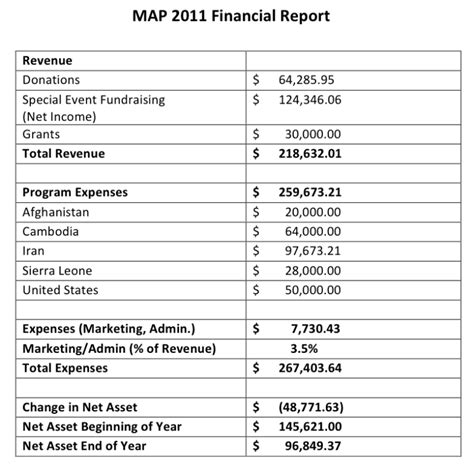

Before diving into HealthAde’s financials, it’s crucial to understand the three primary financial statements: the Balance Sheet, the Income Statement, and the Cash Flow Statement. - The Balance Sheet provides a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity. - The Income Statement shows the revenues and expenses over a period, resulting in net income or loss. - The Cash Flow Statement categorizes the company’s cash inflows and outflows into operating, investing, and financing activities, helping to assess its liquidity and solvency.

Review of HealthAde’s Financial Statements

To conduct a comprehensive review, we would typically examine each of the financial statements in detail. However, since specific financial data for HealthAde is not provided, we’ll discuss the general approach to analyzing these statements and highlight key points of interest.

Balance Sheet Analysis

A thorough analysis of the Balance Sheet would involve looking at: * Assets: Are they properly valued? What is the composition of current vs. non-current assets? * Liabilities: What is the debt structure? Are there any signs of over-leveraging? * Equity: How has shareholder equity changed over time?

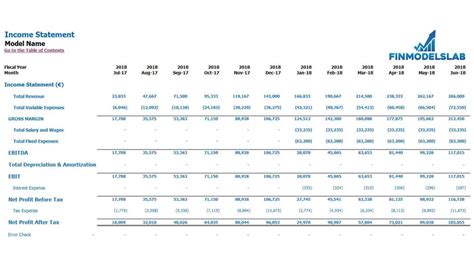

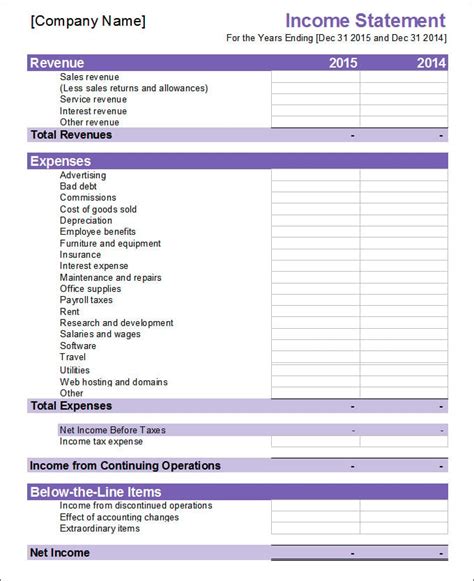

Income Statement Analysis

For the Income Statement: * Revenue Growth: Is there a consistent increase in revenues? What drives this growth? * Cost Structure: What are the main cost components? Are there any opportunities for cost reduction? * Profitability: What are the profit margins? How do they compare to industry averages?

Cash Flow Statement Analysis

The Cash Flow Statement helps in understanding: * Operational Cash Flow: Is the company generating sufficient cash from its operations? * Investing Activities: What investments is the company making? Are they likely to generate future cash flows? * Financing Activities: How is the company funding its operations and investments?

Financial Ratios and Metrics

In addition to the financial statements, various financial ratios and metrics provide valuable insights into a company’s financial health and performance. Some key ratios include: * Current Ratio: Indicates a company’s ability to pay short-term debts. * Debt-to-Equity Ratio: Shows the extent of leverage. * Return on Equity (ROE): Measures profitability from shareholders’ perspective. * Price-to-Earnings (P/E) Ratio: Helps in valuing the company relative to its earnings.

Industry Comparison

Comparing HealthAde’s financial performance with industry averages and competitors can highlight its relative strengths and weaknesses. This comparison can involve looking at similar metrics and ratios across the industry to understand where HealthAde stands.

Future Outlook and Growth Prospects

The future outlook for HealthAde would depend on various factors including market trends, competition, regulatory environment, and the company’s strategic plans. Factors such as innovation, expansion into new markets, and the ability to adapt to changing consumer preferences would play a significant role in determining its growth prospects.

💡 Note: When analyzing financial statements, it's also important to consider external factors such as economic conditions, industry trends, and regulatory changes that could impact the company's financial health and performance.

Conclusion and Final Thoughts

In conclusion, a thorough review of HealthAde’s financial statements, supplemented by industry comparisons and an analysis of financial ratios, provides a comprehensive view of its financial health and growth prospects. Understanding these elements is crucial for making informed decisions, whether as an investor, stakeholder, or simply someone interested in the company’s well-being. By considering both the internal financial dynamics and external influences, one can gain a deeper insight into HealthAde’s position within its industry and its potential for future success.

What are the primary financial statements used in analyzing a company’s financial health?

+

The primary financial statements are the Balance Sheet, the Income Statement, and the Cash Flow Statement. Each provides unique insights into a company’s financial position, performance, and cash flows.

Why is it important to analyze financial ratios and metrics?

+

Financial ratios and metrics, such as the current ratio, debt-to-equity ratio, and return on equity, offer insights into a company’s liquidity, leverage, profitability, and efficiency, helping to assess its financial health and performance.

What role does industry comparison play in financial analysis?

+

Industry comparison helps in understanding a company’s relative performance and position within its sector. By comparing financial metrics and ratios with industry averages and competitors, one can identify the company’s strengths, weaknesses, and areas for improvement.

Related Terms:

- Health Ade acquisition

- Who owns Health Ade Kombucha