5 Health-Ade Financial Tips

Introduction to Healthy Financial Habits

In today’s fast-paced world, maintaining a healthy financial lifestyle is just as important as a healthy physical lifestyle. Financial stability and security can significantly reduce stress and improve overall well-being. Developing healthy financial habits can seem daunting, but with the right strategies and mindset, anyone can achieve financial health. This article will delve into five essential Health-Ade financial tips designed to help individuals cultivate a stronger financial foundation.

Understanding the Importance of Financial Health

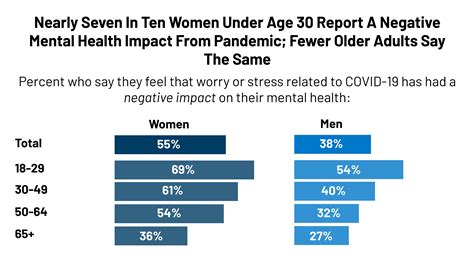

Before diving into the tips, it’s crucial to understand why financial health is vital. Financial health affects not only your economic stability but also your mental and physical health. Chronic stress about financial issues can lead to anxiety, depression, and even physical ailments like hypertension and digestive problems. By adopting healthy financial habits, you can mitigate these risks and ensure a more balanced and peaceful life.

Tip 1: Create a Budget and Track Expenses

The first step towards achieving financial health is creating a personal budget. A budget acts as a roadmap for your money, helping you understand where your income is going and identifying areas where you can cut back on unnecessary expenses. To create an effective budget: - Calculate your total monthly income. - List all your fixed expenses (rent, utilities, car payments, etc.). - Estimate your variable expenses (groceries, entertainment, etc.). - Set aside a portion for savings and emergency funds. - Regularly review and adjust your budget as your financial situation changes.

💡 Note: Using budgeting apps can make tracking expenses easier and more efficient.

Tip 2: Build an Emergency Fund

An emergency fund is a safety net that protects you from financial shocks, such as car repairs, medical bills, or losing your job. Aim to save enough to cover 3-6 months of living expenses. Having this fund in place can provide peace of mind and prevent you from going into debt when unexpected expenses arise.

Tip 3: Manage Debt Effectively

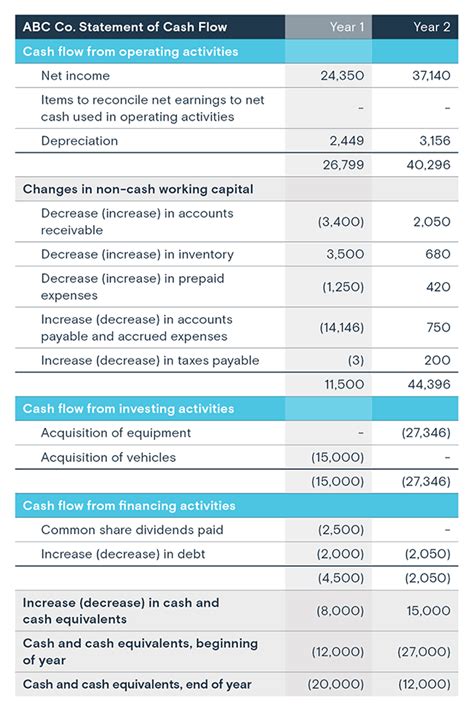

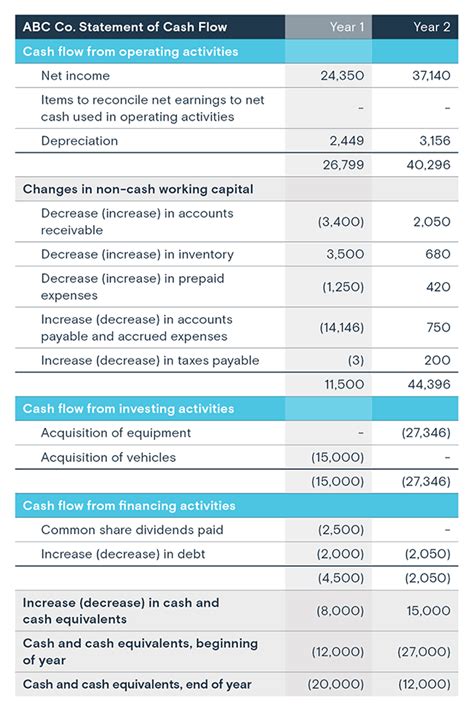

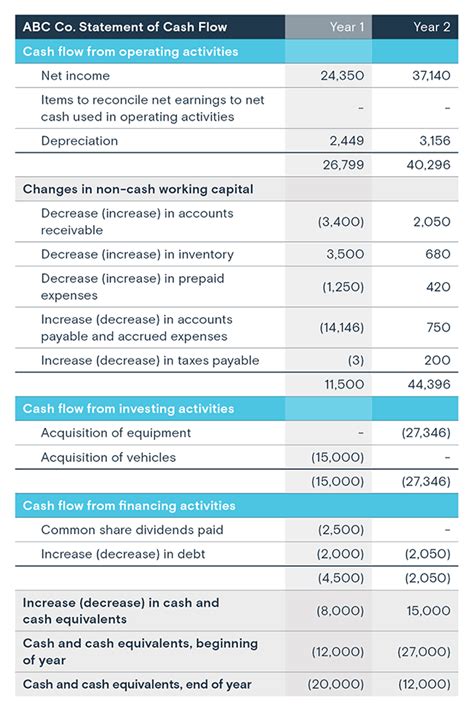

Debt management is a critical aspect of financial health. High-interest debts, such as credit card balances, can quickly spiral out of control. Strategies for managing debt include: - The snowball method: Paying off debts with the smallest balances first. - The avalanche method: Prioritizing debts with the highest interest rates. - Debt consolidation: Combining multiple debts into one loan with a lower interest rate.

Tip 4: Invest for the Future

Investing is key to building wealth over time. It allows your money to grow, helping you achieve long-term financial goals, such as retirement or buying a house. Consider consulting with a financial advisor to find investment opportunities that align with your risk tolerance and financial objectives.

Tip 5: Educate Yourself on Personal Finance

Continuous financial education is vital for making informed decisions about your money. Stay updated on personal finance topics, such as saving strategies, investment options, and tax planning. Reading financial blogs, listening to podcasts, or attending seminars can help you stay informed and adapt to changes in the financial landscape.

| Financial Tip | Description |

|---|---|

| Create a Budget | Plan how you want to allocate your money |

| Build an Emergency Fund | Save for unexpected expenses |

| Manage Debt | Pay off high-interest loans and credit cards |

| Invest for the Future | Growth your wealth through investments |

| Financial Education | Learn about personal finance to make informed decisions |

In conclusion, achieving financial health requires patience, discipline, and the right strategies. By implementing these five Health-Ade financial tips, individuals can set themselves on the path to financial stability and security. Remember, financial health is a journey, and every step counts. Whether you’re creating a budget, paying off debt, or investing for the future, each decision brings you closer to your financial goals.

What is the first step in achieving financial health?

+

The first step is creating a personal budget to understand and manage your income and expenses effectively.

Why is building an emergency fund important?

+

An emergency fund acts as a financial safety net, protecting you from unexpected expenses and preventing debt.

How do I start investing for the future?

+

Start by educating yourself on investment options, considering your risk tolerance, and possibly consulting with a financial advisor to find the best investments for your goals.

Related Terms:

- health ade financial statements reddit

- health ade financial statements reddit

- Health ade Kombucha Costco

- health ade kombucha benefits

- Health Ade acquisition

- health ade kombucha reviews