Illinois Health Alliance Insurance Options

Introduction to Illinois Health Alliance Insurance Options

The Illinois Health Alliance is a significant player in the state’s health insurance market, offering a range of plans to individuals, families, and groups. With the ever-changing healthcare landscape, it’s essential to understand the available insurance options and how they can benefit you. In this article, we will delve into the details of Illinois Health Alliance insurance options, including their features, benefits, and what to consider when choosing a plan.

Understanding Illinois Health Alliance Insurance Plans

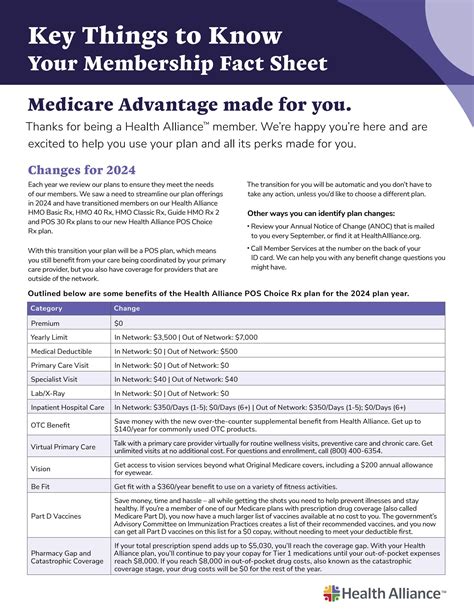

Illinois Health Alliance offers various insurance plans, each designed to cater to different needs and budgets. Their plans include: * Individual and Family Plans: These plans are ideal for those who are not covered by their employer or are self-employed. They offer a range of deductible and copayment options, allowing individuals to choose a plan that suits their financial situation. * Group Plans: Designed for businesses and organizations, these plans provide comprehensive coverage for employees and their families. They often offer more extensive network coverage and lower out-of-pocket costs compared to individual plans. * Medicare Plans: For seniors and individuals with disabilities, Illinois Health Alliance offers Medicare Advantage plans, which provide additional benefits beyond traditional Medicare coverage. * Short-Term Plans: These plans offer temporary coverage for individuals who are between jobs, waiting for other coverage to start, or need immediate coverage due to a life change.

Key Features of Illinois Health Alliance Insurance Plans

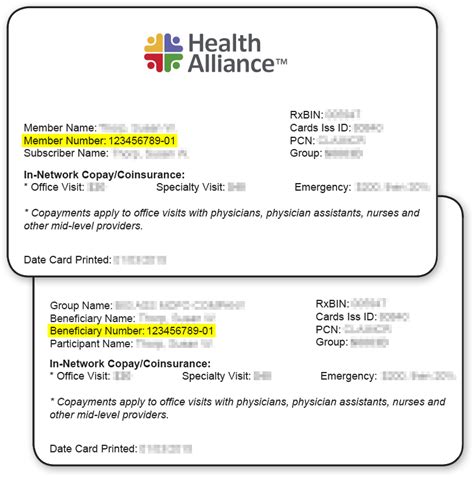

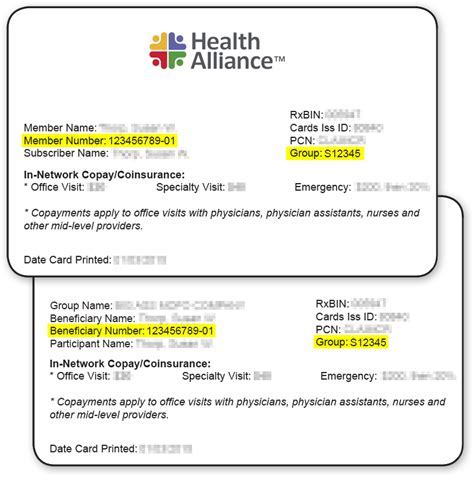

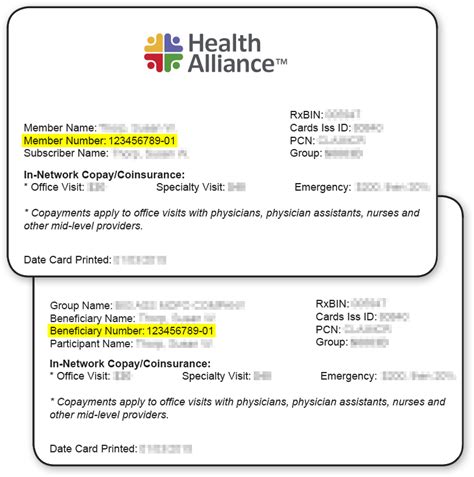

When exploring Illinois Health Alliance insurance options, it’s crucial to consider the following key features: * Network Coverage: Illinois Health Alliance has a large network of participating providers, including primary care physicians, specialists, and hospitals. Understanding the network coverage is vital to ensure that your healthcare needs are met. * Deductibles and Copayments: The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Copayments are the fixed amounts you pay for specific services, such as doctor visits or prescription medications. * Prescription Coverage: Many Illinois Health Alliance plans include prescription coverage, which helps reduce the cost of medications. * Preventive Care: Most plans cover preventive care services, such as annual check-ups, screenings, and vaccinations, without requiring a copayment or deductible.

Benefits of Choosing Illinois Health Alliance Insurance

There are several benefits to choosing Illinois Health Alliance insurance, including: * Comprehensive Coverage: Illinois Health Alliance plans offer extensive coverage for various medical services, including hospital stays, surgeries, and outpatient care. * Affordable Options: With a range of plans available, individuals and families can find an option that fits their budget. * Large Network: The extensive network of participating providers ensures that you have access to quality care when you need it. * Customer Support: Illinois Health Alliance provides dedicated customer support to help you navigate the insurance process and answer any questions you may have.

What to Consider When Choosing an Illinois Health Alliance Insurance Plan

When selecting an Illinois Health Alliance insurance plan, consider the following factors: * Your Health Needs: Think about your current health needs and any potential future needs. Choose a plan that covers the services you require. * Budget: Determine how much you can afford to pay in premiums, deductibles, and copayments. * Network Coverage: Ensure that your healthcare providers are part of the Illinois Health Alliance network. * Plan Features: Consider the plan’s features, such as prescription coverage, preventive care, and mental health services.

📝 Note: It's essential to carefully review the plan's details, including the summary of benefits and coverage, to ensure you understand what is included and excluded.

Comparison of Illinois Health Alliance Insurance Plans

To help you make an informed decision, here is a comparison of some Illinois Health Alliance insurance plans:

| Plan | Deductible | Copayment | Prescription Coverage |

|---|---|---|---|

| Individual Plan 1 | 1,000</td> <td>20 | Yes | |

| Group Plan 1 | 500</td> <td>15 | Yes | |

| Medicare Plan 1 | 0</td> <td>10 | Yes |

Next Steps

Now that you have a better understanding of Illinois Health Alliance insurance options, it’s time to take the next step: * Research Plans: Visit the Illinois Health Alliance website or consult with a licensed insurance agent to learn more about the available plans. * Compare Plans: Use the information provided to compare plans and determine which one best suits your needs. * Enroll in a Plan: Once you’ve selected a plan, enroll through the Illinois Health Alliance website, a licensed insurance agent, or the health insurance marketplace.

In summary, Illinois Health Alliance offers a range of insurance plans designed to meet the diverse needs of individuals, families, and groups. By understanding the key features, benefits, and considerations, you can make an informed decision and choose a plan that provides the right coverage for you.

What is the difference between an individual and group plan?

+

An individual plan is designed for one person or a family, while a group plan is designed for businesses and organizations. Group plans often offer more extensive network coverage and lower out-of-pocket costs.

Do Illinois Health Alliance plans cover preventive care services?

+

Yes, most Illinois Health Alliance plans cover preventive care services, such as annual check-ups, screenings, and vaccinations, without requiring a copayment or deductible.

How do I enroll in an Illinois Health Alliance insurance plan?

+

You can enroll in an Illinois Health Alliance insurance plan through their website, a licensed insurance agent, or the health insurance marketplace.

Related Terms:

- health alliance illinois customer service

- health alliance provider website

- health alliance provider login

- health alliance provider portal illinois

- health alliance provider portal login

- health alliance login