5 Ways Healthcare ETF

Introduction to Healthcare ETFs

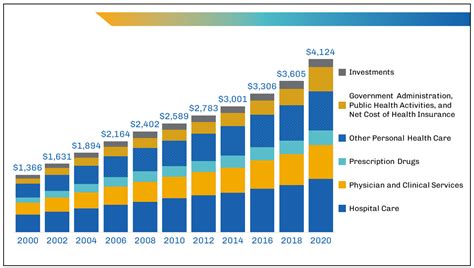

The healthcare sector is one of the most significant and rapidly growing industries globally, driven by an aging population, advancements in medical technology, and an increased focus on healthcare services. For investors looking to capitalize on this trend, Healthcare Exchange-Traded Funds (ETFs) offer a diversified and efficient way to gain exposure to the sector. In this article, we will explore five ways Healthcare ETFs can be a valuable addition to an investment portfolio.

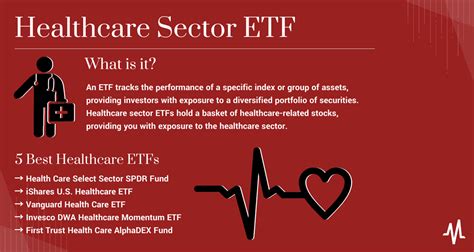

What are Healthcare ETFs?

Healthcare ETFs are funds that track a specific index of healthcare stocks, providing investors with a broad and diversified portfolio of companies involved in the healthcare industry. This can include pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers, and health insurance companies. By investing in a Healthcare ETF, individuals can gain exposure to the entire healthcare sector with a single investment, reducing the risk associated with investing in individual stocks.

Benefits of Investing in Healthcare ETFs

There are several benefits to investing in Healthcare ETFs, including: * Diversification: By investing in a broad range of healthcare stocks, ETFs can reduce the risk associated with individual stock volatility. * Convenience: Healthcare ETFs offer a simple and efficient way to gain exposure to the healthcare sector, without the need to select and monitor individual stocks. * Cost-effective: ETFs often have lower fees compared to actively managed mutual funds, making them a cost-effective option for investors. * Flexibility: ETFs can be traded throughout the day, allowing investors to quickly respond to changes in the market. * Transparency: ETFs disclose their holdings daily, providing investors with a clear understanding of their portfolio composition.

5 Ways to Invest in Healthcare ETFs

Here are five ways to consider investing in Healthcare ETFs: * Pharmaceutical ETFs: Invest in ETFs that track pharmaceutical companies, such as the SPDR S&P Pharmaceuticals ETF (XPH). * Biotechnology ETFs: Invest in ETFs that track biotechnology companies, such as the iShares Nasdaq Biotechnology ETF (IBB). * Healthcare Services ETFs: Invest in ETFs that track healthcare services companies, such as the Health Care Select Sector SPDR Fund (XLV). * Medical Device ETFs: Invest in ETFs that track medical device manufacturers, such as the iShares U.S. Medical Devices ETF (IHI). * Global Healthcare ETFs: Invest in ETFs that track global healthcare companies, such as the Vanguard Healthcare ETF (VHT).

Key Considerations

When investing in Healthcare ETFs, there are several key considerations to keep in mind, including: * Index tracking: Understand the underlying index that the ETF tracks and the methodology used to select and weight the stocks. * Fees and expenses: Compare the fees and expenses of different ETFs to ensure you are getting the best value. * Tax implications: Consider the tax implications of investing in an ETF, including capital gains and dividend income. * Risk management: Use ETFs as part of a broader investment strategy to manage risk and achieve your investment goals.

💡 Note: It's essential to conduct thorough research and consult with a financial advisor before investing in any ETF.

Conclusion and Final Thoughts

In conclusion, Healthcare ETFs offer a diversified and efficient way to gain exposure to the rapidly growing healthcare sector. By understanding the benefits and key considerations of investing in Healthcare ETFs, individuals can make informed investment decisions and potentially achieve their long-term financial goals. Whether you’re looking to invest in pharmaceuticals, biotechnology, healthcare services, medical devices, or global healthcare companies, there is a Healthcare ETF to suit your investment needs.

What is the difference between a Healthcare ETF and a mutual fund?

+

A Healthcare ETF is a type of exchange-traded fund that tracks a specific index of healthcare stocks, whereas a mutual fund is an actively managed investment vehicle that pools money from multiple investors to invest in a variety of assets.

How do I choose the right Healthcare ETF for my investment portfolio?

+

When choosing a Healthcare ETF, consider factors such as the underlying index, fees and expenses, investment objective, and risk management strategy to ensure it aligns with your investment goals and risk tolerance.

Can I invest in a Healthcare ETF through a retirement account?

+

Yes, you can invest in a Healthcare ETF through a retirement account, such as a 401(k) or IRA, providing a tax-advantaged way to save for retirement while gaining exposure to the healthcare sector.

Related Terms:

- best health care etf 2025

- list of health care etfs

- health care etfs with dividends

- health care etfs list

- top performing health care etfs