5 Tips for Early Retirees

Introduction to Early Retirement

Planning for retirement is a crucial aspect of financial management, and for those aiming to retire early, it requires meticulous planning and discipline. Early retirement, often considered as retiring before the age of 65, offers the opportunity to enjoy more years of leisure and pursue hobbies and interests without the burden of a 9-to-5 job. However, it also means that retirees will need to make their savings last longer. In this blog post, we will explore five essential tips for early retirees to manage their finances effectively and make the most out of their retirement.

Tip 1: Create a Sustainable Budget

Creating a budget is the foundation of financial planning, and it becomes even more critical for early retirees. Since they will be relying on their savings for a longer period, understanding where their money is going and making conscious spending decisions is vital. Tracking expenses can help identify areas where costs can be cut back, allowing for the allocation of more funds towards enjoyment and less towards unnecessary expenditures. A sustainable budget should also account for inflation, as the cost of living tends to increase over time, which can erode the purchasing power of retirement savings.

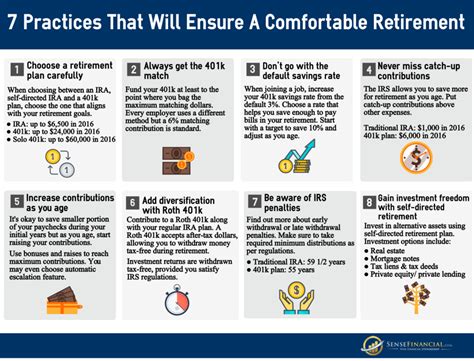

Tip 2: Invest Wisely

Investing wisely is another crucial aspect for early retirees. The goal is to grow your retirement portfolio at a rate that outpaces inflation while minimizing risk. Diversification is key; it involves spreading investments across different asset classes such as stocks, bonds, and real estate. Diversified portfolios can help mitigate risk and potentially increase returns over the long term. Early retirees should also consider tax-efficient investing strategies to minimize tax liabilities and maximize their after-tax returns.

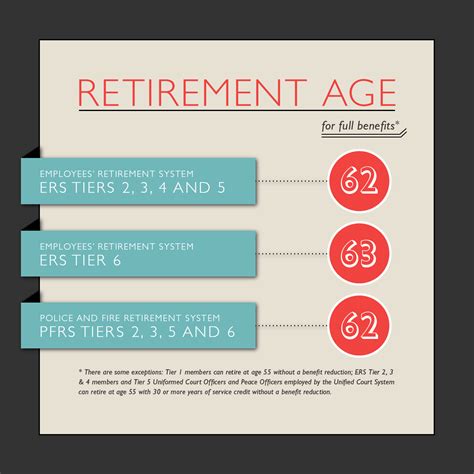

Tip 3: Manage Healthcare Costs

Healthcare costs can be a significant expense for retirees, especially as they age. Early retirees need to plan for these costs carefully, as they may not yet be eligible for Medicare. Health Savings Accounts (HSAs) can be a valuable tool for saving for medical expenses on a tax-advantaged basis. Additionally, considering long-term care insurance can provide financial protection against the potential need for extended care, which can be extremely costly.

Tip 4: Plan for Tax Efficiency

Tax planning is essential for early retirees to minimize their tax burden and stretch their retirement dollars further. Understanding how different income sources are taxed (e.g., 401(k), IRA, Roth IRA) can help in making informed decisions about which accounts to draw from and when. Roth IRA conversions might be beneficial for some, as they allow for tax-free growth and withdrawals in retirement, though they require paying taxes upfront. Consulting with a financial advisor can provide personalized strategies tailored to individual circumstances.

Tip 5: Stay Engaged and Healthy

Lastly, while financial planning is critical, it’s equally important for early retirees to focus on their physical and mental health. Retirement can bring about significant lifestyle changes, and staying engaged through hobbies, volunteering, or part-time work can contribute to a sense of purpose and fulfillment. Regular exercise and a balanced diet are crucial for maintaining physical health, while social connections and mental stimulation can help preserve cognitive function and emotional well-being.

📝 Note: Staying informed about financial markets, tax law changes, and healthcare options is vital for making adjustments as needed to ensure a comfortable and secure retirement.

In summary, early retirement requires careful financial planning, a sustainable lifestyle, and a focus on health and personal fulfillment. By creating a budget, investing wisely, managing healthcare costs, planning for tax efficiency, and staying engaged and healthy, early retirees can set themselves up for a successful and enjoyable post-work life. Whether it’s traveling, pursuing hobbies, or simply enjoying time with loved ones, early retirement can be a rewarding experience with the right planning and mindset.

What is the first step in planning for early retirement?

+

The first step in planning for early retirement is creating a comprehensive financial plan, which includes assessing your current financial situation, setting clear retirement goals, and devising strategies to achieve them.

How can I ensure my retirement savings last longer?

+

To ensure your retirement savings last longer, consider living below your means, investing for growth, and being mindful of inflation and healthcare costs. Additionally, creating a sustainable withdrawal strategy from your retirement accounts can help stretch your savings.

What role does health play in early retirement planning?

+

Health plays a crucial role in early retirement planning. Good physical and mental health can enhance your quality of life and reduce healthcare expenses, which can be a significant portion of retirement costs. Staying active, eating well, and engaging in activities that promote mental well-being are essential.

Related Terms:

- health insurance for 62 year old retirees

- Health insurance Marketplace

- affordable health insurance before 65

- early retirement health insurance advice

- health care when retiring early