5 Health Conditions Pension Tips

Introduction to Health Conditions and Pension Tips

When dealing with certain health conditions, it’s essential to understand how they can impact your pension and overall financial well-being. Many individuals struggle with managing their health while also planning for their retirement. In this article, we will delve into five significant health conditions and provide valuable pension tips to help you navigate these challenges.

Understanding the Impact of Health Conditions on Pensions

Health conditions can significantly affect an individual’s ability to work and, consequently, their pension. Chronic illnesses, such as diabetes, heart disease, and arthritis, can lead to increased medical expenses, reduced income, and a shorter lifespan. It’s crucial to consider these factors when planning your pension to ensure you have sufficient funds for your retirement.

5 Health Conditions and Pension Tips

Here are five health conditions and corresponding pension tips to help you prepare for your future: * Diabetes: Individuals with diabetes should focus on saving aggressively for their pension, as they may face higher medical expenses. Consider consulting a financial advisor to create a personalized pension plan. * Heart Disease: Those with heart disease should prioritize investing in a diverse portfolio to minimize risk and maximize returns. This can help ensure a stable income stream during retirement. * Arthritis: People with arthritis may need to plan for early retirement due to potential mobility issues. It’s essential to start saving early and take advantage of tax-advantaged retirement accounts. * Cancer: Cancer patients should focus on building an emergency fund to cover unexpected medical expenses. This can help reduce financial stress and ensure they can maintain their standard of living. * Mental Health: Individuals with mental health conditions should prioritize investing in a pension with flexible payment options. This can provide a sense of security and help them manage their finances more effectively.

💡 Note: It's essential to consult with a financial advisor to determine the best pension plan for your specific health condition and financial situation.

Pension Planning Strategies

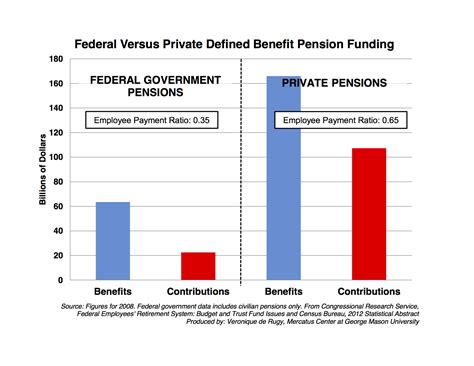

In addition to the health condition-specific tips, there are several general pension planning strategies to consider: * Start saving early: The sooner you begin saving for your pension, the more time your money has to grow. * Take advantage of tax-advantaged accounts: Utilize tax-deferred retirement accounts, such as 401(k) or IRA, to minimize taxes and maximize your savings. * Diversify your portfolio: Spread your investments across different asset classes to reduce risk and increase potential returns. * Consider long-term care insurance: If you have a chronic health condition, long-term care insurance can help cover expenses related to assisted living or nursing home care.

Managing Pension and Health Conditions

Managing your pension and health conditions requires careful planning and attention to detail. Here are some additional tips to help you navigate these challenges: * Keep track of your expenses: Monitor your medical expenses and adjust your pension plan accordingly. * Stay informed about pension options: Research and understand the different pension options available to you, such as defined benefit or defined contribution plans. * Seek professional advice: Consult with a financial advisor or pension expert to create a personalized plan tailored to your needs.

Conclusion and Final Thoughts

In conclusion, managing health conditions and pension planning requires a comprehensive approach. By understanding the impact of health conditions on your pension and following the tips outlined in this article, you can create a secure and stable financial future. Remember to start saving early, diversify your portfolio, and consider long-term care insurance to ensure you’re prepared for any situation that may arise. With careful planning and attention to detail, you can enjoy a comfortable and secure retirement despite any health challenges you may face.

What is the best way to save for a pension with a chronic health condition?

+

The best way to save for a pension with a chronic health condition is to start saving early and take advantage of tax-advantaged retirement accounts. Consider consulting a financial advisor to create a personalized pension plan.

How can I manage my medical expenses and pension planning simultaneously?

+

To manage your medical expenses and pension planning, keep track of your expenses, research pension options, and consider seeking professional advice from a financial advisor or pension expert.

What are the benefits of investing in a diverse portfolio for pension planning?

+

Investing in a diverse portfolio can help minimize risk and maximize returns, providing a stable income stream during retirement. This can be especially beneficial for individuals with health conditions who may face uncertain financial futures.

Related Terms:

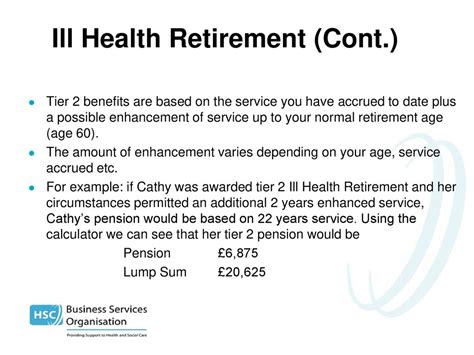

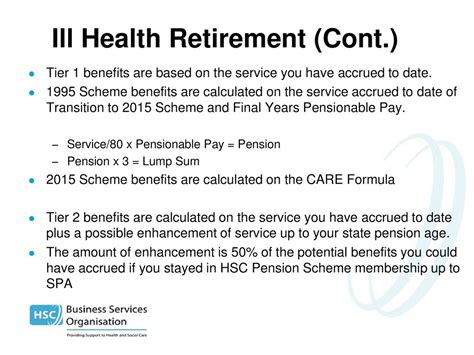

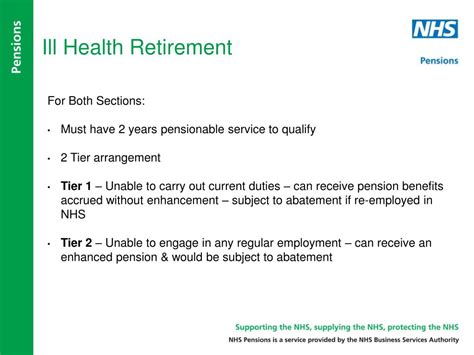

- Ill health retirement calculator

- Ill health pension lump sum

- How to get medical retirement

- Refused ill health retirement

- Medical retirement pay

- Ill health retirement benefits