Health

5 Health Pensions

Introduction to Health Pensions

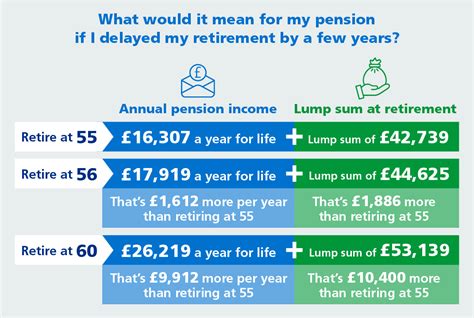

When it comes to planning for the future, one of the most critical aspects to consider is healthcare. As people age, their healthcare needs often become more complex and costly. A health pension is a type of pension plan that provides financial support for healthcare expenses in retirement. In this article, we will explore the concept of health pensions, their benefits, and how they can be used to ensure a healthy and secure retirement.

What are Health Pensions?

A health pension is a type of pension plan that is specifically designed to provide financial support for healthcare expenses in retirement. These plans are typically offered by employers as part of their employee benefits package, but they can also be purchased individually. Health pensions can provide a range of benefits, including medical expense coverage, long-term care coverage, and disability income protection. By having a health pension in place, individuals can ensure that they have a steady stream of income to cover their healthcare expenses, even if they are no longer working.

Benefits of Health Pensions

There are several benefits to having a health pension. Some of the most significant advantages include: * Financial security: A health pension can provide a steady stream of income to cover healthcare expenses, reducing the financial burden on individuals and their families. * Access to quality care: With a health pension, individuals can afford to access quality healthcare services, including specialist care and prescription medications. * Peace of mind: Knowing that they have a health pension in place can give individuals peace of mind, reducing stress and anxiety about their healthcare expenses. * Flexibility: Health pensions can be tailored to meet the individual’s specific needs, providing flexibility and choice in terms of the level of coverage and the types of benefits provided.

Types of Health Pensions

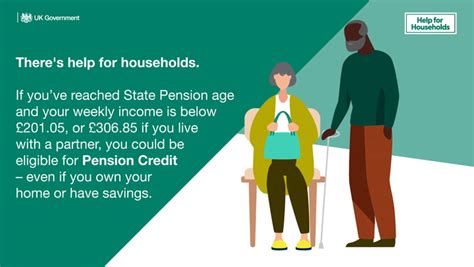

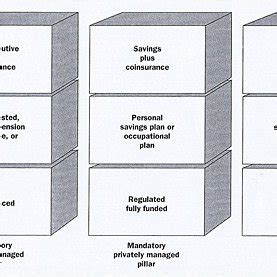

There are several types of health pensions available, including: * Employer-sponsored health pensions: These are offered by employers as part of their employee benefits package. * Individual health pensions: These can be purchased individually by individuals who are not eligible for an employer-sponsored plan. * Government-sponsored health pensions: These are offered by government agencies, such as Medicare and Medicaid in the United States. * Private health pensions: These are offered by private insurance companies and can be purchased individually or through an employer.

How to Choose a Health Pension

Choosing a health pension can be a complex and daunting task, but there are several factors to consider. Some of the key factors to consider include: * Level of coverage: Consider the level of coverage provided by the plan, including the types of benefits and the amount of coverage. * Cost: Consider the cost of the plan, including premiums, deductibles, and copays. * Provider network: Consider the provider network, including the number and quality of healthcare providers participating in the plan. * Customer service: Consider the customer service provided by the plan, including the ease of filing claims and the responsiveness of customer support staff.

📝 Note: When choosing a health pension, it's essential to carefully review the plan's terms and conditions, including the level of coverage, cost, and provider network.

Conclusion and Final Thoughts

In conclusion, health pensions are an essential tool for ensuring a healthy and secure retirement. By providing financial support for healthcare expenses, health pensions can help individuals maintain their independence, dignity, and quality of life. When choosing a health pension, it’s crucial to consider the level of coverage, cost, provider network, and customer service. By doing so, individuals can ensure that they have a comprehensive and affordable health pension in place, providing peace of mind and financial security for years to come.

What is a health pension?

+

A health pension is a type of pension plan that provides financial support for healthcare expenses in retirement.

What are the benefits of a health pension?

+

The benefits of a health pension include financial security, access to quality care, peace of mind, and flexibility.

How do I choose a health pension?

+

When choosing a health pension, consider the level of coverage, cost, provider network, and customer service.

Related Terms:

- pensionbee sickness retirement

- medical conditions for sickness retirement

- eligibility for ill health pension