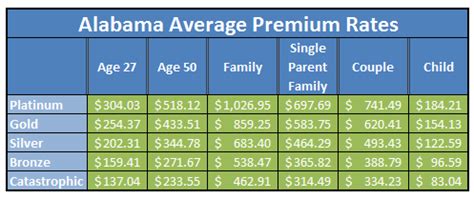

Alabama Health Coverage Options

Introduction to Alabama Health Coverage Options

When it comes to health coverage, the state of Alabama offers its residents a variety of options to choose from. With the ever-changing landscape of healthcare, it’s essential to understand the different alternatives available to ensure you and your family are well-protected. In this blog post, we will delve into the world of Alabama health coverage, exploring the various options, their benefits, and how to navigate the system.

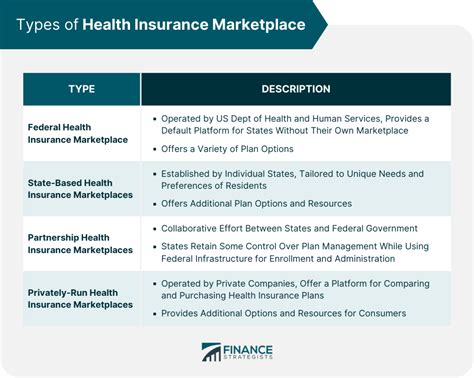

Understanding the Alabama Health Insurance Marketplace

The Alabama Health Insurance Marketplace, also known as the exchange, is a platform where individuals and families can purchase health insurance plans. The marketplace offers a range of plans from different insurance providers, allowing consumers to compare prices and benefits. Qualified Health Plans (QHPs) are available through the marketplace, which provides essential health benefits, including: * Doctor visits * Hospital stays * Prescription medication * Maternity care * Mental health services * Substance abuse treatment

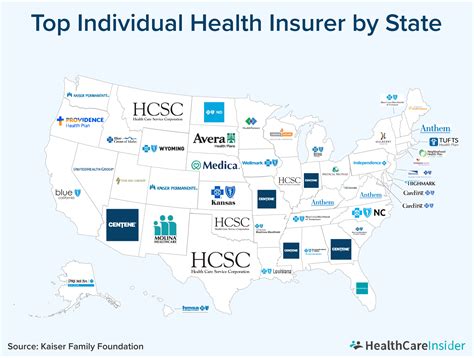

Types of Health Coverage Options in Alabama

Alabama residents have several health coverage options to consider: * Individual and Family Plans: These plans are available through the marketplace or directly from insurance providers. They offer a range of benefits and are ideal for those who are self-employed, unemployed, or not covered by their employer. * Employer-Sponsored Plans: Many employers in Alabama offer group health insurance plans as a benefit to their employees. These plans often have lower premiums and better coverage than individual plans. * Medicaid and CHIP: The Medicaid program provides health coverage to low-income individuals and families, while the Children’s Health Insurance Program (CHIP) offers coverage to children from low-income families. * Medicare: Alabama residents who are 65 or older, or have a disability, may be eligible for Medicare, a federal health insurance program.

Short-Term Health Insurance in Alabama

Short-term health insurance plans are temporary plans that provide limited coverage for a specified period, usually up to 12 months. These plans are ideal for individuals who are between jobs, waiting for coverage to begin, or need temporary coverage. However, it’s essential to note that short-term plans often have: * Limited benefits: They may not cover essential health benefits, such as maternity care or mental health services. * Pre-existing condition exclusions: Short-term plans may not cover pre-existing conditions, which can leave you with significant medical bills.

Alabama Health Savings Account (HSA) Options

A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to set aside money for medical expenses. To be eligible for an HSA, you must have a High-Deductible Health Plan (HDHP). The benefits of an HSA include: * Tax deductions: Contributions to an HSA are tax-deductible. * Tax-free growth: The money in your HSA grows tax-free. * Tax-free withdrawals: Withdrawals from an HSA are tax-free if used for qualified medical expenses.

| Option | Benefits | Eligibility |

|---|---|---|

| Individual and Family Plans | Essential health benefits, tax credits | Anyone can apply |

| Employer-Sponsored Plans | Lower premiums, better coverage | Employees of participating companies |

| Medicaid and CHIP | Low-cost or no-cost coverage | Low-income individuals and families |

| Medicare | Comprehensive coverage | 65 or older, or have a disability |

📝 Note: It's essential to review and compare the different health coverage options in Alabama to determine which one best suits your needs and budget.

In summary, Alabama residents have a range of health coverage options to choose from, including individual and family plans, employer-sponsored plans, Medicaid and CHIP, Medicare, and short-term health insurance plans. Understanding the benefits and eligibility requirements of each option is crucial to making an informed decision. By considering your needs, budget, and health status, you can select the best health coverage option for yourself and your family.

What is the Alabama Health Insurance Marketplace?

+

The Alabama Health Insurance Marketplace is a platform where individuals and families can purchase health insurance plans from various providers.

What are the benefits of a Health Savings Account (HSA)?

+

An HSA offers tax deductions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Am I eligible for Medicaid in Alabama?

+

To be eligible for Medicaid in Alabama, you must meet the income and eligibility requirements, which vary depending on your family size and income level.

Related Terms:

- Alabama health insurance Marketplace

- Health insurance companies in Alabama

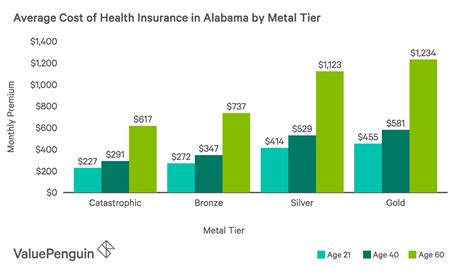

- Cheapest health insurance in Alabama

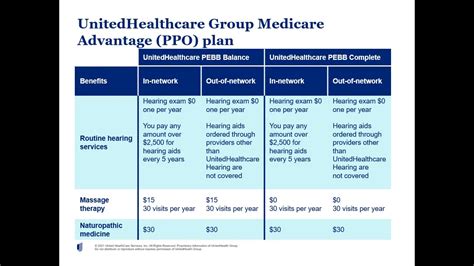

- UnitedHealthcare Alabama phone number

- United Healthcare alonex providers

- Best health insurance in Alabama