5 Health Insurance Tips

Introduction to Health Insurance

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It is an essential aspect of healthcare, as it helps individuals and families cover the high costs of medical care. With so many health insurance options available, it can be overwhelming to choose the right one. In this article, we will provide you with 5 health insurance tips to help you make an informed decision.

Tip 1: Assess Your Needs

Before selecting a health insurance plan, it is crucial to assess your needs. Consider the following factors: * Your age and health status * Your family’s health needs * Your budget * Your lifestyle * Your medical history Take the time to evaluate your needs, and make a list of your priorities. This will help you choose a plan that meets your requirements.

Tip 2: Understand the Types of Health Insurance Plans

There are several types of health insurance plans available, including: * Health Maintenance Organization (HMO) plans * Preferred Provider Organization (PPO) plans * Exclusive Provider Organization (EPO) plans * Point of Service (POS) plans * High-Deductible Health Plan (HDHP) plans Each type of plan has its advantages and disadvantages. Research and compare the different plans to determine which one is best for you.

Tip 3: Check the Network

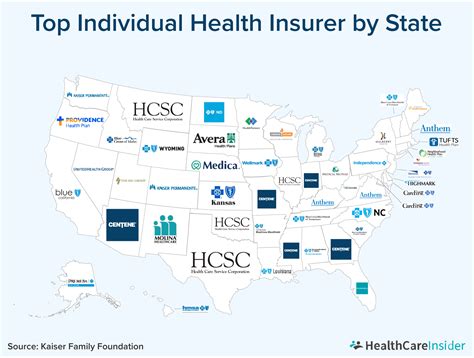

When selecting a health insurance plan, it is essential to check the network of healthcare providers. Make sure that your primary care physician and any specialists you see are part of the plan’s network. You should also check the plan’s coverage for out-of-network care, in case you need to see a doctor or receive treatment outside of the network.

Tip 4: Review the Costs

Health insurance plans can be expensive, so it is crucial to review the costs carefully. Consider the following expenses: * Premiums: the monthly or annual cost of the plan * Deductibles: the amount you must pay out-of-pocket before the plan kicks in * Copays: the amount you must pay for each doctor visit or prescription * Coinsurance: the percentage of medical expenses you must pay after meeting the deductible * Maximum out-of-pocket: the maximum amount you must pay for medical expenses in a year Calculate your total costs and make sure you can afford them.

Tip 5: Read the Fine Print

Finally, it is essential to read the fine print of your health insurance plan. Pay attention to the following: * Pre-existing condition exclusions * Waiting periods * Coverage limitations * Exclusions * Riders Take the time to understand your plan’s terms and conditions, and ask questions if you are unsure about anything.

📝 Note: Always review and understand your health insurance plan's terms and conditions before purchasing.

To help you better understand the different types of health insurance plans, here is a comparison table:

| Plan Type | Network | Out-of-Network Coverage | Premiums |

|---|---|---|---|

| HMO | Restricted network | Limited or no coverage | Lower premiums |

| PPO | Larger network | Coverage for out-of-network care | Higher premiums |

| EPO | Restricted network | No coverage for out-of-network care | Lower premiums |

| POS | Combination of HMO and PPO | Coverage for out-of-network care | Higher premiums |

| HDHP | High deductible | Coverage for out-of-network care | Lower premiums |

In summary, choosing the right health insurance plan requires careful consideration of your needs, the types of plans available, the network of healthcare providers, the costs, and the fine print. By following these 5 health insurance tips, you can make an informed decision and select a plan that meets your requirements.

What is the difference between an HMO and a PPO plan?

+

An HMO plan has a restricted network of healthcare providers, while a PPO plan has a larger network and coverage for out-of-network care.

How do I choose the right health insurance plan for my family?

+

Consider your family’s health needs, budget, and lifestyle when choosing a health insurance plan. You should also research and compare different plans to determine which one is best for your family.

What is a high-deductible health plan (HDHP)?

+

A high-deductible health plan (HDHP) is a type of health insurance plan that has a high deductible and lower premiums. It is often paired with a health savings account (HSA) to help cover medical expenses.

Related Terms:

- Health insurance

- Health insurance bundles

- Health and dental insurance

- Health insurance companies

- affordable health dental vision insurance

- affordable dental and vision coverage