5 Tips Health Insurance

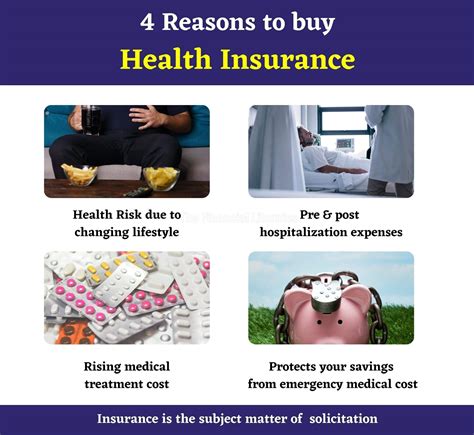

Introduction to Health Insurance

Health insurance is a type of insurance that covers the cost of medical expenses incurred by an individual or a family. It is an essential aspect of financial planning, as it helps to protect against unexpected medical expenses that can be financially devastating. With the rising cost of healthcare, having a health insurance plan is more important than ever. In this article, we will discuss five tips for choosing the right health insurance plan for your needs.

Tip 1: Assess Your Needs

Before choosing a health insurance plan, it is essential to assess your needs. Consider your age, health status, and lifestyle. If you have a pre-existing medical condition, you may need a plan that covers that condition. If you are young and healthy, you may be able to opt for a plan with a lower premium. It is also important to consider your budget and choose a plan that fits within your means. You should also think about the types of services you may need, such as maternity care or mental health services.

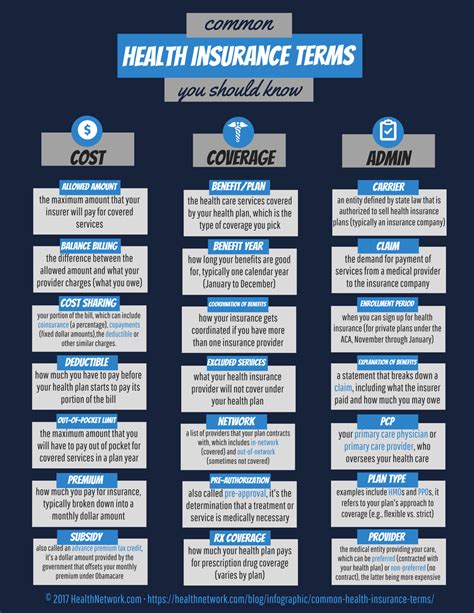

Tip 2: Understand the Types of Plans

There are several types of health insurance plans available, including: * HMOs (Health Maintenance Organizations): These plans require you to receive care from a network of providers. * PPOs (Preferred Provider Organizations): These plans allow you to see any provider, but you pay less for care from providers in the network. * EPOs (Exclusive Provider Organizations): These plans are similar to HMOs, but they may offer more flexibility. * POS (Point of Service) plans: These plans combine elements of HMOs and PPOs. It is essential to understand the differences between these plans and choose the one that best fits your needs.

Tip 3: Consider the Network

The network of providers is a critical aspect of any health insurance plan. You should research the network to ensure that it includes your primary care physician and any specialists you may need to see. You should also consider the quality of care provided by the network and the convenience of the locations. If you travel frequently, you may want to choose a plan with a nationwide network.

Tip 4: Look at the Out-of-Pocket Costs

In addition to the premium, you should also consider the out-of-pocket costs associated with a health insurance plan. These costs include: * Deductibles: The amount you must pay before the insurance plan begins to pay. * Copays: The amount you pay for each doctor visit or prescription. * Coinsurance: The percentage of costs you pay after meeting the deductible. * Maximum out-of-pocket expenses: The maximum amount you pay per year. You should choose a plan with out-of-pocket costs that fit within your budget.

Tip 5: Read the Fine Print

Finally, it is essential to read the fine print of any health insurance plan before choosing it. You should carefully review the policy documents to understand what is covered and what is not. You should also look for any exclusions or limitations that may apply. It is also a good idea to ask questions and seek clarification on any aspects of the plan that you do not understand.

📝 Note: It is crucial to carefully evaluate your options and choose a plan that meets your specific needs and budget.

Comparing Health Insurance Plans

When comparing health insurance plans, you should consider the following factors:

| Plan | Premium | Deductible | Copay | Coinsurance |

|---|---|---|---|---|

| Plan A | 500</td> <td>1,000 | 20</td> <td>20%</td> </tr> <tr> <td>Plan B</td> <td>400 | 1,500</td> <td>30 | 30% |

| Plan C | 600</td> <td>500 | $10 | 10% |

By carefully evaluating these factors, you can choose a health insurance plan that meets your needs and budget.

In final thoughts, choosing the right health insurance plan is a critical decision that requires careful consideration of your needs and budget. By following these five tips, you can make an informed decision and select a plan that provides the coverage you need at a price you can afford. Remember to always read the fine print and ask questions before making a decision.

What is the difference between an HMO and a PPO?

+

An HMO (Health Maintenance Organization) requires you to receive care from a network of providers, while a PPO (Preferred Provider Organization) allows you to see any provider, but you pay less for care from providers in the network.

How do I choose the right health insurance plan for my needs?

+

To choose the right health insurance plan, you should assess your needs, understand the types of plans available, consider the network, look at the out-of-pocket costs, and read the fine print.

What is the importance of reading the fine print of a health insurance plan?

+

Reading the fine print of a health insurance plan is crucial to understand what is covered and what is not, and to avoid any surprises or unexpected costs.

Related Terms:

- Insurance Office of America