5 Tips Health Insurance BC

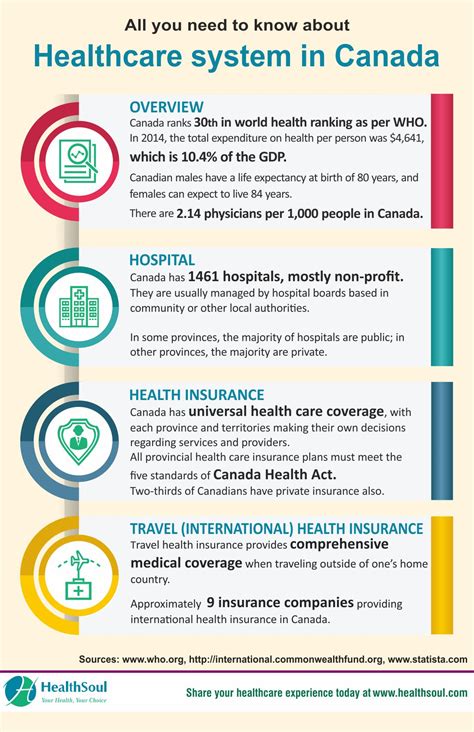

Introduction to Health Insurance in British Columbia

In British Columbia, Canada, health insurance is a crucial aspect of life, providing individuals with financial protection against medical expenses. The province’s public health care system, known as the Medical Services Plan (MSP), covers a wide range of medical services, including doctor visits, hospital stays, and surgical procedures. However, there are some services that are not covered under the MSP, such as prescription medications, dental care, and vision care. This is where private health insurance comes in, providing individuals with additional coverage for these services. In this article, we will explore five tips for navigating health insurance in British Columbia.

Tip 1: Understand the Medical Services Plan (MSP)

The MSP is the public health care system in British Columbia, providing coverage for a wide range of medical services. To be eligible for MSP, individuals must be residents of British Columbia and have a valid health care card. It is essential to understand what services are covered under the MSP and what services are not. For example, MSP covers doctor visits, hospital stays, and surgical procedures, but it does not cover prescription medications, dental care, or vision care. Understanding what is covered and what is not will help individuals make informed decisions about their health insurance needs.

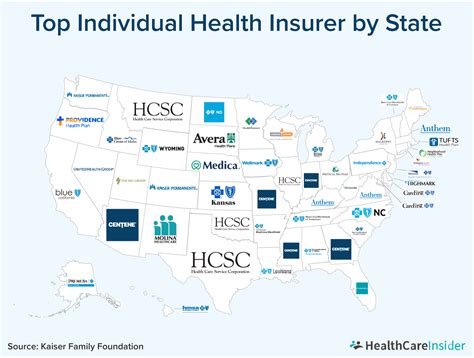

Tip 2: Consider Private Health Insurance Options

Private health insurance can provide individuals with additional coverage for services not covered under the MSP, such as prescription medications, dental care, and vision care. There are several private health insurance options available in British Columbia, including individual plans, group plans, and employer-sponsored plans. When considering private health insurance, it is essential to compare different plans and providers to find the best coverage for your needs and budget. Some popular private health insurance providers in British Columbia include Pacific Blue Cross, Great-West Life, and Sun Life Financial.

Tip 3: Review and Update Your Coverage Regularly

Health insurance needs can change over time, and it is essential to review and update your coverage regularly to ensure you have adequate protection. For example, if you have a change in employment or income, you may need to adjust your coverage to reflect these changes. Additionally, if you have a change in health status or develop a new medical condition, you may need to update your coverage to ensure you have adequate protection. It is also essential to review your coverage regularly to ensure you are not over-insured or under-insured.

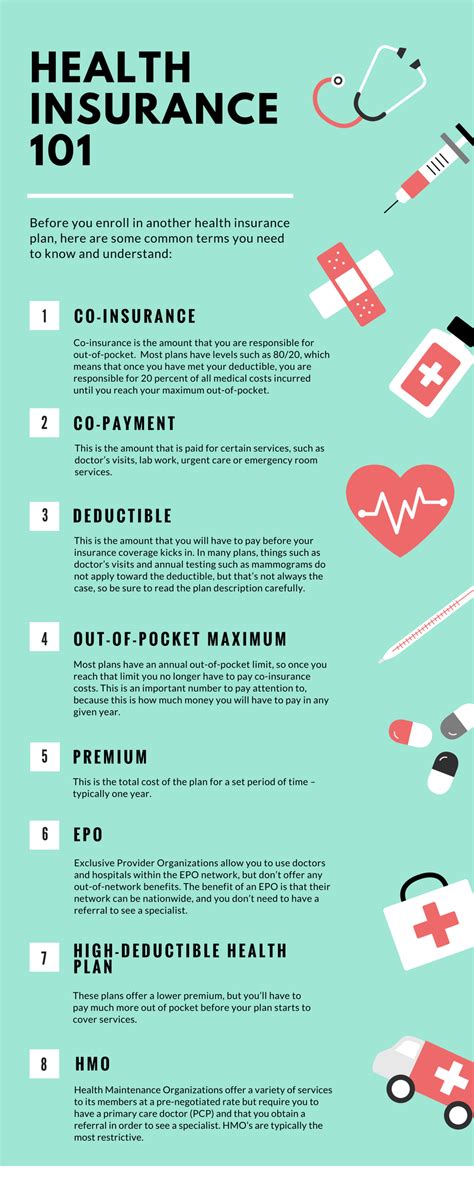

Tip 4: Understand the Difference Between Extended Health and Dental Care

Extended health care and dental care are two types of private health insurance that can provide individuals with additional coverage for services not covered under the MSP. Extended health care typically covers services such as prescription medications, vision care, and paramedical services, such as chiropractic and massage therapy. Dental care, on the other hand, typically covers services such as routine cleanings, fillings, and extractions. It is essential to understand the difference between these two types of coverage and choose the coverage that best meets your needs.

Tip 5: Consider Group Health Insurance Options

Group health insurance is a type of private health insurance that is offered through an employer or other organization. Group health insurance can provide individuals with lower premiums and more comprehensive coverage than individual plans. Additionally, group health insurance often has guaranteed issue, which means that individuals with pre-existing medical conditions may be eligible for coverage. If you are an employee or member of an organization, it is essential to consider group health insurance options to see if they are available and meet your needs.

💡 Note: When considering group health insurance, it is essential to review the coverage and premiums to ensure they meet your needs and budget.

In summary, navigating health insurance in British Columbia requires understanding the Medical Services Plan, considering private health insurance options, reviewing and updating your coverage regularly, understanding the difference between extended health and dental care, and considering group health insurance options. By following these tips, individuals can make informed decisions about their health insurance needs and ensure they have adequate protection against medical expenses.

What is the Medical Services Plan (MSP) in British Columbia?

+

The Medical Services Plan (MSP) is the public health care system in British Columbia, providing coverage for a wide range of medical services, including doctor visits, hospital stays, and surgical procedures.

What services are not covered under the MSP?

+

Services not covered under the MSP include prescription medications, dental care, and vision care.

What is the difference between extended health and dental care?

+

Extended health care typically covers services such as prescription medications, vision care, and paramedical services, while dental care typically covers services such as routine cleanings, fillings, and extractions.

Related Terms:

- bc provincial health insurance

- medical insurance bc

- bc private health insurance

- health insurance bc

- bc medical services insurance

- bc health insurance providers