5 Tips Between Jobs

Introduction to the Job Transition Period

When you find yourself between jobs, it can be a challenging and uncertain time. This period can be filled with anxiety about the future, financial concerns, and a sense of disconnection from professional networks and routines. However, it’s essential to approach this phase with a positive mindset, seeing it as an opportunity for growth, learning, and self-improvement. In this article, we will explore five valuable tips to help you navigate this transition smoothly and come out stronger on the other side.

Tip 1: Update Your Professional Profile

One of the first steps when you’re between jobs is to refresh and enhance your professional profile. This includes your resume, LinkedIn profile, and any other social media platforms where you have a professional presence. Ensure that your resume is tailored to highlight your skills, achievements, and experience in a way that aligns with your career goals. Your LinkedIn profile should be complete, professional, and regularly updated with engaging content that showcases your expertise and interests. This will not only make you more visible to potential employers but also open doors for new connections and opportunities.

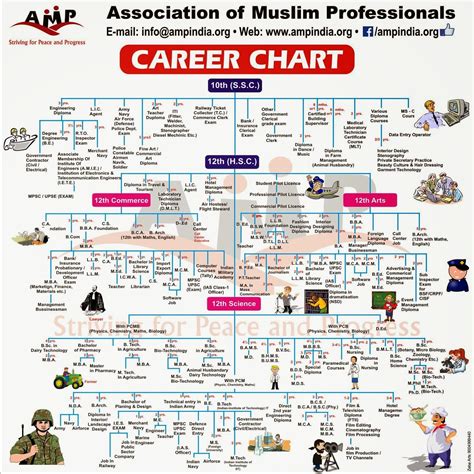

Tip 2: Expand Your Skill Set

Being between jobs provides a unique opportunity to invest in personal and professional development. Consider taking online courses, attending seminars, or participating in workshops that can enhance your existing skills or help you acquire new ones. This not only makes you a more competitive candidate in the job market but also keeps your mind engaged and active. Platforms like Coursera, Udemy, and LinkedIn Learning offer a wide range of courses across various disciplines. Moreover, many of these resources are free or low-cost, making them accessible to everyone.

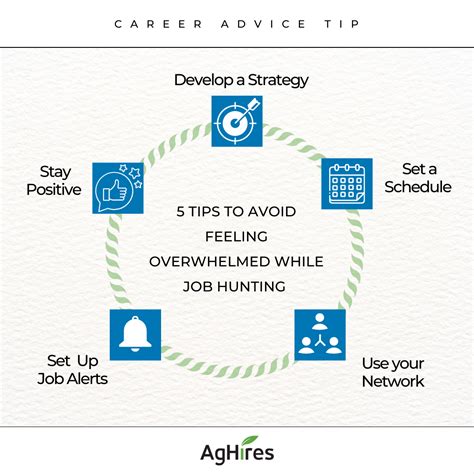

Tip 3: Network Strategically

Networking is a crucial aspect of career development, especially when you’re transitioning between jobs. Reaching out to contacts in your industry can lead to valuable advice, job leads, or even referrals. Attend industry events, join professional associations, and engage in online forums related to your field. These interactions can provide insights into the current job market, trends, and requirements, helping you prepare for your next role. Remember, networking is a two-way street; be open to helping others as well, which can foster meaningful and lasting professional relationships.

Tip 4: Manage Your Finances Wisely

Financial stability is a significant concern when you’re between jobs. It’s essential to manage your finances carefully to avoid unnecessary stress and ensure you have enough resources to sustain yourself during this period. Create a budget that prioritizes your needs over your wants, and look for ways to reduce expenses. Consider freelancing, consulting, or part-time work to generate income. Additionally, utilize this time to review and optimize your long-term financial plans, including savings, investments, and retirement funds.

Tip 5: Maintain a Healthy Work-Life Balance

Lastly, it’s vital to prioritize your mental and physical health during this transition. Establishing a routine that includes time for job searching, personal development, exercise, and relaxation is key. Avoid the temptation to spend all your time job hunting, as this can lead to burnout. Schedule time for activities that bring you joy and help you unwind, whether that’s reading, hiking, or spending time with family and friends. A healthy work-life balance will help you stay positive, motivated, and ready to take on new challenges when the right opportunity arises.

📝 Note: Staying organized and positive during the job transition period can significantly impact your ability to find the right opportunity. Utilize tools, apps, and planners to keep track of your applications, follow-ups, and deadlines.

In the end, being between jobs is not just a period of transition; it’s an opportunity for reflection, growth, and renewal. By focusing on personal development, strategic networking, financial management, and maintaining a healthy lifestyle, you can turn this challenging time into a stepping stone for your next career advancement. Remember, it’s about perspective and how you choose to utilize this time to prepare for your future professional endeavors.

How can I stay motivated during a long job search?

+

Staying motivated involves setting achievable daily goals, celebrating small victories, and maintaining a healthy work-life balance. Engaging in activities that bring you joy and practicing gratitude can also help.

What are the most effective ways to network when between jobs?

+

Effective networking includes attending industry events, joining professional associations, engaging in online forums, and leveraging social media platforms like LinkedIn. Personalized emails or messages to contacts can also initiate meaningful connections.

How can I manage my finances to ensure stability during unemployment?

+

Financial stability during unemployment can be achieved by creating a strict budget, reducing unnecessary expenses, and exploring temporary income sources like freelancing or part-time jobs. Reviewing and adjusting long-term financial plans is also advisable.

Related Terms:

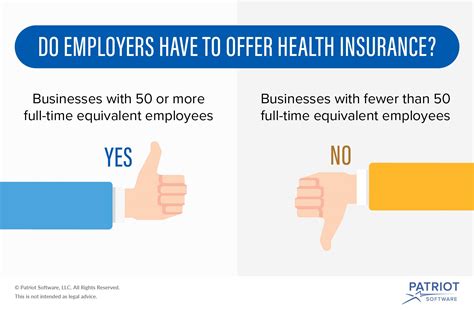

- Health insurance Marketplace

- Short term health insurance

- job based health insurance options

- affordable health insurance between jobs

- health insurance offered by employer

- does cobra coverage begin immediately