5 Tips Health Insurance

Introduction to Health Insurance

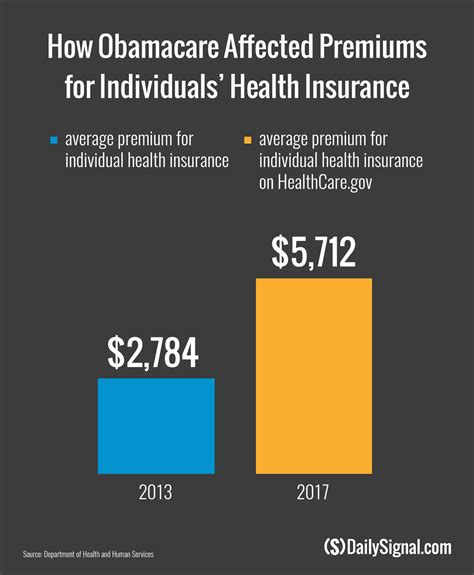

When it comes to health insurance, it’s essential to understand the various aspects that can impact your coverage and overall well-being. With the rising costs of medical care, having a good health insurance plan can provide financial protection and peace of mind. In this article, we’ll explore five valuable tips to help you navigate the world of health insurance and make informed decisions about your coverage.

Tip 1: Assess Your Needs

Before selecting a health insurance plan, it’s crucial to assess your individual needs and circumstances. Consider factors such as your age, health status, lifestyle, and financial situation. Ask yourself: * What are my healthcare needs? * Do I have any pre-existing conditions? * How much can I afford to pay in premiums and out-of-pocket expenses? * Do I need coverage for my family or just myself?

By evaluating these factors, you can choose a plan that provides the right level of coverage and fits your budget.

Tip 2: Understand Plan Types

There are various types of health insurance plans available, including: * HMOs (Health Maintenance Organizations): These plans require you to receive care from a specific network of providers. * PPOs (Preferred Provider Organizations): These plans offer more flexibility, allowing you to see any healthcare provider, but with higher costs for out-of-network care. * EPOs (Exclusive Provider Organizations): These plans combine elements of HMOs and PPOs, offering a network of providers but with some out-of-network benefits. * HDHPs (High-Deductible Health Plans): These plans have lower premiums but higher deductibles, often paired with a Health Savings Account (HSA).

Understanding the differences between these plan types can help you select the one that best suits your needs.

Tip 3: Review Plan Details

When evaluating health insurance plans, it’s essential to review the plan details carefully. Consider the following: * Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in. * Co-pay: The fixed amount you pay for each doctor visit or prescription. * Co-insurance: The percentage of medical costs you pay after meeting your deductible. * Maximum out-of-pocket: The maximum amount you’ll pay for healthcare expenses in a given year. * Network: The list of participating healthcare providers and facilities.

By carefully reviewing these details, you can ensure that you understand what’s covered and what’s not, as well as any potential costs or limitations.

Tip 4: Consider Additional Benefits

Many health insurance plans offer additional benefits that can enhance your coverage. These may include: * Prescription drug coverage: Coverage for prescription medications, often with a separate deductible and co-pay. * Dental and vision coverage: Separate coverage for dental and vision care, which may be included in your main plan or offered as a separate policy. * Mental health and substance abuse coverage: Coverage for mental health and substance abuse treatment, which may be subject to separate deductibles and co-pays. * Wellness programs: Programs that promote healthy habits, such as fitness classes or nutrition counseling.

When evaluating plans, consider whether these additional benefits are important to you and whether they’re included in your coverage.

Tip 5: Seek Professional Advice

Finally, it’s often helpful to seek professional advice when navigating the complex world of health insurance. Consider consulting with: * Insurance brokers: Licensed professionals who can help you compare plans and find the best coverage for your needs. * Health insurance navigators: Trained individuals who can provide guidance on plan selection and enrollment. * Financial advisors: Professionals who can help you understand the financial implications of different plan options.

By seeking professional advice, you can ensure that you’re making informed decisions about your health insurance coverage.

📝 Note: When selecting a health insurance plan, it's essential to carefully review the plan details and ask questions to ensure you understand what's covered and what's not.

In summary, choosing the right health insurance plan requires careful consideration of your individual needs, plan types, plan details, additional benefits, and professional advice. By following these five tips, you can make informed decisions about your health insurance coverage and ensure that you have the financial protection and peace of mind you deserve.

What is the difference between an HMO and a PPO?

+

An HMO (Health Maintenance Organization) requires you to receive care from a specific network of providers, while a PPO (Preferred Provider Organization) offers more flexibility, allowing you to see any healthcare provider, but with higher costs for out-of-network care.

How do I choose the right health insurance plan for my needs?

+

To choose the right health insurance plan, consider your individual needs, plan types, plan details, additional benefits, and seek professional advice. Carefully review the plan details and ask questions to ensure you understand what’s covered and what’s not.

What is a Health Savings Account (HSA)?

+

A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to set aside money for healthcare expenses, often paired with a High-Deductible Health Plan (HDHP).

Related Terms:

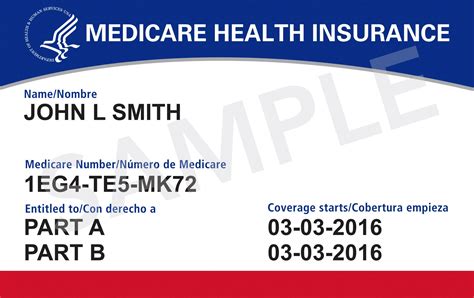

- health insurance card in cantonese

- health insurance card in cantonese