Pakistan Health Insurance Comparison

Introduction to Health Insurance in Pakistan

Pakistan, a country with a population of over 220 million people, faces numerous challenges in its healthcare system. One of the significant concerns is the lack of health insurance coverage among its citizens. The country’s healthcare system is primarily based on out-of-pocket payments, which can lead to financial hardship for many individuals and families. However, in recent years, there has been an increase in the availability of health insurance products in Pakistan, offering a glimmer of hope for those seeking financial protection against medical expenses.

Importance of Health Insurance in Pakistan

Health insurance is essential in Pakistan due to the country’s limited public healthcare resources and the high cost of private medical care. Without health insurance, many individuals and families are left to bear the financial burden of medical expenses, which can lead to financial ruin. Health insurance provides a safety net, allowing individuals to access necessary medical care without incurring significant financial hardship. Moreover, health insurance can help reduce the out-of-pocket expenses associated with medical care, making it more affordable for people to seek treatment.

Types of Health Insurance in Pakistan

There are several types of health insurance available in Pakistan, including: * Individual Health Insurance: Designed for individuals and families, this type of insurance provides coverage for medical expenses, including hospitalization, surgeries, and other medical treatments. * Group Health Insurance: Offered to groups of people, such as employees of a company or members of an organization, this type of insurance provides coverage for medical expenses and can be more affordable than individual health insurance. * Critical Illness Insurance: Provides a lump-sum payment in the event of a critical illness, such as cancer or heart attack, to help cover medical expenses and other related costs. * Personal Accident Insurance: Offers coverage for accidental injuries, including medical expenses and disability benefits.

Health Insurance Providers in Pakistan

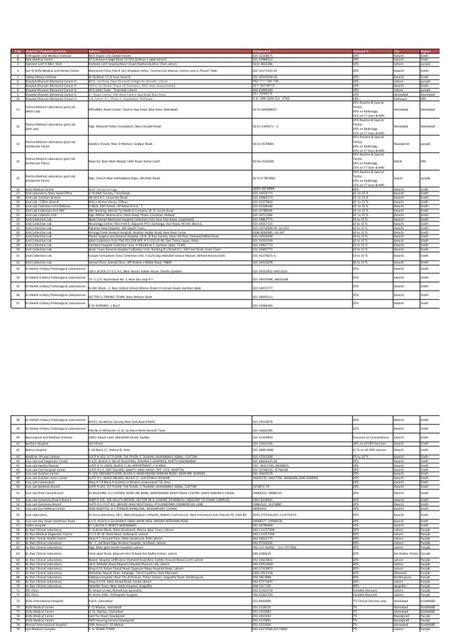

There are several health insurance providers operating in Pakistan, including: * Adamjee Insurance Company Limited * EFU Life Assurance Limited * IGI Life Insurance Limited * Jubilee Life Insurance Company Limited * State Life Insurance Corporation of Pakistan Each of these providers offers a range of health insurance products, with varying levels of coverage and premiums.

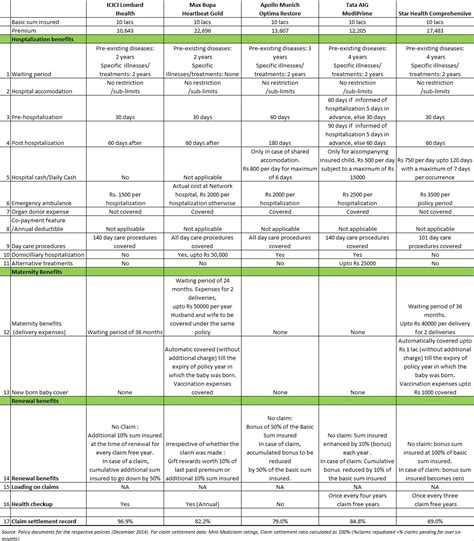

Comparison of Health Insurance Plans in Pakistan

When comparing health insurance plans in Pakistan, there are several factors to consider, including: * Premium costs: The cost of the insurance premium, which can vary depending on the provider, level of coverage, and individual or group plan. * Level of coverage: The extent of medical expenses covered, including hospitalization, surgeries, and other medical treatments. * Deductible and co-payment: The amount of money that must be paid out-of-pocket before the insurance coverage kicks in, as well as any co-payment requirements. * Network of hospitals: The list of hospitals and medical facilities that are part of the insurance provider’s network, which can impact the level of coverage and convenience. * Claim process: The process of filing a claim, including the required documentation and timeframe for reimbursement.

| Insurance Provider | Premium Cost | Level of Coverage | Deductible and Co-payment | Network of Hospitals |

|---|---|---|---|---|

| Adamjee Insurance Company Limited | PKR 10,000 - 50,000 per year | Up to PKR 1 million | PKR 1,000 deductible, 10% co-payment | Over 100 hospitals |

| EFU Life Assurance Limited | PKR 15,000 - 75,000 per year | Up to PKR 2 million | PKR 2,000 deductible, 15% co-payment | Over 150 hospitals |

| IGI Life Insurance Limited | PKR 20,000 - 100,000 per year | Up to PKR 3 million | PKR 3,000 deductible, 20% co-payment | Over 200 hospitals |

📝 Note: The premium costs, level of coverage, deductible, and co-payment may vary depending on the individual or group plan, as well as the insurance provider.

Choosing the Right Health Insurance Plan in Pakistan

When choosing a health insurance plan in Pakistan, it is essential to consider several factors, including: * Assessing your medical needs: Evaluating your medical requirements, including any pre-existing conditions or ongoing medical treatments. * Comparing insurance providers: Researching and comparing different insurance providers, including their level of coverage, premium costs, and network of hospitals. * Reading reviews and ratings: Checking online reviews and ratings from other customers to gauge the insurance provider’s reputation and customer service. * Seeking professional advice: Consulting with a licensed insurance agent or broker to get personalized advice and guidance.

In summary, health insurance is a crucial aspect of financial planning in Pakistan, providing a safety net against medical expenses and financial hardship. With various types of health insurance available, including individual, group, critical illness, and personal accident insurance, individuals and families can choose the plan that best suits their needs. By comparing insurance providers, assessing medical needs, and seeking professional advice, individuals can make informed decisions when selecting a health insurance plan in Pakistan.

What is the importance of health insurance in Pakistan?

+

Health insurance is essential in Pakistan due to the country’s limited public healthcare resources and the high cost of private medical care. It provides a safety net, allowing individuals to access necessary medical care without incurring significant financial hardship.

What types of health insurance are available in Pakistan?

+

There are several types of health insurance available in Pakistan, including individual health insurance, group health insurance, critical illness insurance, and personal accident insurance.

How do I choose the right health insurance plan in Pakistan?

+

When choosing a health insurance plan in Pakistan, it is essential to consider several factors, including assessing your medical needs, comparing insurance providers, reading reviews and ratings, and seeking professional advice.

Related Terms:

- Health insurance in Pakistan

- Health insurance in Pakistan price

- Best health insurance in Pakistan

- Jubilee Health insurance

- Pak Qatar health Insurance

- Islamic health insurance in Pakistan