Short Term Health Insurance One Month

Understanding Short Term Health Insurance

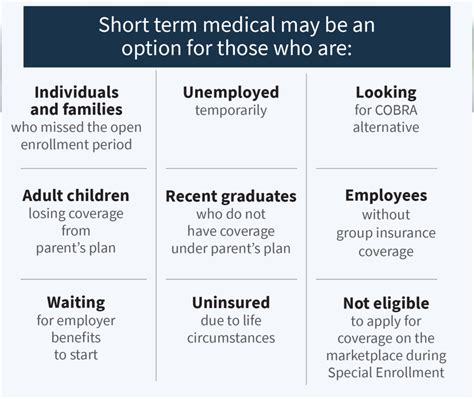

Short term health insurance, also known as temporary or term health insurance, provides limited duration health coverage for individuals and families. These plans are designed to offer temporary relief from medical expenses due to unexpected illnesses, accidents, or other health-related issues. Short term health insurance plans are ideal for individuals who are between jobs, waiting for other coverage to begin, or need temporary coverage for a specific period, such as one month.

Key Features of Short Term Health Insurance Plans

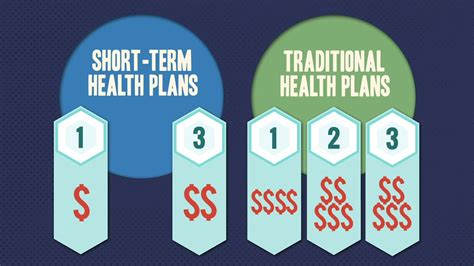

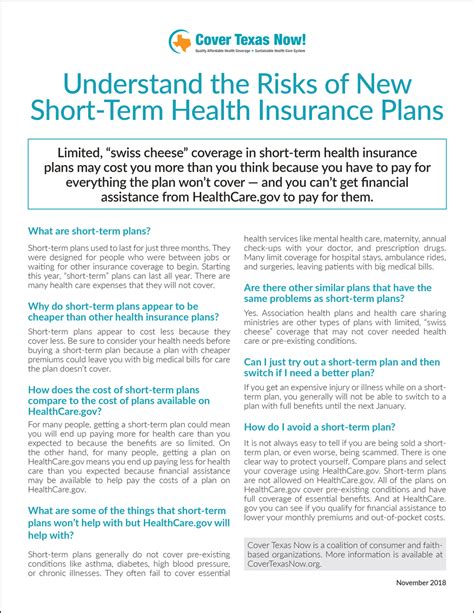

Some key features of short term health insurance plans include: * Flexibility: Short term plans can be purchased for various durations, ranging from a few months to a year or more, depending on the insurer and state regulations. * Lower Premiums: Short term plans typically have lower premiums compared to major medical plans, making them an attractive option for those on a tight budget. * Limited Benefits: Short term plans usually have limited benefits, including coverage for doctor visits, hospital stays, and other medical expenses, but may not cover pre-existing conditions, preventive care, or other essential health benefits. * Pre-Existing Condition Exclusions: Short term plans often exclude pre-existing conditions, which means that any medical conditions you had before purchasing the plan may not be covered.

One Month Short Term Health Insurance Plans

One month short term health insurance plans are designed to provide temporary coverage for a short period, usually 30 days. These plans are ideal for individuals who need coverage for a brief period, such as: * Between jobs: If you’re between jobs and waiting for new employer-sponsored coverage to begin. * Waiting for other coverage: If you’re waiting for other health insurance coverage to start, such as a new job or a special enrollment period. * Temporary coverage: If you need temporary coverage for a specific event, such as a sports injury or a short-term illness.

📝 Note: One month short term health insurance plans may not be available in all states, and some insurers may not offer these plans. It's essential to check with insurers and state regulations before purchasing a plan.

Benefits of One Month Short Term Health Insurance Plans

One month short term health insurance plans offer several benefits, including: * Quick coverage: These plans can provide quick coverage, usually within 24 hours of application. * Low premiums: One month plans typically have lower premiums compared to longer-term plans. * Flexibility: One month plans can be renewed or extended if needed, depending on the insurer and state regulations.

Drawbacks of One Month Short Term Health Insurance Plans

While one month short term health insurance plans offer several benefits, there are also some drawbacks to consider: * Limited benefits: One month plans usually have limited benefits, which may not cover all medical expenses. * Pre-existing condition exclusions: One month plans often exclude pre-existing conditions, which means that any medical conditions you had before purchasing the plan may not be covered. * No preventive care coverage: One month plans may not cover preventive care services, such as routine check-ups, screenings, and vaccinations.

| Plan Duration | Premiums | Benefits |

|---|---|---|

| 1 month | Lower premiums | Limited benefits, excluding pre-existing conditions |

| 3 months | Medium premiums | More comprehensive benefits, including some preventive care services |

| 6 months | Higher premiums | More extensive benefits, including preventive care services and some pre-existing condition coverage |

Choosing the Right One Month Short Term Health Insurance Plan

When choosing a one month short term health insurance plan, consider the following factors: * Premiums: Compare premiums from different insurers to find the best rate. * Benefits: Review the plan’s benefits to ensure they meet your needs. * Pre-existing condition exclusions: Check if the plan excludes pre-existing conditions and if so, what conditions are excluded. * Provider network: Check if the plan has a provider network and if your preferred doctors and hospitals are included.

In summary, one month short term health insurance plans can provide temporary relief from medical expenses, but it’s essential to carefully review the plan’s benefits, premiums, and exclusions before purchasing. By understanding the key features and drawbacks of these plans, you can make an informed decision and choose the right plan for your needs.

What is short term health insurance?

+

Short term health insurance provides limited duration health coverage for individuals and families, usually for a few months to a year or more.

Can I purchase a one month short term health insurance plan?

+

Yes, one month short term health insurance plans are available, but may not be offered in all states or by all insurers. It’s essential to check with insurers and state regulations before purchasing a plan.

What are the benefits of one month short term health insurance plans?

+

One month short term health insurance plans offer quick coverage, low premiums, and flexibility, making them an attractive option for those who need temporary coverage.

Related Terms:

- Temporary health insurance between jobs

- Best short term health insurance

- Aetna short term health insurance

- Cigna short term health insurance

- short term health insurance