Health Insurance Guide

Introduction to Health Insurance

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It is a crucial aspect of healthcare that helps individuals and families cover the high costs of medical care. With the rising costs of healthcare, having health insurance is more important than ever. In this guide, we will explore the world of health insurance, its importance, types, and how to choose the right plan for your needs.

Why is Health Insurance Important?

Having health insurance is important for several reasons. Firstly, it helps protect you and your family from financial ruin in the event of a medical emergency. Medical bills can quickly add up, and without insurance, you may be forced to pay out of pocket, which can lead to financial hardship. Secondly, health insurance encourages preventive care, which can help detect health problems early on, reducing the risk of serious illnesses. Finally, health insurance provides peace of mind, knowing that you are protected in case of an unexpected medical event.

Types of Health Insurance

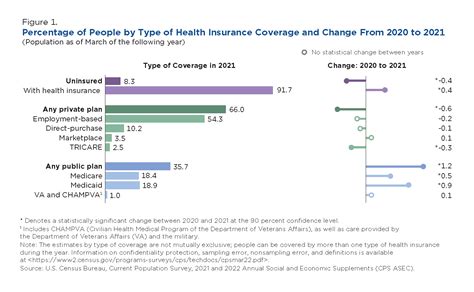

There are several types of health insurance plans available, each with its own unique features and benefits. Some of the most common types of health insurance plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans. * Medicare: This is a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). * Medicaid: This is a joint federal and state program that helps with medical costs for some people with limited income and resources.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be overwhelming, but there are several factors to consider when making your decision. Here are some tips to help you choose the right plan: * Determine Your Budget: Calculate how much you can afford to pay each month for your health insurance premium. * Consider Your Health Needs: Think about your health needs and the needs of your family. Do you have any pre-existing conditions? Do you need maternity coverage? * Research Different Plans: Research different health insurance plans, including their coverage, deductibles, copays, and coinsurance. * Check the Network: Make sure your doctor and hospital are part of the plan’s network. * Read Reviews: Read reviews from other customers to get an idea of the plan’s customer service and claims process.

💡 Note: It's essential to carefully review the plan's summary of benefits and coverage to ensure it meets your needs.

Understanding Health Insurance Terms

Health insurance can be confusing, especially with all the terminology used. Here are some key terms to understand: * Deductible: The amount you must pay out of pocket before your insurance plan starts paying. * Copay: A fixed amount you pay for a doctor visit or prescription medication. * Coinsurance: The percentage of medical costs you pay after meeting your deductible. * Premium: The monthly payment you make to maintain your health insurance coverage. * Out-of-Pocket Maximum: The maximum amount you pay for medical expenses in a year, including deductibles, copays, and coinsurance.

Health Insurance and Pre-Existing Conditions

If you have a pre-existing condition, it’s essential to choose a health insurance plan that covers your condition. The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage based on pre-existing conditions. However, some plans may have limitations or exclusions, so it’s crucial to carefully review the plan’s summary of benefits and coverage.

Health Insurance and Preventive Care

Preventive care is essential for maintaining good health, and many health insurance plans cover preventive care services, such as: * Annual physical exams * Vaccinations * Screenings for diseases, such as cancer and diabetes * Mental health services

Health Insurance Costs

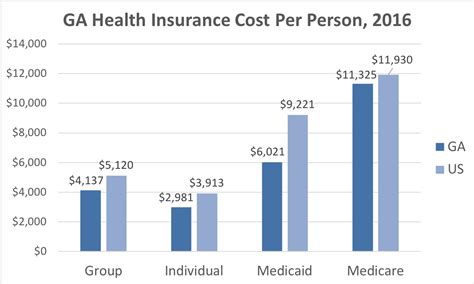

The cost of health insurance varies depending on several factors, including: * Age: Older individuals tend to pay more for health insurance. * Location: Health insurance costs can vary depending on where you live. * Income: Lower-income individuals may be eligible for subsidies or Medicaid. * Plan type: Different types of health insurance plans have varying costs.

| Plan Type | Monthly Premium | Deductible | Copay |

|---|---|---|---|

| Individual Plan | $300 | $1,000 | $20 |

| Group Plan | $200 | $500 | $10 |

| Medicare | $100 | $0 | $0 |

In summary, health insurance is a vital aspect of healthcare that helps individuals and families cover the high costs of medical care. There are several types of health insurance plans available, each with its own unique features and benefits. When choosing a health insurance plan, it’s essential to consider your budget, health needs, and the plan’s coverage, deductibles, copays, and coinsurance. By understanding health insurance terms and costs, you can make an informed decision and choose the right plan for your needs.

What is health insurance?

+

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured.

Why is health insurance important?

+

Having health insurance is important because it helps protect you and your family from financial ruin in the event of a medical emergency, encourages preventive care, and provides peace of mind.

What are the different types of health insurance plans?

+

There are several types of health insurance plans, including individual and family plans, group plans, Medicare, and Medicaid.

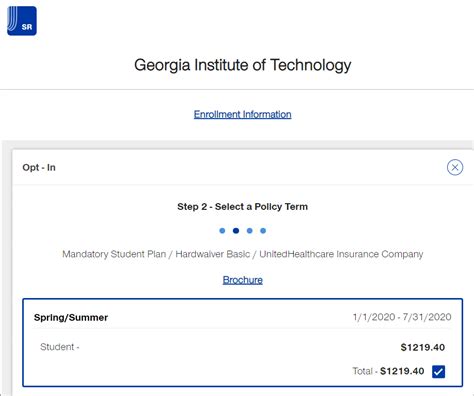

Related Terms:

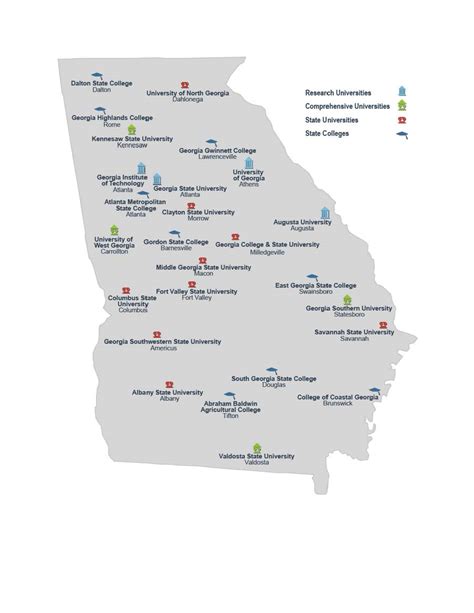

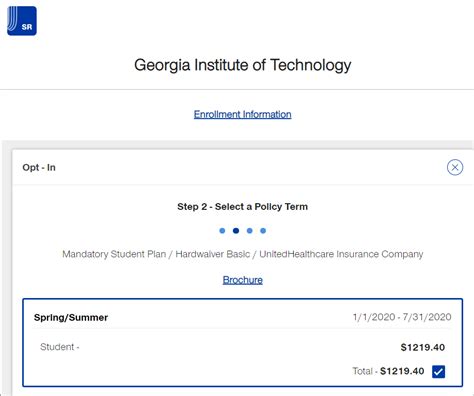

- Gatech health insurance

- Georgia Tech health insurance waiver

- USG Mandatory Health Insurance

- student health insurance plan ship

- UGA Health Insurance cost

- UGA benefits Health Insurance