5 H1B Health Insurance Hacks

Introduction to H1B Health Insurance Hacks

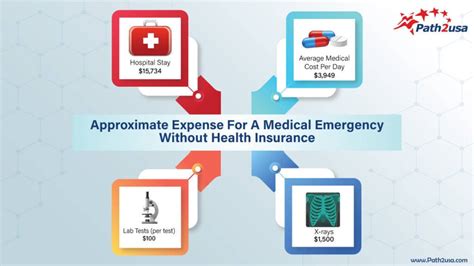

As an H1B visa holder in the United States, navigating the complex landscape of health insurance can be daunting. With numerous options available and the constant flux of healthcare regulations, it’s essential to stay informed to make the most cost-effective and beneficial decisions for your health and financial well-being. This guide is designed to provide you with actionable insights and hacks to optimize your H1B health insurance experience, ensuring you’re adequately covered without breaking the bank.

Understanding H1B Health Insurance Requirements

Before diving into the hacks, it’s crucial to understand the basic requirements and options available for H1B visa holders. Employer-sponsored plans are a common choice, but they might not always be the best option due to varying coverage levels and costs. Some employers may not offer health insurance to their H1B employees, or the coverage might be limited. In such cases, private health insurance plans or short-term health insurance can fill the gap. Knowing your options and their implications is the first step towards making informed decisions.

H1B Health Insurance Hacks

Here are five key hacks to consider when navigating H1B health insurance:

- Hack 1: Research and Compare Plans Thoroughly - With so many insurance providers offering a wide range of plans, it’s vital to research and compare them based on coverage, deductibles, copays, and premiums. Websites like eHealthInsurance or HealthCare.gov can be invaluable resources in this process.

- Hack 2: Consider Spouse or Family Plans - If you have a spouse or children, exploring family plans can sometimes be more cost-effective than individual plans. However, calculate the total costs and benefits carefully, as this isn’t always the case.

- Hack 3: Utilize Health Savings Accounts (HSAs) - For those with High-Deductible Health Plans (HDHPs), contributing to an HSA can provide a tax-advantaged way to save for medical expenses. HSAs are portable, meaning you can take them with you if you change jobs, and the funds can be used for a wide range of health-related expenses.

- Hack 4: Look into Short-Term Health Insurance - If you’re between jobs or waiting for your employer-sponsored plan to kick in, short-term health insurance can provide temporary coverage. These plans are generally less expensive but offer limited benefits and may not cover pre-existing conditions.

- Hack 5: Review and Adjust Annually - Health insurance needs can change yearly due to changes in income, family size, or health status. It’s essential to review your plan annually during the open enrollment period to ensure you’re still in the best plan for your current situation.

Additional Tips for H1B Visa Holders

- Understand Pre-Existing Conditions: If you have a pre-existing condition, ensure your chosen plan covers it. Some plans, especially short-term insurance, may not cover pre-existing conditions. - Network Providers: Check if your regular healthcare providers are within the plan’s network to avoid out-of-network charges. - Maximum Out-of-Pocket (MOOP) Costs: Consider the MOOP when choosing a plan, as it can significantly impact your annual healthcare expenses.

📝 Note: Always review the plan's documentation carefully and ask questions if you're unsure about any aspect of the coverage.

Health Insurance Marketplaces and Exchanges

The Affordable Care Act (ACA) created health insurance marketplaces where individuals, including H1B visa holders, can purchase health insurance. These marketplaces offer plans from various insurance companies, and eligibility for subsidies is based on income. It’s worth exploring these options, especially during the annual open enrollment period, to find the most suitable and affordable plan.

| Plan Type | Coverage | Cost |

|---|---|---|

| Employer-Sponsored | Varies by Employer | Shared between Employer and Employee |

| Private Plans | Varies by Provider | Varies by Provider and Plan |

| Short-Term Plans | Limited | Generally Less Expensive |

Final Thoughts

Navigating the world of H1B health insurance requires patience, research, and a keen understanding of your needs and options. By applying these hacks and staying informed, you can make the best decisions for your health and financial situation. Remember, your health insurance plan is not a one-size-fits-all solution; it should evolve with your changing needs and circumstances.

What is the difference between an HMO and a PPO?

+

A Health Maintenance Organization (HMO) typically requires you to receive medical care and services within a specific network, except in emergency situations. A Preferred Provider Organization (PPO) offers more flexibility, allowing you to see any healthcare provider, both in and out of network, though out-of-network care usually costs more.

Can H1B visa holders purchase health insurance through the ACA marketplace?

+

Yes, H1B visa holders can purchase health insurance through the Affordable Care Act (ACA) marketplace. However, they may not be eligible for subsidies if their income is above certain thresholds or if they have access to an employer-sponsored plan that meets the ACA’s minimum essential coverage requirements.

How do I choose the best health insurance plan for my needs?

+

Choosing the best health insurance plan involves considering several factors, including your health needs, budget, provider network, and coverage details. It’s also important to read reviews, ask questions, and compare different plans side by side to find the one that best aligns with your needs and financial situation.

Related Terms:

- H1B visa health insurance requirements

- Health insurance for H1B holders

- H1B parents health insurance

- H1b health insurance reddit

- H1B health insurance penalty

- United health insurance