Best Individual Health Insurance Plans

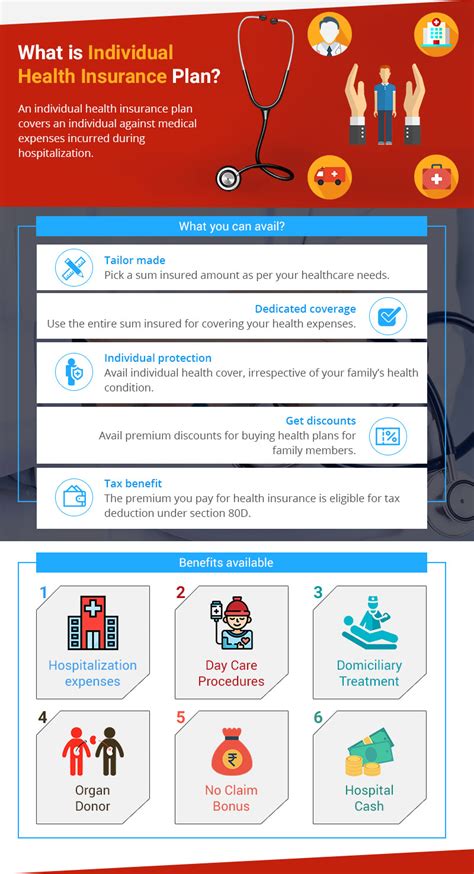

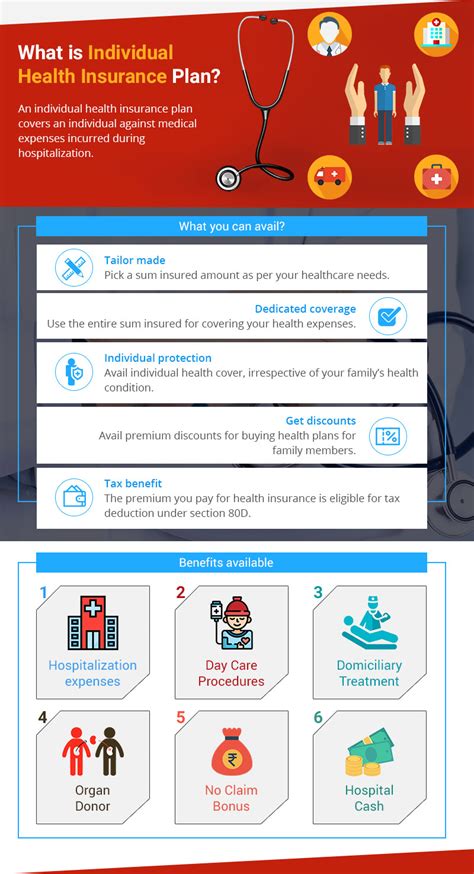

Introduction to Individual Health Insurance Plans

When it comes to securing health insurance, individuals have a multitude of options to choose from, ranging from group plans offered by employers to individual health insurance plans that can be purchased directly from insurance providers. Individual health insurance plans are designed for people who are not covered by their employer or are self-employed. These plans offer a range of benefits, including access to a network of healthcare providers, coverage for pre-existing conditions, and financial protection against medical expenses. In this article, we will delve into the world of individual health insurance plans, exploring what they entail, their benefits, and how to select the best plan for your needs.

Understanding Individual Health Insurance Plans

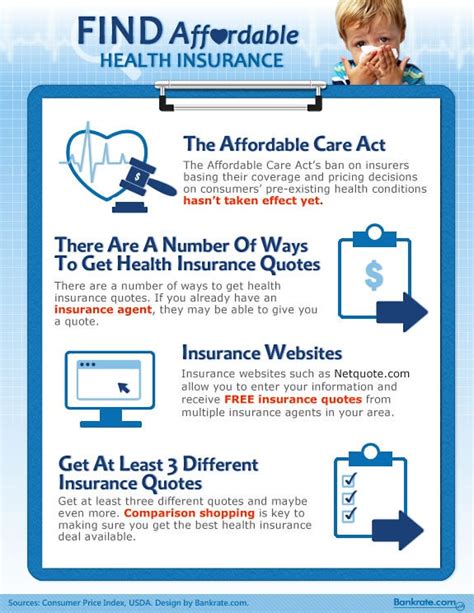

Individual health insurance plans are personalized insurance policies that individuals can purchase for themselves and their families. These plans are not tied to employment, which means that individuals can maintain their coverage even if they change jobs or become self-employed. The Affordable Care Act (ACA), also known as Obamacare, has played a significant role in shaping the individual health insurance market by introducing provisions such as the prohibition of denying coverage based on pre-existing conditions and the requirement for essential health benefits to be covered.

Types of Individual Health Insurance Plans

There are several types of individual health insurance plans available, each with its own set of benefits and drawbacks. Some of the most common types include: - Preferred Provider Organization (PPO) Plans: These plans offer a network of healthcare providers from which individuals can choose. They have the flexibility to see any healthcare provider, both in and out of network, although seeing an out-of-network provider may result in higher costs. - Health Maintenance Organization (HMO) Plans: HMO plans also have a network of healthcare providers but typically require individuals to receive medical care and services from within the network, except in emergency situations. - Exclusive Provider Organization (EPO) Plans: EPO plans allow individuals to receive care from any provider within the plan’s network, excluding emergency situations. They do not cover care received from out-of-network providers. - Catastrophic Plans: These plans have lower premiums but higher deductibles. They are designed for young adults or individuals who cannot afford other types of coverage.

Benefits of Individual Health Insurance Plans

Individual health insurance plans offer numerous benefits, including: - Financial Protection: They protect individuals from the high costs of medical care by covering a significant portion of the expenses. - Access to Healthcare: These plans provide access to a network of healthcare providers, ensuring that individuals can receive the medical care they need. - Preventive Care: Many plans cover preventive care services, such as annual check-ups and screenings, without additional costs. - Flexibility: Individual plans can be tailored to meet the specific health needs and budget of an individual or family.

How to Choose the Best Individual Health Insurance Plan

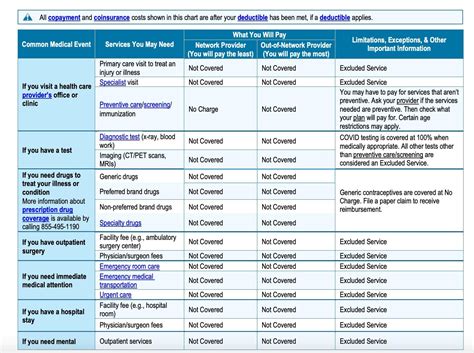

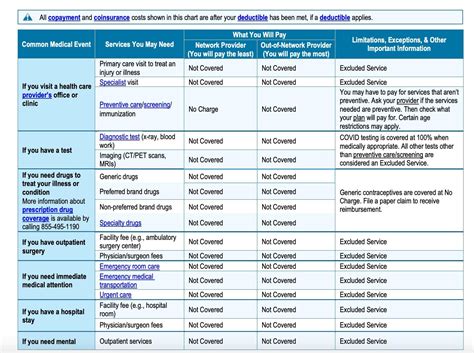

Choosing the best individual health insurance plan involves several steps: - Assess Your Needs: Consider your health status, the health status of your family members, and your budget. - Compare Plans: Look at the different types of plans available, their coverage, deductibles, copays, and coinsurance. - Check the Network: Ensure that your preferred healthcare providers are included in the plan’s network. - Review the Benefits: Consider what benefits are essential to you, such as coverage for prescription drugs, mental health services, and maternity care. - Evaluate the Costs: Calculate the total cost of the plan, including premiums, deductibles, and out-of-pocket expenses.

| Plan Type | Network | Coverage | Cost |

|---|---|---|---|

| PPO | Flexible network | Comprehensive | Higher premiums |

| HMO | Restrictive network | Comprehensive | Lower premiums |

| EPO | No out-of-network coverage | Comprehensive | Lower premiums |

| Catastrophic | Limited network | Basic | Lowest premiums |

📝 Note: When selecting an individual health insurance plan, it's crucial to read and understand the plan's details, including any exclusions or limitations, to ensure it meets your health and financial needs.

In the end, selecting the best individual health insurance plan requires careful consideration of your health needs, budget, and the specifics of each plan. By understanding the different types of plans, their benefits, and how to compare them effectively, individuals can make informed decisions that provide them with the coverage they need at a price they can afford. Whether you’re looking for comprehensive coverage or a more basic plan, there’s an individual health insurance plan out there that can meet your requirements and provide you with peace of mind knowing that you’re protected against unexpected medical expenses.

What is the difference between a PPO and an HMO plan?

+

A PPO (Preferred Provider Organization) plan offers a network of healthcare providers but allows for out-of-network care at a higher cost. An HMO (Health Maintenance Organization) plan also has a network but typically only covers care received within the network, except in emergency situations.

How do I choose the best individual health insurance plan for my needs?

+

To choose the best individual health insurance plan, assess your health needs, compare different plans, check the network of providers, review the benefits covered, and evaluate the costs, including premiums, deductibles, and out-of-pocket expenses.

What is a catastrophic health insurance plan?

+

A catastrophic health insurance plan is a type of plan that has lower premiums but higher deductibles. It is designed for young adults or individuals who cannot afford other types of coverage and primarily covers essential health benefits after the deductible is met.

Related Terms:

- Best individual health insurance

- Individual health insurance plans

- Best health insurance reddit

- Affordable health insurance

- Cheap health insurance reddit

- Getting health insurance reddit