5 Health Insurance Stocks

Introduction to Health Insurance Stocks

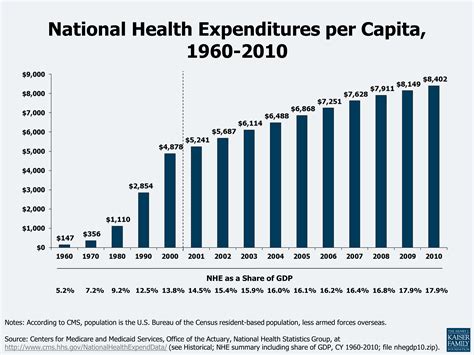

The health insurance industry is a significant sector within the healthcare market, providing coverage to millions of people worldwide. Investing in health insurance stocks can be a lucrative opportunity, considering the constant demand for healthcare services. In this article, we will explore five prominent health insurance stocks, their performance, and factors influencing their growth.

1. UnitedHealth Group (UNH)

UnitedHealth Group is one of the largest health insurance companies in the world. It provides a wide range of healthcare services, including health insurance, medical care, and pharmaceutical benefits. UNH has consistently demonstrated strong financial performance, with a market capitalization of over $400 billion. The company’s diversified portfolio, which includes Optum and UnitedHealthcare, contributes to its stability and growth.

2. Anthem, Inc. (ANTM)

Anthem, Inc. is another leading health insurance provider, operating in 14 states and serving over 70 million people. ANTM has shown resilience in the face of regulatory challenges, with a market capitalization of around $80 billion. The company’s focus on expanding its Medicaid and Medicare Advantage businesses has contributed to its growth.

3. Aetna Inc. (AET)

Aetna Inc., now a part of CVS Health, is a well-established health insurance company with a market capitalization of over $60 billion. AET has a strong presence in the commercial and government businesses, including Medicare Advantage and Medicaid. The company’s integration with CVS Health has enhanced its capabilities in providing comprehensive healthcare services.

4. Humana Inc. (HUM)

Humana Inc. is a prominent player in the health insurance industry, with a focus on Medicare Advantage and Medicaid. HUM has a market capitalization of around $50 billion and serves over 18 million members. The company’s emphasis on value-based care and its partnerships with healthcare providers have contributed to its growth.

5. Cigna Corporation (CI)

Cigna Corporation is a global health insurance company with a market capitalization of over $60 billion. CI provides a range of healthcare services, including medical, dental, and pharmaceutical benefits. The company’s acquisition of Express Scripts has enhanced its capabilities in pharmacy benefits management.

💡 Note: Investing in health insurance stocks involves understanding the complex regulatory environment and the companies' adaptability to changing market conditions.

Key Factors Influencing Health Insurance Stocks

Several factors influence the performance of health insurance stocks, including: * Regulatory changes: Modifications in healthcare policies and regulations can significantly impact health insurance companies’ operations and profitability. * Demographic trends: Changes in population demographics, such as aging or migration, can affect the demand for healthcare services and health insurance coverage. * Technological advancements: The adoption of digital technologies, such as telemedicine and artificial intelligence, can improve healthcare delivery and reduce costs. * Competition: The health insurance market is highly competitive, with companies competing for market share and customers.

Investment Considerations

When investing in health insurance stocks, consider the following: * Financial performance: Evaluate the company’s revenue growth, profitability, and dividend yield. * Market position: Assess the company’s market share, competitive advantage, and growth potential. * Regulatory environment: Understand the regulatory landscape and the company’s ability to adapt to changes. * Growth prospects: Consider the company’s expansion plans, partnerships, and innovative initiatives.

| Company | Market Capitalization | Revenue Growth |

|---|---|---|

| UnitedHealth Group (UNH) | $400 billion | 10% |

| Anthem, Inc. (ANTM) | $80 billion | 12% |

| Aetna Inc. (AET) | $60 billion | 8% |

| Humana Inc. (HUM) | $50 billion | 15% |

| Cigna Corporation (CI) | $60 billion | 10% |

As the healthcare industry continues to evolve, health insurance stocks are likely to remain a vital component of investment portfolios. By understanding the key factors influencing these stocks and considering the investment considerations outlined above, investors can make informed decisions about their investments in the health insurance sector.

In summary, the five health insurance stocks discussed in this article – UnitedHealth Group, Anthem, Inc., Aetna Inc., Humana Inc., and Cigna Corporation – offer a range of investment opportunities. Each company has its strengths and weaknesses, and investors should carefully evaluate their financial performance, market position, and growth prospects before making investment decisions. By doing so, investors can navigate the complexities of the health insurance industry and potentially generate strong returns on their investments.

What are the key factors influencing health insurance stocks?

+

The key factors influencing health insurance stocks include regulatory changes, demographic trends, technological advancements, and competition.

How can I evaluate the financial performance of health insurance companies?

+

You can evaluate the financial performance of health insurance companies by analyzing their revenue growth, profitability, and dividend yield.

What are the growth prospects for the health insurance industry?

+

The growth prospects for the health insurance industry are positive, driven by increasing demand for healthcare services, an aging population, and the expansion of health insurance coverage to more people.

Related Terms:

- hiiq stock