5 Health Insurance Jobs

Introduction to Health Insurance Jobs

The health insurance industry is a vital part of the healthcare system, providing financial protection to individuals and families against medical expenses. With the increasing demand for healthcare services, the health insurance industry is growing rapidly, creating a wide range of job opportunities for professionals with various skills and expertise. In this article, we will explore five health insurance jobs that are in high demand and offer a rewarding career path.

1. Health Insurance Underwriter

A health insurance underwriter is responsible for assessing the risk of insuring an individual or group and determining the premium rates. They analyze medical history, lifestyle, and other factors to determine the likelihood of claims being made. Key skills required for this job include analytical thinking, attention to detail, and excellent communication skills. Health insurance underwriters typically require a bachelor’s degree in a related field, such as business or health administration, and may need to obtain professional certifications like the Chartered Property Casualty Underwriter (CPCU) designation.

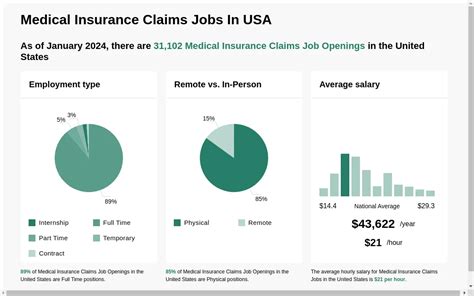

2. Insurance Claims Adjuster

An insurance claims adjuster is responsible for investigating and settling claims made by policyholders. They review medical records, interview claimants, and negotiate with healthcare providers to determine the validity and value of claims. Essential skills for this job include strong communication and negotiation skills, attention to detail, and the ability to analyze complex medical information. Insurance claims adjusters typically require a high school diploma or equivalent and may need to obtain professional certifications like the Registered Professional Adjuster (RPA) designation.

3. Health Insurance Broker

A health insurance broker is an independent agent who helps individuals and businesses find and purchase health insurance policies. They work with multiple insurance companies to offer a range of policy options and provide guidance on plan selection and enrollment. Key skills required for this job include excellent communication and sales skills, knowledge of health insurance products and regulations, and the ability to build strong relationships with clients. Health insurance brokers typically require a license to sell insurance in their state and may need to obtain professional certifications like the Registered Health Underwriter (RHU) designation.

4. Medical Billing and Coding Specialist

A medical billing and coding specialist is responsible for assigning medical codes to diagnoses and procedures and preparing insurance claims for reimbursement. They work with healthcare providers to ensure accurate and timely billing and coding. Essential skills for this job include attention to detail, analytical thinking, and knowledge of medical coding systems like ICD-10 and CPT. Medical billing and coding specialists typically require a postsecondary certificate or associate’s degree in medical billing and coding and may need to obtain professional certifications like the Certified Professional Coder (CPC) designation.

5. Health Insurance Actuary

A health insurance actuary is responsible for analyzing data to predict future healthcare costs and determine premium rates. They use statistical models and machine learning algorithms to identify trends and patterns in healthcare utilization and costs. Key skills required for this job include strong analytical and mathematical skills, knowledge of statistics and data analysis, and excellent communication skills. Health insurance actuaries typically require a bachelor’s degree in actuarial science, mathematics, or statistics and may need to obtain professional certifications like the Fellow of the Society of Actuaries (FSA) designation.

💡 Note: These jobs may require additional education, training, or certifications beyond what is listed here, and job requirements may vary depending on the employer and location.

In summary, these five health insurance jobs offer a range of career opportunities for professionals with various skills and expertise. Whether you’re interested in underwriting, claims adjustment, brokering, medical billing and coding, or actuarial science, there’s a health insurance job that can provide a rewarding and challenging career path. With the growing demand for healthcare services, the health insurance industry is expected to continue to grow, creating new job opportunities and career advancement possibilities for professionals in this field.

What is the average salary for a health insurance underwriter?

+

The average salary for a health insurance underwriter can range from 60,000 to over 100,000 per year, depending on experience and location.

Do I need a license to sell health insurance?

+

Yes, you typically need a license to sell health insurance in your state. Requirements vary by state, but most states require completion of a pre-licensing course and passing a licensing exam.

What is the job outlook for medical billing and coding specialists?

+

The job outlook for medical billing and coding specialists is strong, with the Bureau of Labor Statistics predicting 13% growth in employment opportunities from 2020 to 2030.

Related Terms:

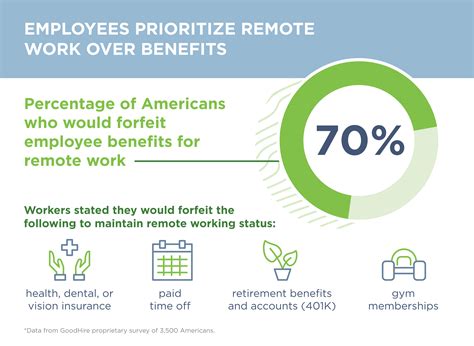

- Medical insurance careers Remote

- Work from home jobs

- Remote medical insurance

- United healthcare Remote jobs

- remote health insurance jobs hiring

- entry level insurance jobs remote