5 Tips Maine Health Insurance

Introduction to Maine Health Insurance

Maine health insurance is a crucial aspect of healthcare in the state, providing financial protection against medical expenses. With the ever-changing landscape of healthcare, it’s essential to stay informed about the options available. In this article, we’ll explore five tips for navigating Maine health insurance, helping you make informed decisions about your healthcare coverage.

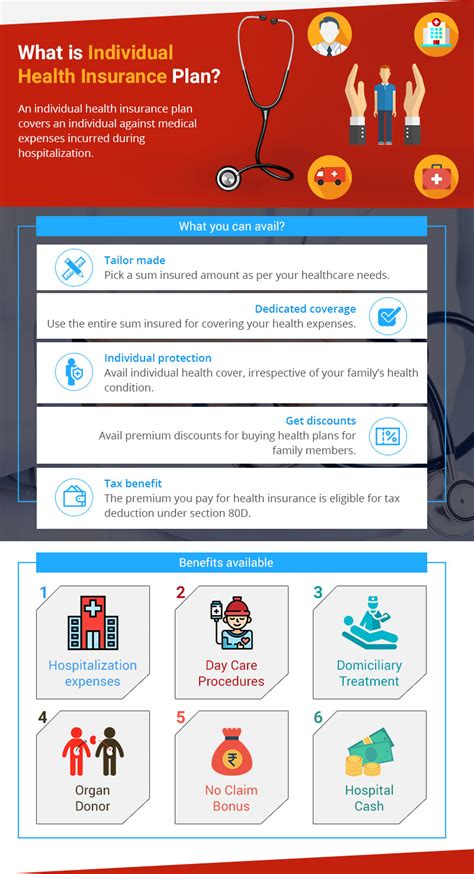

Understanding Your Options

When it comes to Maine health insurance, you have several options to consider. These include: * Employer-sponsored plans: Many employers in Maine offer health insurance as part of their benefits package. * Individual and family plans: You can purchase these plans directly from insurance companies or through the Health Insurance Marketplace. * Medicaid and CHIP: These government-funded programs provide health insurance to low-income individuals and families. * Military and veterans’ insurance: If you’re a member of the military or a veteran, you may be eligible for health insurance through the TRICARE or Veterans Administration programs.

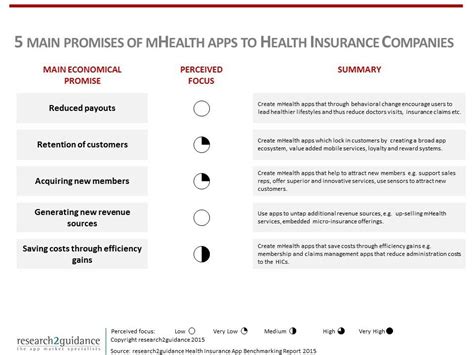

Tips for Navigating Maine Health Insurance

Here are five tips to help you navigate the complex world of Maine health insurance: * Research, research, research: Take the time to learn about the different types of health insurance available in Maine, including their benefits, drawbacks, and costs. * Compare plans: Once you’ve identified your options, compare the plans to determine which one best meets your needs and budget. * Consider your network: Make sure your healthcare providers are part of the insurance company’s network to avoid out-of-pocket expenses. * Review the fine print: Carefully read the policy documents to understand the terms and conditions, including deductibles, copays, and coinsurance. * Seek professional advice: If you’re unsure about any aspect of Maine health insurance, consider consulting with a licensed insurance agent or broker.

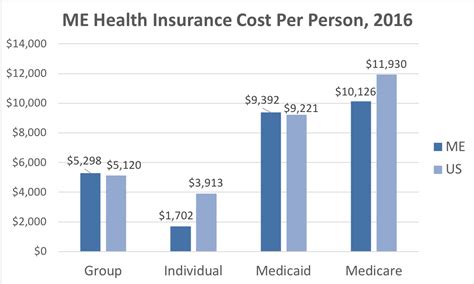

Maine Health Insurance Costs

The cost of Maine health insurance varies depending on several factors, including: * Age: Older individuals typically pay more for health insurance than younger individuals. * Location: Insurance premiums can vary depending on where you live in Maine. * Income: Lower-income individuals may be eligible for subsidies or tax credits to help offset the cost of health insurance. * Plan type: Different types of plans, such as HMOs or PPOs, can have varying costs.

| Plan Type | Premium | Deductible | Copay |

|---|---|---|---|

| HMO | $300 | $1,000 | $20 |

| PPO | $400 | $1,500 | $30 |

| EPO | $350 | $1,200 | $25 |

💡 Note: The costs listed in the table are examples and may not reflect the actual costs of Maine health insurance plans.

Staying Informed About Maine Health Insurance

To stay up-to-date on the latest developments in Maine health insurance, consider the following: * Visit the official website: The Maine Bureau of Insurance website provides information on health insurance options, costs, and regulations. * Follow industry news: Stay informed about changes in the healthcare landscape by following reputable news sources and industry publications. * Attend community events: Many organizations in Maine host events and workshops to educate consumers about health insurance options and how to navigate the system.

As we’ve explored the world of Maine health insurance, it’s clear that navigating the system can be complex. By following these five tips and staying informed, you can make informed decisions about your healthcare coverage and ensure you have the protection you need.

In the end, having the right health insurance coverage can provide peace of mind and financial security. By taking the time to research and understand your options, you can make the best choice for your unique needs and budget.

What is the difference between an HMO and a PPO?

+

An HMO (Health Maintenance Organization) is a type of health insurance plan that requires you to receive medical care from a specific network of providers, while a PPO (Preferred Provider Organization) allows you to see any healthcare provider, both in and out of network, although you’ll typically pay more for out-of-network care.

How do I know if I’m eligible for Medicaid in Maine?

+

To determine if you’re eligible for Medicaid in Maine, you can visit the MaineCare website or contact your local Department of Health and Human Services office. They will assess your income, family size, and other factors to determine if you qualify for the program.

Can I purchase health insurance outside of the open enrollment period?

+

Yes, you can purchase health insurance outside of the open enrollment period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. You may also be eligible for a special enrollment period if you’re a member of a Native American tribe or qualify for Medicaid or CHIP.

Related Terms:

- maine health insurance pre approval

- health insurance maine self employed

- maine health insurance providers

- health insurance for maine residents

- affordable health insurance in maine

- affordable health insurance plans maine