5 Tips NC Health Insurance

Introduction to NC Health Insurance

In North Carolina, having the right health insurance is crucial for protecting your health and financial well-being. With numerous options available, selecting the most suitable health insurance plan can be overwhelming. This article aims to provide you with essential tips for choosing the best NC health insurance plan for your needs.

Understanding Your Needs

Before diving into the world of health insurance, it’s vital to assess your needs. Consider factors such as your age, health status, income level, and the number of people you need to cover. This evaluation will help you determine the type of plan that suits you best. For instance, if you have a pre-existing condition, you may want to opt for a plan with more comprehensive coverage.

Tips for Choosing the Right NC Health Insurance Plan

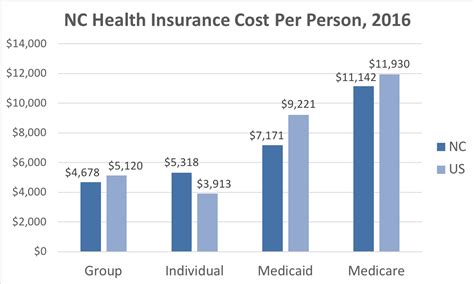

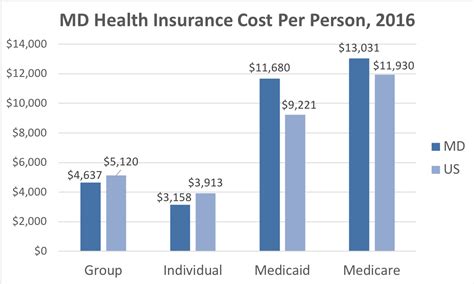

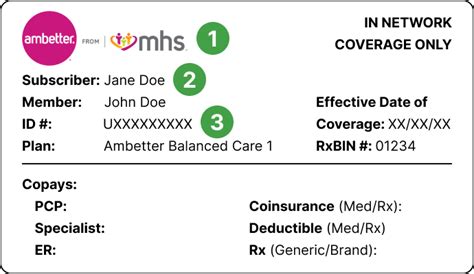

Here are five valuable tips to keep in mind when selecting a health insurance plan in North Carolina: * Research, research, research: Take the time to explore different insurance providers and their offerings. Look into their reputation, coverage options, and customer reviews. * Compare plans: Once you’ve shortlisted potential providers, compare their plans side by side. Consider factors like deductibles, copays, coinsurance, and out-of-pocket maximums. * Check the network: Ensure that your preferred healthcare providers are part of the insurance network. This is crucial for minimizing out-of-pocket expenses. * Evaluate the costs: Calculate the total costs associated with each plan, including premiums, deductibles, and other expenses. Consider your budget and choose a plan that balances coverage and affordability. * Seek professional advice: If you’re unsure about any aspect of the process, consider consulting a licensed insurance agent or broker. They can provide personalized guidance and help you make an informed decision.

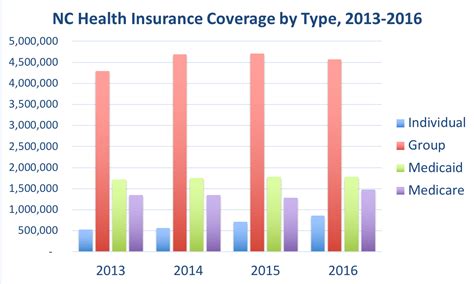

Types of Health Insurance Plans in NC

North Carolina offers various types of health insurance plans, including:

| Plan Type | Description |

|---|---|

| HMO (Health Maintenance Organization) | A type of plan that requires you to receive care from a specific network of providers. |

| PPO (Preferred Provider Organization) | A type of plan that offers more flexibility in choosing healthcare providers, both in-network and out-of-network. |

| EPO (Exclusive Provider Organization) | A type of plan that combines elements of HMO and PPO plans, offering a balance between flexibility and cost savings. |

💡 Note: It's essential to carefully review the terms and conditions of each plan before making a decision.

Additional Considerations

When selecting a health insurance plan in North Carolina, it’s also important to consider factors like: * Prescription coverage: If you take prescription medications regularly, ensure that your plan covers them. * Mental health services: If you or a family member requires mental health services, look for a plan that includes comprehensive coverage. * Dental and vision coverage: Some plans may offer additional coverage for dental and vision services.

Final Thoughts

Choosing the right NC health insurance plan requires careful consideration and research. By following these tips and evaluating your needs, you can make an informed decision and find a plan that provides the coverage you need at a price you can afford. Remember to stay vigilant and review your plan regularly to ensure it continues to meet your changing needs.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires you to receive care from a specific network of providers, while a PPO plan offers more flexibility in choosing healthcare providers, both in-network and out-of-network.

How do I determine which health insurance plan is best for me?

+

To determine which health insurance plan is best for you, consider factors like your age, health status, income level, and the number of people you need to cover. Research different plans, compare their features, and evaluate their costs to find the one that balances coverage and affordability.

Can I change my health insurance plan after enrollment?

+

Yes, you can change your health insurance plan after enrollment, but it may be subject to certain restrictions and limitations. Typically, you can make changes during the annual open enrollment period or if you experience a qualifying life event, such as a change in income or family status.

Related Terms:

- Health insurance artinya

- nc healthcare gov login

- Cigna Health Insurance NC

- NC health insurance

- Cheapest health insurance NC

- Free health insurance NC