Montana Health Insurance Options

Introduction to Montana Health Insurance Options

Montana, known for its vast open spaces and natural beauty, is home to a diverse population with varying healthcare needs. When it comes to health insurance, Montana residents have several options to choose from, each with its own set of benefits and drawbacks. In this post, we will delve into the different types of health insurance available in Montana, exploring the pros and cons of each, as well as the eligibility criteria and application processes.

Individual and Family Plans

Individual and family plans are a popular choice for those who are not covered by their employer or are self-employed. These plans can be purchased through the health insurance marketplace or directly from insurance companies. Key benefits of individual and family plans include: * Flexibility in choosing a plan that suits your needs and budget * Ability to apply for subsidies to reduce premium costs * Access to a wide range of healthcare providers and services However, drawbacks may include: * Higher premium costs compared to group plans * Limited provider networks * Potential for higher out-of-pocket costs

Group Plans

Group plans, typically offered by employers, are another option for Montana residents. These plans often have lower premium costs and broader provider networks compared to individual plans. Additionally, group plans may offer: * More comprehensive coverage, including dental and vision care * Access to health savings accounts (HSAs) or flexible spending accounts (FSAs) * Simplified application and enrollment processes However, eligibility is usually limited to employees and their dependents, and benefits may vary depending on the employer and plan chosen.

Medicaid and CHIP

For low-income individuals and families, Medicaid and the Children’s Health Insurance Program (CHIP) are vital options. These programs provide comprehensive coverage at little to no cost, including: * Doctor visits and hospital stays * Prescription medications and medical equipment * Mental health and substance abuse services To be eligible, applicants must meet specific income and family size requirements, which vary depending on the program and household circumstances.

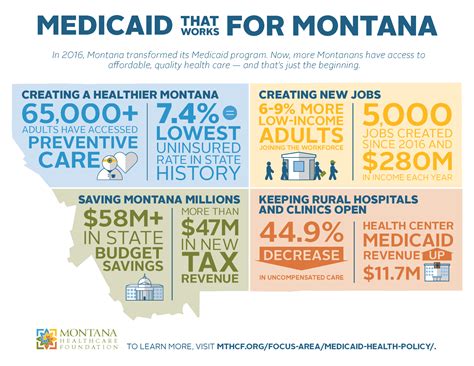

Montana Medicaid Expansion

In 2016, Montana expanded its Medicaid program to include adults with incomes up to 138% of the federal poverty level. This expansion has increased access to healthcare for thousands of Montana residents, including: * Low-income parents and caregivers * Childless adults * Individuals with disabilities The expansion has also reduced the uninsured rate in Montana, improving overall health outcomes and economic stability.

Short-Term Limited-Duration Insurance (STLDI)

Short-term limited-duration insurance (STLDI) plans are temporary solutions for individuals who need coverage for a short period, typically up to 12 months. These plans often have lower premium costs and simplified application processes, but may also have: * Limited benefits, excluding essential health benefits like maternity care and mental health services * Pre-existing condition exclusions, which may limit coverage for individuals with ongoing health needs * Higher out-of-pocket costs, including deductibles and coinsurance

Catastrophic Plans

Catastrophic plans are designed for young adults or those who are exempt from the individual mandate. These plans have lower premium costs and higher deductibles, making them suitable for individuals who: * Are under 30 years old * Have a hardship exemption * Are unable to afford other coverage options However, benefits are limited, and out-of-pocket costs may be higher compared to other plan types.

📝 Note: When selecting a health insurance plan, it's essential to carefully review the benefits, costs, and eligibility criteria to ensure you choose the best option for your needs and budget.

Comparison of Montana Health Insurance Options

The following table summarizes the key features of each health insurance option in Montana:

| Plan Type | Premium Costs | Benefits | Eligibility |

|---|---|---|---|

| Individual and Family Plans | Varying | Comprehensive | Any individual or family |

| Group Plans | Lower | Comprehensive | Employees and dependents |

| Medicaid and CHIP | Low or no cost | Comprehensive | Low-income individuals and families |

| STLDI Plans | Lower | Limited | Any individual or family |

| Catastrophic Plans | Lower | Limited | Young adults or exempt individuals |

In the end, selecting the right health insurance option in Montana depends on various factors, including your income, family size, health needs, and budget. By carefully evaluating the pros and cons of each plan type and considering your individual circumstances, you can make an informed decision and choose the best coverage for yourself and your loved ones.

What is the difference between a group plan and an individual plan?

+

A group plan is typically offered by an employer and provides coverage for employees and their dependents, while an individual plan is purchased directly by an individual or family.

Am I eligible for Medicaid in Montana?

+

To be eligible for Medicaid in Montana, you must meet specific income and family size requirements, which vary depending on the program and household circumstances.

Can I purchase a short-term limited-duration insurance (STLDI) plan in Montana?

+

Yes, STLDI plans are available in Montana, but they may have limited benefits and higher out-of-pocket costs compared to other plan types.

Related Terms:

- Low cost health insurance Montana

- Health insurance Montana Marketplace

- Best health insurance in Montana

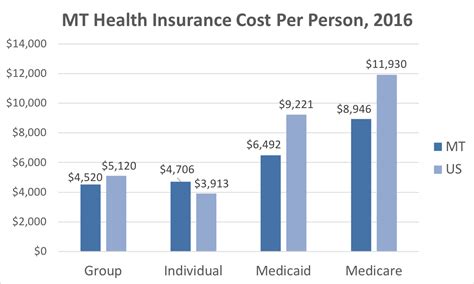

- Montana health insurance cost

- Blue Cross Blue Shield Montana

- Montana state University health insurance