Nebraska Health Insurance Options

Introduction to Nebraska Health Insurance Options

When it comes to health insurance, Nebraskans have a variety of options to choose from. With the Affordable Care Act (ACA) in place, residents of Nebraska can access affordable health insurance plans that cater to their needs. In this article, we will delve into the different types of health insurance options available in Nebraska, including individual and family plans, group plans, Medicaid, and Medicare. We will also discuss the benefits and drawbacks of each option, as well as provide guidance on how to choose the best plan for your needs.

Individual and Family Plans

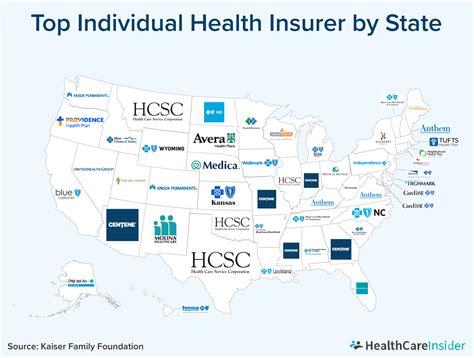

Individual and family plans are a popular option for those who do not have access to employer-sponsored health insurance. These plans are available through the health insurance marketplace or directly from insurance companies. In Nebraska, some of the top insurance companies offering individual and family plans include Blue Cross and Blue Shield of Nebraska, UnitedHealthcare, and Aetna. When shopping for an individual or family plan, it’s essential to consider factors such as premium costs, deductibles, copays, and network providers.

Group Plans

Group plans are typically offered by employers to their employees as a benefit. These plans are often more affordable than individual plans and may offer more comprehensive coverage. In Nebraska, group plans are available for small businesses (2-50 employees) and large businesses (51+ employees). Some of the benefits of group plans include lower premiums, better network coverage, and additional benefits such as dental and vision insurance.

Medicaid

Medicaid is a government-funded health insurance program that provides coverage to low-income individuals and families. In Nebraska, Medicaid is available to those who meet certain income requirements and eligibility criteria. Medicaid coverage includes doctor visits, hospital stays, prescription medications, and other essential health services. To apply for Medicaid in Nebraska, you can visit the Nebraska Department of Health and Human Services website or contact your local Medicaid office.

Medicare

Medicare is a federal health insurance program that provides coverage to individuals 65 and older, as well as those with certain disabilities or end-stage renal disease. In Nebraska, Medicare is available in several parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). Medicare Advantage plans, also known as Part C, are also available and offer additional benefits such as dental, vision, and hearing coverage.

👉 Note: It's essential to understand the different parts of Medicare and how they work together to provide comprehensive coverage.

Short-Term Limited-Duration Insurance (STLDI)

STLDI plans are temporary health insurance plans that provide coverage for a limited period (typically 3-12 months). These plans are designed for individuals who are between jobs, waiting for other coverage to start, or need temporary coverage. STLDI plans are often less expensive than major medical plans but may not provide the same level of coverage. In Nebraska, STLDI plans are available from insurance companies such as UnitedHealthcare and Aetna.

Benefits and Drawbacks of Each Option

Each health insurance option in Nebraska has its benefits and drawbacks. For example: * Individual and family plans offer flexibility and portability but may be more expensive than group plans. * Group plans offer lower premiums and better network coverage but may have limited provider options. * Medicaid offers comprehensive coverage but has income requirements and eligibility criteria. * Medicare offers predictable costs and comprehensive coverage but may have limited provider options and out-of-pocket costs. * STLDI plans offer temporary coverage and lower premiums but may not provide major medical coverage and have pre-existing condition limitations.

How to Choose the Best Plan

Choosing the best health insurance plan in Nebraska depends on several factors, including: * Age and health status * Income and budget * Family size and dependency status * Employment status and access to employer-sponsored coverage * Provider network and coverage needs When shopping for a health insurance plan, it’s essential to compare plans, read reviews, and consult with a licensed insurance agent.

| Plan Type | Premium Costs | Deductibles | Copays | Network Providers |

|---|---|---|---|---|

| Individual and Family Plans | Vary by plan and insurance company | Vary by plan and insurance company | Vary by plan and insurance company | Vary by plan and insurance company |

| Group Plans | Generally lower than individual plans | Generally lower than individual plans | Generally lower than individual plans | Generally more comprehensive than individual plans |

| Medicaid | No premium costs for eligible individuals | No deductibles for eligible individuals | No copays for eligible individuals | Comprehensive network of providers |

| Medicare | Vary by part and plan | Vary by part and plan | Vary by part and plan | Comprehensive network of providers |

| STLDI Plans | Generally lower than major medical plans | Generally higher than major medical plans | Generally higher than major medical plans | Generally limited network of providers |

In summary, Nebraska residents have a range of health insurance options to choose from, each with its benefits and drawbacks. By understanding the different types of plans, their costs, and their coverage, individuals can make informed decisions about their health insurance needs.

What is the difference between individual and family plans?

+

Individual plans are designed for one person, while family plans are designed for two or more people. Family plans often offer more comprehensive coverage and lower premiums than individual plans.

How do I apply for Medicaid in Nebraska?

+

To apply for Medicaid in Nebraska, you can visit the Nebraska Department of Health and Human Services website or contact your local Medicaid office. You will need to provide documentation of your income, family size, and other eligibility criteria.

What is the difference between Medicare Part A and Part B?

+

Medicare Part A provides coverage for hospital stays, while Medicare Part B provides coverage for doctor visits, outpatient services, and medical equipment. Most people enroll in both Part A and Part B to receive comprehensive coverage.

Related Terms:

- health insurance nebraska buka sekarang

- Short term health insurance Nebraska

- health insurance nebraska rating tertinggi

- Nebraska health insurance Marketplace

- Best health insurance in Nebraska

- Family health insurance plans Nebraska