New Mexico Health Insurance Plans

New Mexico Health Insurance Plans: An Overview

The state of New Mexico offers a variety of health insurance plans to its residents, catering to different needs and budgets. With the Affordable Care Act (ACA) in place, individuals and families can access affordable health insurance options through the New Mexico Health Insurance Exchange or directly from insurance providers. In this article, we will delve into the world of New Mexico health insurance plans, exploring the different types, benefits, and ways to enroll.

Types of Health Insurance Plans in New Mexico

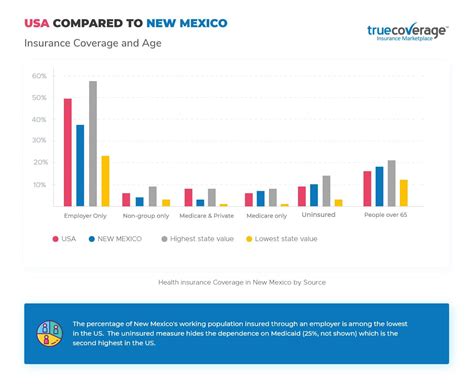

New Mexico residents can choose from several types of health insurance plans, including: * Individual and Family Plans: These plans are designed for individuals and families who do not have access to employer-sponsored coverage. They can be purchased through the New Mexico Health Insurance Exchange or directly from insurance providers. * Group Plans: These plans are offered by employers to their employees and often provide more comprehensive coverage at a lower cost. * Medicaid and CHIP: These government-sponsored programs provide health insurance coverage to low-income individuals and families, including children. * Short-Term Limited-Duration Insurance (STLDI): These plans provide temporary health insurance coverage for a limited period, usually up to 12 months.

Benefits of New Mexico Health Insurance Plans

New Mexico health insurance plans offer a range of benefits, including: * Essential Health Benefits (EHBs): All health insurance plans in New Mexico must cover EHBs, which include services such as: + Ambulatory patient services + Emergency services + Hospitalization + Maternity and newborn care + Mental health and substance use disorder services + Prescription drugs + Rehabilitative and habilitative services + Laboratory services + Preventive and wellness services * Pre-Existing Condition Coverage: New Mexico health insurance plans cannot deny coverage or charge higher premiums due to pre-existing conditions. * No Annual or Lifetime Limits: Health insurance plans in New Mexico cannot impose annual or lifetime limits on essential health benefits.

How to Enroll in New Mexico Health Insurance Plans

To enroll in a New Mexico health insurance plan, follow these steps: 1. Determine Eligibility: Check if you are eligible for a health insurance plan through the New Mexico Health Insurance Exchange or directly from an insurance provider. 2. Choose a Plan: Select a health insurance plan that meets your needs and budget. 3. Apply for Coverage: Submit an application for coverage through the New Mexico Health Insurance Exchange or directly to the insurance provider. 4. Provide Required Documents: Submit required documents, such as proof of income and residency. 5. Pay Premiums: Pay your premiums on time to maintain coverage.

📝 Note: It is essential to review and understand the terms and conditions of your health insurance plan before enrolling.

Cost of New Mexico Health Insurance Plans

The cost of New Mexico health insurance plans varies depending on factors such as age, income, family size, and plan type. The following table provides an estimated monthly premium range for individual and family plans in New Mexico:

| Age | Individual Plan | Family Plan |

|---|---|---|

| 21-30 | $300-$500 | $800-$1,500 |

| 31-40 | $350-$600 | $1,000-$2,000 |

| 41-50 | $450-$700 | $1,200-$2,500 |

| 51-60 | $550-$800 | $1,500-$3,000 |

Conclusion

In conclusion, New Mexico health insurance plans offer a range of benefits and options for individuals and families. By understanding the different types of plans, benefits, and enrollment process, residents can make informed decisions about their health insurance coverage. It is essential to review and compare plans carefully to find the best fit for your needs and budget.

What is the deadline to enroll in a New Mexico health insurance plan?

+

The deadline to enroll in a New Mexico health insurance plan varies depending on the type of plan and enrollment period. Generally, the open enrollment period for individual and family plans is from November 1 to December 15.

Can I purchase a New Mexico health insurance plan outside of the open enrollment period?

+

Yes, you can purchase a New Mexico health insurance plan outside of the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby.

What is the difference between a bronze, silver, gold, and platinum plan in New Mexico?

+

The main difference between bronze, silver, gold, and platinum plans in New Mexico is the level of cost-sharing and premium costs. Bronze plans have the lowest premiums but higher cost-sharing, while platinum plans have the highest premiums but lower cost-sharing.

Related Terms:

- Free health insurance New Mexico

- Cheapest health insurance New Mexico

- New Mexico health insurance Medicaid

- Bcbs of nm Login

- affordable health care new mexico

- affordable new mexico health insurance