5 Tips Health Insurance SD

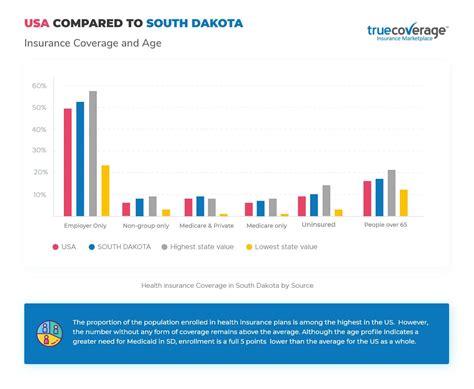

Introduction to Health Insurance in South Dakota

When it comes to protecting your health and financial well-being, having the right health insurance is crucial. In South Dakota, residents have various options to choose from, including individual and family plans, group plans, and Medicare. With so many options available, it can be overwhelming to navigate the complex world of health insurance. In this article, we will provide you with 5 tips to help you make an informed decision when selecting a health insurance plan in South Dakota.

Tip 1: Understand Your Options

Before selecting a health insurance plan, it’s essential to understand the different types of plans available in South Dakota. These include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans. * Medicare: This is a federal health insurance program designed for people 65 and older, as well as certain younger people with disabilities. * Medicaid: This is a joint federal and state program that provides health insurance to low-income individuals and families.

Tip 2: Consider Your Budget

When selecting a health insurance plan, it’s crucial to consider your budget. You’ll need to factor in the premiums, which are the monthly payments you make to maintain your coverage. You’ll also need to consider the deductible, which is the amount you pay out-of-pocket before your insurance kicks in. Other costs to consider include copays and coinsurance. Make sure to choose a plan that fits within your budget and provides the coverage you need.

Tip 3: Evaluate the Network

When selecting a health insurance plan, it’s essential to evaluate the network of healthcare providers. You’ll want to make sure that your primary care physician and any specialists you see are part of the plan’s network. You’ll also want to consider the plan’s out-of-network coverage, in case you need to see a doctor or receive treatment outside of the network. Some plans may have a referral requirement, which means you’ll need to get a referral from your primary care physician before seeing a specialist.

Tip 4: Check the Coverage

When selecting a health insurance plan, it’s crucial to check the coverage. You’ll want to make sure that the plan covers the services you need, such as: * Doctor visits * Hospital stays * Prescription medications * Mental health services * Substance abuse treatment You’ll also want to consider the plan’s maximum out-of-pocket costs, which is the maximum amount you’ll pay for healthcare expenses in a given year.

Tip 5: Read Reviews and Ask Questions

Finally, when selecting a health insurance plan, it’s essential to read reviews and ask questions. You can check with the South Dakota Division of Insurance to see if there have been any complaints filed against the insurance company. You can also check online review sites, such as Consumer Reports or NCQA, to see how the plan rates in terms of quality and customer satisfaction. Don’t be afraid to ask questions, such as: * What is the plan’s premium and deductible? * What is the plan’s copay and coinsurance? * Does the plan have a referral requirement? * What is the plan’s maximum out-of-pocket cost?

| Plan Type | Premium | Deductible | Copay | Coinsurance |

|---|---|---|---|---|

| Individual Plan | $300/month | $1,000/year | $20/visit | 20% |

| Group Plan | $200/month | $500/year | $10/visit | 10% |

| Medicare | $150/month | $0/year | $0/visit | 0% |

💡 Note: When selecting a health insurance plan, it's essential to consider your individual needs and circumstances. Make sure to read the plan's documentation carefully and ask questions if you're unsure about any aspect of the plan.

In summary, selecting a health insurance plan in South Dakota requires careful consideration of several factors, including your options, budget, network, coverage, and reviews. By following these 5 tips, you can make an informed decision and choose a plan that meets your needs and provides the coverage you need.

What is the difference between an individual and group health insurance plan?

+

An individual health insurance plan is designed for individuals and families who are not covered by an employer-sponsored plan. A group health insurance plan, on the other hand, is offered by employers to their employees and is often more affordable than individual plans.

What is the maximum out-of-pocket cost for a health insurance plan in South Dakota?

+

The maximum out-of-pocket cost for a health insurance plan in South Dakota varies depending on the plan. However, the Affordable Care Act (ACA) requires that all health insurance plans have a maximum out-of-pocket cost of no more than 8,150 for an individual and 16,300 for a family.

Can I purchase a health insurance plan outside of the open enrollment period?

+

Yes, you can purchase a health insurance plan outside of the open enrollment period if you experience a qualifying life event, such as losing your job or having a baby. You may also be eligible for a special enrollment period if you are a member of a federally recognized tribe or if you are eligible for Medicaid or the Children’s Health Insurance Program (CHIP).

Related Terms:

- South Dakota health insurance Marketplace

- South Dakota medical Benefits card

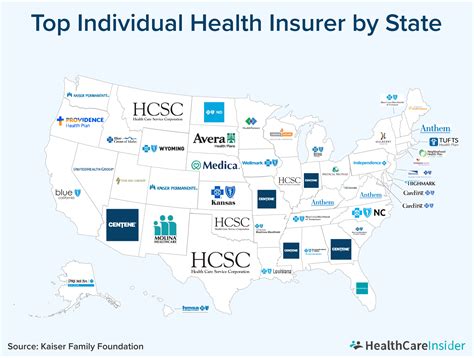

- Avera Health insurance

- Avera Health Plans payment

- south dakota temporary health insurance

- affordable health insurance south dakota