5 Tips Health Insurance

Introduction to Health Insurance

When it comes to protecting ourselves and our families from unexpected medical expenses, health insurance plays a vital role. It provides financial security and peace of mind, knowing that we are covered in case of any unforeseen medical emergencies. With so many options available, choosing the right health insurance plan can be overwhelming. In this article, we will discuss five essential tips to help you navigate the world of health insurance and make an informed decision.

Tip 1: Assess Your Needs

Before selecting a health insurance plan, it’s crucial to assess your needs. Consider factors such as your age, health status, lifestyle, and budget. If you have a pre-existing medical condition, you may want to opt for a plan that provides comprehensive coverage for that condition. Additionally, think about the number of dependents you have and whether you need a plan that covers your entire family. Making a list of your priorities will help you narrow down your options and choose a plan that meets your specific needs.

Tip 2: Understand the Types of Plans

There are several types of health insurance plans available, including: * HMO (Health Maintenance Organization): A plan that requires you to receive medical care from a specific network of providers. * PPO (Preferred Provider Organization): A plan that allows you to see any healthcare provider, but offers a higher level of coverage for providers within the network. * EPO (Exclusive Provider Organization): A plan that only covers care from providers within the network, except in emergency situations. * POS (Point of Service): A plan that combines elements of HMO and PPO plans. Understanding the differences between these plans will help you choose the one that best fits your needs and budget.

Tip 3: Check the Network

The network of healthcare providers is a critical factor to consider when selecting a health insurance plan. Make sure the plan you choose includes your primary care physician and any specialists you see regularly. You should also check if the plan covers care from out-of-network providers, in case you need to see a specialist who is not part of the network. A plan with a strong network of providers will ensure that you receive high-quality care and minimize out-of-pocket expenses.

Tip 4: Review the Costs

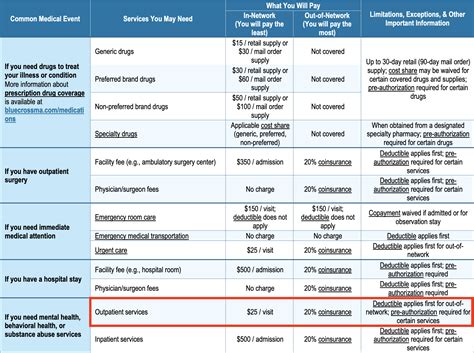

The cost of a health insurance plan is a significant factor to consider. In addition to the premium, you should also review the: * Deductible: The amount you must pay out-of-pocket before the insurance plan starts covering costs. * Co-pay: The amount you pay for each doctor visit or prescription. * Co-insurance: The percentage of medical costs you pay after meeting the deductible. * Out-of-pocket maximum: The maximum amount you pay for medical expenses in a given year. Understanding the costs associated with a plan will help you budget and avoid unexpected expenses.

Tip 5: Read Reviews and Ask Questions

Finally, it’s essential to read reviews and ask questions before selecting a health insurance plan. Research the insurance company’s reputation and read reviews from current policyholders. You should also ask questions such as: * What is the process for filing claims? * How do I appeal a denied claim? * What are the exclusions and limitations of the plan? * How do I access care when traveling or living abroad? Asking the right questions will help you understand the plan’s benefits and limitations, ensuring you make an informed decision.

📝 Note: Always carefully review the plan's documentation and ask questions before enrolling, to ensure you understand the terms and conditions of the policy.

In summary, choosing the right health insurance plan requires careful consideration of your needs, the types of plans available, the network of providers, the costs, and the insurance company’s reputation. By following these five tips, you’ll be well on your way to selecting a plan that provides the coverage and protection you need.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires you to receive medical care from a specific network of providers, while a PPO plan allows you to see any healthcare provider, but offers a higher level of coverage for providers within the network.

How do I choose the right health insurance plan for my family?

+

Consider factors such as your family’s health status, budget, and lifestyle. You may also want to opt for a plan that covers your entire family, including dependents.

What is the out-of-pocket maximum, and how does it work?

+

The out-of-pocket maximum is the maximum amount you pay for medical expenses in a given year. Once you reach this limit, the insurance plan covers 100% of eligible expenses.

Related Terms:

- Affordable health insurance for students

- Blue Cross student health insurance

- Health insurance Marketplace

- International student insurance reddit

- Cheap health insurance

- does college require health insurance