Massachusetts Health Insurers Options

Introduction to Massachusetts Health Insurers

Massachusetts has been at the forefront of healthcare reform, and its health insurance market reflects this commitment to providing comprehensive coverage to its residents. With a range of options available, individuals, families, and businesses can find plans that suit their needs and budgets. In this post, we’ll delve into the various Massachusetts health insurers, their offerings, and what to consider when selecting a plan.

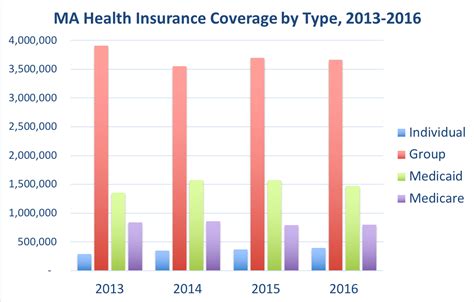

Types of Health Insurers in Massachusetts

The health insurance landscape in Massachusetts is diverse, with several types of insurers offering a variety of plans. These include: - Non-profit insurers: Organizations like Blue Cross Blue Shield of Massachusetts and Harvard Pilgrim Health Care offer a range of plans, including HMOs, PPOs, and POS plans. - For-profit insurers: Companies such as UnitedHealthcare and Tufts Health Plan provide competitive options, often with a focus on network size and flexibility. - Public programs: MassHealth (Medicaid) and the Health Connector (the state’s health insurance marketplace) provide coverage for low-income individuals and families, as well as those who qualify for subsidies.

Major Health Insurers in Massachusetts

Some of the major health insurers in Massachusetts include: - Blue Cross Blue Shield of Massachusetts: Known for its extensive network and range of plan options. - Harvard Pilgrim Health Care: Offers innovative plans with a focus on preventive care and wellness programs. - UnitedHealthcare: Provides a broad network of providers and competitive pricing. - Tufts Health Plan: Focuses on preventive care and offers a variety of plan options, including HMOs and PPOs. - Fallon Health: Offers affordable plans with a focus on community-based care.

Plan Options and Networks

When selecting a health insurer in Massachusetts, it’s essential to consider the plan options and networks available. Key factors include: - Network size and quality: Look for insurers with extensive networks of primary care physicians, specialists, and hospitals. - Plan types: HMOs, PPOs, and POS plans offer varying levels of flexibility and cost-sharing. - Deductibles and copays: Consider the out-of-pocket costs associated with each plan. - Preventive care: Many plans offer free or low-cost preventive services, such as annual physicals and screenings.

Cost Considerations

The cost of health insurance in Massachusetts can vary significantly depending on the insurer, plan, and individual or family circumstances. Factors to consider include: - Premiums: The monthly cost of the plan. - Subsidies: Eligible individuals and families may qualify for subsidies to reduce premium costs. - Out-of-pocket costs: Deductibles, copays, and coinsurance can add up quickly. - Maximum out-of-pocket: The maximum amount an individual or family will pay for healthcare expenses in a given year.

📝 Note: When evaluating costs, consider not only the premium but also the potential out-of-pocket expenses and the maximum out-of-pocket limit.

Choosing the Right Insurer

With so many options available, selecting the right health insurer in Massachusetts can be overwhelming. To make an informed decision, consider the following steps: - Assess your needs: Evaluate your healthcare requirements, including any ongoing treatments or medications. - Research insurers: Compare plan options, networks, and costs among different insurers. - Evaluate customer service: Look for insurers with responsive customer service and user-friendly online platforms. - Check ratings and reviews: Research the insurer’s reputation and ratings from independent organizations.

Additional Resources

For those seeking additional guidance or support, there are several resources available: - The Health Connector: The state’s health insurance marketplace offers a range of plans and resources for individuals and families. - MassHealth: Provides coverage for low-income individuals and families. - Health insurance brokers: Licensed brokers can help individuals and businesses navigate the complex health insurance market.

| Insurer | Plan Options | Network Size |

|---|---|---|

| Blue Cross Blue Shield of Massachusetts | HMO, PPO, POS | Extensive network |

| Harvard Pilgrim Health Care | HMO, PPO, POS | Large network |

| UnitedHealthcare | HMO, PPO, POS | Broad network |

In summary, Massachusetts offers a wide range of health insurance options, from non-profit and for-profit insurers to public programs. When selecting a plan, it’s essential to consider factors such as network size, plan types, deductibles, and copays. By researching and comparing different insurers, individuals and families can find the right plan to meet their unique needs and budgets.

What is the difference between an HMO and a PPO plan?

+

An HMO (Health Maintenance Organization) plan typically requires you to receive care from a specific network of providers, while a PPO (Preferred Provider Organization) plan offers more flexibility, allowing you to see any healthcare provider, both in and out of network, although out-of-network care usually costs more.

How do I determine which health insurer is right for me?

+

To determine which health insurer is right for you, consider your healthcare needs, budget, and preferences. Research different insurers, their plan options, network sizes, and customer service. You may also want to consult with a licensed health insurance broker for personalized guidance.

What is the Health Connector, and how does it work?

+

The Health Connector is Massachusetts’ health insurance marketplace, where individuals, families, and small businesses can find and purchase health insurance plans. It offers a range of plans from various insurers, and eligible individuals and families can also apply for subsidies to reduce their premium costs.

Related Terms:

- Health insurance plans Massachusetts

- Best health insurance in Massachusetts

- inexpensive health insurance massachusetts

- massachusetts health insurance companies list

- health insurance for individuals massachusetts

- affordable health insurance in massachusetts