San Mateo Health Plan Options

Introduction to San Mateo Health Plan Options

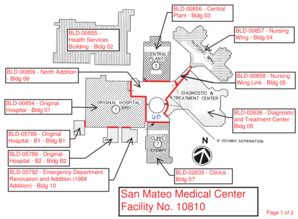

San Mateo, being a part of the larger Silicon Valley and the San Francisco Bay Area, offers a variety of health plan options to its residents. The health insurance landscape in San Mateo is diverse, catering to different needs and budgets. From individual and family plans to group and employer-sponsored plans, San Mateo residents have a range of choices. This diversity is partly due to the county’s strong economy and its proximity to healthcare innovation hubs, ensuring that residents have access to cutting-edge medical facilities and a wide array of health insurance providers.

Understanding Health Insurance Types

When navigating the health plan options in San Mateo, it’s essential to understand the different types of health insurance available. These include: - Preferred Provider Organization (PPO) Plans: These plans offer a network of healthcare providers from which to choose, with lower out-of-pocket costs for using in-network providers. - Health Maintenance Organization (HMO) Plans: HMOs provide care through a specific network of providers, except in emergency situations. They often require a primary care physician referral to see a specialist. - Exclusive Provider Organization (EPO) Plans: Similar to PPOs but without out-of-network benefits, except in emergencies. - Point of Service (POS) Plans: Combine elements of HMOs and PPOs, allowing members to choose between receiving care from an in-network provider (with a referral for specialists) or going out-of-network (usually at a higher cost). - Catastrophic Plans: These are high-deductible, low-premium plans primarily designed for young adults or those who are exempt from the requirement to have health insurance. They cover essential health benefits but have limited provider networks and higher deductibles.

Key Considerations for Choosing a Health Plan

Choosing the right health plan in San Mateo involves considering several factors: - Network: Ensure your current healthcare providers are part of the plan’s network, or consider the cost and inconvenience of switching providers. - Cost: Calculate the total cost, including premiums, deductibles, copays, and coinsurance. Sometimes, a plan with a higher premium might be more cost-effective due to lower out-of-pocket expenses. - Coverage: Verify the plan covers essential health benefits and any additional services you might need, such as dental, vision, or mental health services. - Maximum Out-of-Pocket (MOOP) Expenses: Understand how much you could pay in a year for healthcare expenses, as plans with lower premiums might have higher MOOPs.

Employer-Sponsored Plans

Many residents of San Mateo receive health insurance through their employers. These plans are often more comprehensive and can be more affordable than individual or family plans due to the group’s negotiating power with insurance providers. However, the specifics of these plans, including coverage, network, and cost-sharing, can vary significantly between employers.

Individual and Family Plans

For those not covered by an employer-sponsored plan, individual and family plans are available through the health insurance marketplace or directly from insurance companies. The Affordable Care Act (ACA), also known as Obamacare, has expanded access to health insurance for many Americans, including those in San Mateo, by providing subsidies to make these plans more affordable for lower-income individuals and families.

Medicaid and Medicare Options

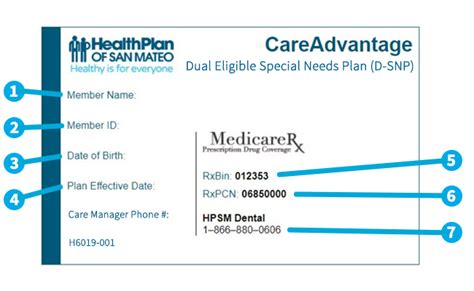

- Medicaid: For low-income individuals and families, Medicaid provides comprehensive coverage. San Mateo County’s Medicaid program, part of the California Medicaid program (known as Medi-Cal), offers health, dental, and vision coverage to eligible residents. - Medicare: Available to individuals 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare offers various parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage Plans), and Part D (prescription drug coverage).

Special Considerations

- Short-Term Limited-Duration Insurance (STLDI): These plans provide temporary health insurance coverage for a limited period, typically up to 12 months, and are not renewable. They do not provide the same level of coverage as major medical plans and are not subject to ACA regulations. - Dental and Vision Insurance: Often provided as separate plans or add-ons to health insurance, these cover dental and vision care services.

📝 Note: When selecting a health plan, it's crucial to review the plan's details, including coverage, costs, and network, to ensure it meets your healthcare needs and budget.

Health Insurance Marketplaces and Insurance Companies

San Mateo residents can purchase health insurance through the California health insurance marketplace (Covered California) during open enrollment periods or special enrollment periods under certain circumstances. Major insurance companies operating in San Mateo include Kaiser Permanente, Blue Shield of California, and Anthem Blue Cross, among others. Each company offers a range of plans with varying levels of coverage and cost.

| Insurance Company | Plan Types | Coverage Area |

|---|---|---|

| Kaiser Permanente | HMO, PPO | San Mateo County and surrounding areas |

| Blue Shield of California | PPO, EPO, HMO | Statewide, including San Mateo County |

| Anthem Blue Cross | PPO, EPO, HMO | Statewide, including San Mateo County |

In conclusion to this overview, navigating the health plan options in San Mateo requires careful consideration of several factors, including the type of plan, cost, coverage, and provider network. Whether you’re selecting an employer-sponsored plan, an individual or family plan through the marketplace, or exploring Medicaid and Medicare options, understanding the specifics of each plan is key to making an informed decision that meets your healthcare needs and budget.

What is the difference between an HMO and a PPO health plan?

+

An HMO (Health Maintenance Organization) requires you to receive medical care and services from providers within a specific network, except in emergency situations. A PPO (Preferred Provider Organization) offers more flexibility, allowing you to see any healthcare provider, in-network or out-of-network, though out-of-network care typically costs more.

Can I purchase health insurance outside of the open enrollment period?

+

Yes, you can purchase health insurance outside of the open enrollment period if you qualify for a special enrollment period. This can happen due to certain life events, such as losing job-based coverage, getting married, having a baby, or moving to a new area.

What is Medicaid, and how do I qualify for it in San Mateo County?

+

Medicaid, known as Medi-Cal in California, is a health coverage program for low-income individuals and families. To qualify, you must meet specific income and resource requirements, which vary based on your family size, income, and disability status. You can apply through the California Department of Health Care Services or local social services offices.

Related Terms:

- san mateo provider portal

- san mateo health plan providers

- www hpsm org member portal login