Oklahoma Health Plans Options

Introduction to Oklahoma Health Plans

Oklahoma residents have various health plan options to choose from, catering to different needs and budgets. With the Affordable Care Act (ACA) in place, individuals and families can access affordable health insurance that meets their requirements. In this blog post, we will delve into the various Oklahoma health plans available, including individual and family plans, Medicaid, Medicare, and short-term health insurance.

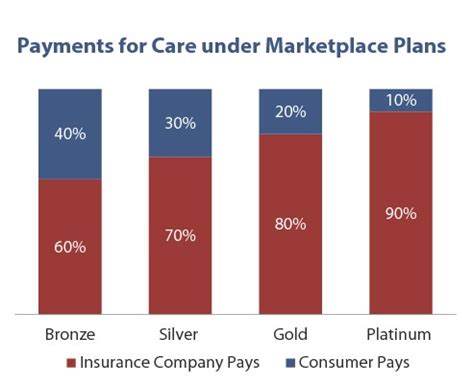

Individual and Family Plans

Individual and family plans in Oklahoma are designed for those who do not have access to employer-sponsored health insurance. These plans can be purchased through the health insurance marketplace or directly from insurance providers. Some of the key features of individual and family plans include: * Essential health benefits: These plans cover essential health benefits, such as doctor visits, hospital stays, and prescription medications. * Pre-existing conditions: Insurance providers cannot deny coverage due to pre-existing conditions. * Financial assistance: Eligible individuals and families may qualify for premium tax credits or cost-sharing reductions to make their health insurance more affordable.

Some popular insurance providers in Oklahoma offering individual and family plans include: * Blue Cross Blue Shield of Oklahoma * UnitedHealthcare * Cigna * Aetna

Medicaid in Oklahoma

Medicaid is a government-funded health insurance program designed for low-income individuals and families. In Oklahoma, Medicaid is known as SoonerCare. To be eligible for SoonerCare, individuals and families must meet specific income and resource requirements. Some of the key benefits of SoonerCare include: * Comprehensive coverage: SoonerCare covers essential health benefits, including doctor visits, hospital stays, and prescription medications. * No premiums: Eligible individuals and families do not have to pay premiums for SoonerCare. * Low out-of-pocket costs: SoonerCare has low or no out-of-pocket costs for covered services.

Medicare in Oklahoma

Medicare is a federal health insurance program designed for individuals 65 and older, as well as those with certain disabilities. In Oklahoma, Medicare is available in several parts, including: * Part A: Hospital insurance that covers hospital stays, skilled nursing facility care, and hospice care. * Part B: Medical insurance that covers doctor visits, outpatient care, and medical equipment. * Part C: Medicare Advantage plans that combine Part A and Part B coverage, often with additional benefits. * Part D: Prescription drug coverage that helps pay for prescription medications.

Short-Term Health Insurance

Short-term health insurance plans in Oklahoma are designed to provide temporary coverage for individuals and families. These plans are ideal for those who: * Are between jobs or waiting for employer-sponsored health insurance to begin. * Missed the open enrollment period for individual and family plans. * Need coverage for a specific period, such as during a gap in coverage.

Some key features of short-term health insurance plans include: * Temporary coverage: These plans provide coverage for a limited period, usually up to 12 months. * Lower premiums: Short-term health insurance plans often have lower premiums compared to individual and family plans. * Limited benefits: These plans may not cover essential health benefits, such as pre-existing conditions or maternity care.

💡 Note: Short-term health insurance plans are not suitable for everyone, as they may not provide comprehensive coverage and can have pre-existing condition exclusions.

Comparison of Oklahoma Health Plans

The following table provides a comparison of the different Oklahoma health plans:

| Plan Type | Premiums | Coverage | Eligibility |

|---|---|---|---|

| Individual and Family Plans | Varying premiums | Essential health benefits | Anyone can apply |

| Medicaid (SoonerCare) | No premiums | Comprehensive coverage | Low-income individuals and families |

| Medicare | Premiums vary by part | Hospital, medical, and prescription drug coverage | Individuals 65 and older or with certain disabilities |

| Short-Term Health Insurance | Lower premiums | Limited benefits | Anyone can apply, but may not be suitable for everyone |

As we have explored the various Oklahoma health plans available, it is essential to consider individual and family needs, budgets, and eligibility requirements when selecting a plan. By understanding the different options and their features, Oklahoma residents can make informed decisions about their health insurance coverage.

In the end, choosing the right health plan is crucial for maintaining good health and financial stability. Oklahoma residents should carefully evaluate their options, consider their specific needs, and select a plan that provides the necessary coverage and benefits. By doing so, individuals and families can ensure they have access to quality healthcare and protect themselves from unexpected medical expenses.

What is the difference between Medicaid and Medicare in Oklahoma?

+

Medicaid (SoonerCare) is a government-funded health insurance program for low-income individuals and families, while Medicare is a federal health insurance program for individuals 65 and older or with certain disabilities.

Can I purchase individual and family plans outside of the open enrollment period?

+

Yes, you can purchase individual and family plans outside of the open enrollment period if you experience a qualifying life event, such as losing employer-sponsored health insurance or having a baby.

What is the purpose of short-term health insurance plans in Oklahoma?

+

Short-term health insurance plans provide temporary coverage for individuals and families who need coverage for a specific period, such as during a gap in coverage or while waiting for employer-sponsored health insurance to begin.

Related Terms:

- Best health insurance in Oklahoma

- Free health insurance Oklahoma

- Affordable health insurance Oklahoma

- Health insurance companies in Oklahoma

- Oklahoma health insurance Marketplace

- Aetna health insurance Oklahoma