5 HRA vs HSA Tips

Understanding the Difference Between HRA and HSA

When it comes to healthcare, there are various options available to individuals and employers to manage medical expenses. Two popular choices are Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs). While both offer tax benefits and help with healthcare costs, they have distinct differences. In this article, we will delve into the world of HRAs and HSAs, exploring their characteristics, advantages, and disadvantages. We will also provide valuable tips to help you make an informed decision about which one suits your needs.

What are HRAs and HSAs?

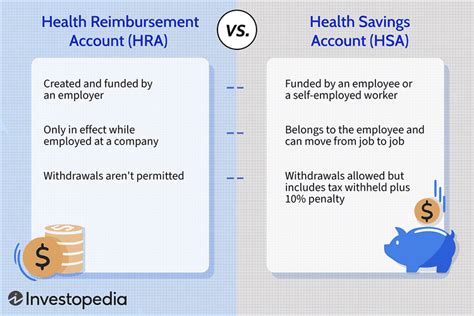

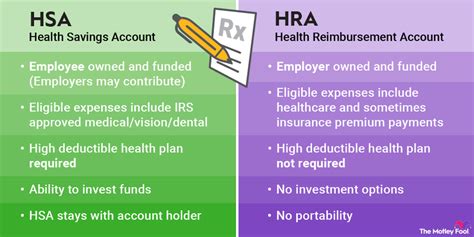

Before we dive into the details, let’s define what HRAs and HSAs are. A Health Reimbursement Arrangement (HRA) is an employer-sponsored plan that allows employees to reimburse medical expenses with pre-tax dollars. On the other hand, a Health Savings Account (HSA) is a savings account that individuals can open to save for medical expenses, also using pre-tax dollars. The key difference lies in who contributes to the account and how the funds can be used.

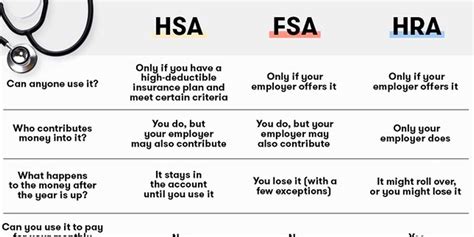

Key Differences Between HRAs and HSAs

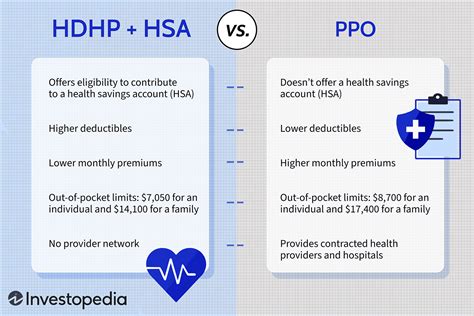

Here are the main differences between HRAs and HSAs: * Eligibility: HRAs are typically offered by employers, while HSAs are available to individuals with a High-Deductible Health Plan (HDHP). * Contributions: Employers contribute to HRAs, whereas individuals and employers can contribute to HSAs. * Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire. HRAs, however, are usually tied to your employment. * Investment Options: HSAs offer investment options, allowing you to grow your savings over time. HRAs do not have this feature. * Usage: Both HRAs and HSAs can be used for qualified medical expenses, but HSAs also allow you to use the funds for non-medical expenses in retirement, subject to penalties and taxes.

5 HRA vs HSA Tips

Now that we’ve covered the basics, here are five tips to help you navigate the world of HRAs and HSAs: * Tip 1: Assess Your Healthcare Needs: Consider your current healthcare expenses and future needs. If you have high medical costs, an HRA might be a better option, as it allows you to reimburse expenses with pre-tax dollars. On the other hand, if you’re relatively healthy and want to save for future medical expenses, an HSA might be a better choice. * Tip 2: Evaluate Your Employer’s Offer: If your employer offers an HRA, review the plan details, including the contribution amount, eligible expenses, and any requirements or restrictions. Compare this to an HSA, considering the potential benefits and drawbacks of each. * Tip 3: Consider Your Financial Situation: Think about your current financial situation and goals. If you’re looking to save for retirement or have a safety net for medical expenses, an HSA might be a better option. If you need help with immediate medical costs, an HRA could be more suitable. * Tip 4: Review the Investment Options: If you’re interested in growing your savings over time, consider the investment options available with an HSA. This can help you build a nest egg for future medical expenses or retirement. * Tip 5: Understand the Tax Implications: Both HRAs and HSAs offer tax benefits, but it’s essential to understand the specifics. For example, HSA contributions are tax-deductible, and the funds grow tax-free. HRAs, on the other hand, are funded with pre-tax dollars, but the reimbursements are tax-free.

Comparison Table

Here’s a summary of the key differences between HRAs and HSAs:

| Feature | HRA | HSA |

|---|---|---|

| Eligibility | Employer-sponsored | Individuals with HDHP |

| Contributions | Employer-only | Individual and employer |

| Portability | Not portable | Portable |

| Investment Options | None | Available |

| Usage | Qualified medical expenses | Qualified medical expenses and non-medical expenses in retirement |

📝 Note: It's essential to review the specific details of your HRA or HSA plan, as the rules and regulations may vary depending on your employer or individual circumstances.

In the end, choosing between an HRA and an HSA depends on your individual circumstances, healthcare needs, and financial goals. By understanding the differences and considering your options carefully, you can make an informed decision that suits your needs and helps you manage your healthcare expenses effectively. Remember to review the details of each plan, assess your needs, and evaluate the potential benefits and drawbacks before making a decision. With the right choice, you can enjoy tax benefits, reduce your healthcare costs, and build a safety net for future medical expenses.

Related Terms:

- HSA vs HRA comparison chart

- HRA vs FSA

- HSA vs HRA vs FSA

- HSA vs FSA

- HRA account

- PPO vs HSA