5 HSA Tips

Introduction to Health Savings Accounts (HSAs)

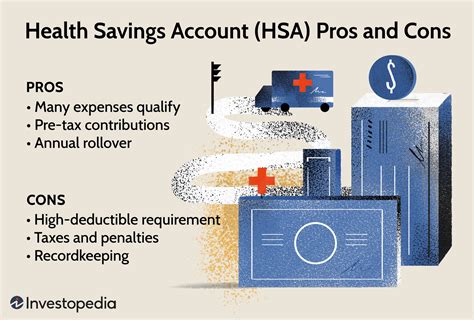

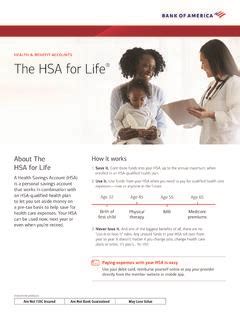

A Health Savings Account (HSA) is a tax-advantaged savings account available to individuals with high-deductible health plans (HDHPs). The funds contributed to an HSA are not subject to federal income tax, and the money can be used to pay for qualified medical expenses. HSAs offer a triple tax benefit: contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. In this article, we will explore five essential tips for getting the most out of your HSA.

Tip 1: Understand HSA Eligibility and Contribution Limits

To be eligible for an HSA, you must have a high-deductible health plan (HDHP) and cannot be enrolled in any other health coverage, such as Medicare or a general health insurance plan. The Internal Revenue Service (IRS) sets the annual contribution limits for HSAs. For 2023, the individual contribution limit is 3,850, and the family contribution limit is 7,750. If you are 55 or older, you can contribute an additional $1,000 as a catch-up contribution. It’s essential to review these limits annually, as they may change.

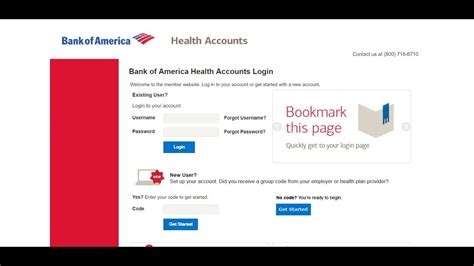

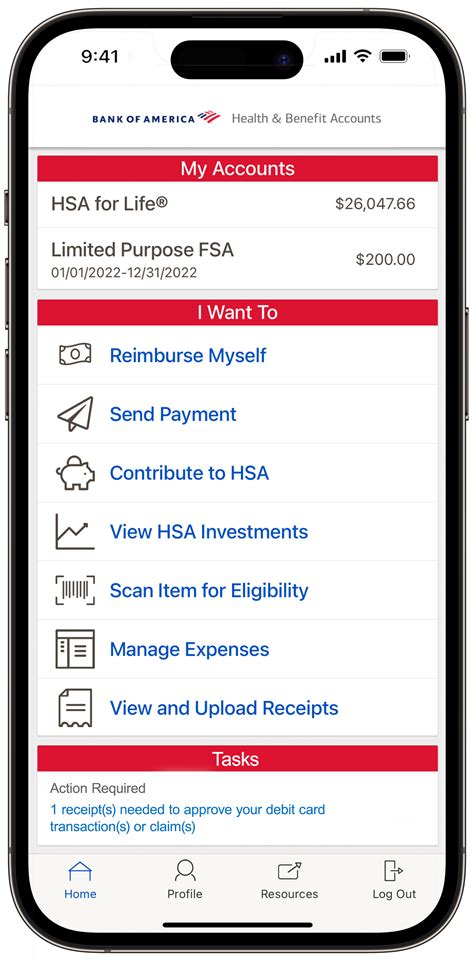

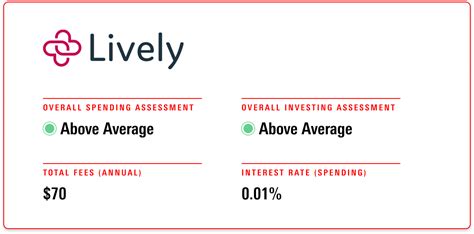

Tip 2: Choose the Right HSA Administrator

When selecting an HSA administrator, consider factors such as fees, investment options, customer service, and user experience. Some HSA administrators offer a wide range of investment options, allowing you to grow your HSA funds over time. Others may have higher fees or limited investment options. Research and compare different HSA administrators to find the one that best suits your needs.

Tip 3: Use Your HSA for Qualified Medical Expenses

HSAs can be used to pay for a wide range of qualified medical expenses, including:

- Doctor visits and copays

- Prescription medications

- Dental and vision care

- Chiropractic care and acupuncture

- Medical equipment and supplies

Tip 4: Invest Your HSA Funds for Long-Term Growth

If you don’t need to use your HSA funds immediately, consider investing them for long-term growth. Many HSA administrators offer investment options, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). By investing your HSA funds, you can potentially grow your account balance over time, providing a source of funds for future medical expenses.

Tip 5: Consider the Portability and Inheritance of HSAs

One of the benefits of HSAs is their portability. If you change jobs or retire, you can take your HSA with you. Additionally, HSAs can be inherited by your beneficiaries, providing a potential source of funds for their medical expenses. However, it’s essential to understand the tax implications of inheriting an HSA, as they may vary depending on the beneficiary’s relationship to the account holder.

📝 Note: It's crucial to review and understand the terms and conditions of your HSA, including any fees, investment options, and withdrawal rules, to ensure you're getting the most out of your account.

In summary, HSAs offer a valuable tool for saving and investing in your health care. By understanding HSA eligibility and contribution limits, choosing the right HSA administrator, using your HSA for qualified medical expenses, investing your HSA funds for long-term growth, and considering the portability and inheritance of HSAs, you can maximize the benefits of your HSA and ensure you’re prepared for future medical expenses.

What is the main advantage of having an HSA?

+

The main advantage of having an HSA is the triple tax benefit: contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Can I use my HSA for non-medical expenses?

+

You can use your HSA for non-medical expenses, but you will be subject to income tax and a 20% penalty on the withdrawal amount. It’s essential to use your HSA for qualified medical expenses to avoid these penalties.

How do I choose the right HSA administrator?

+

When choosing an HSA administrator, consider factors such as fees, investment options, customer service, and user experience. Research and compare different HSA administrators to find the one that best suits your needs.

Related Terms:

- bank of america health account

- boa hsa login

- my bofa hsa

- bank america health savings account

- hsa through bank of america

- bofa health account