Health Savings Account Benefits

Introduction to Health Savings Accounts

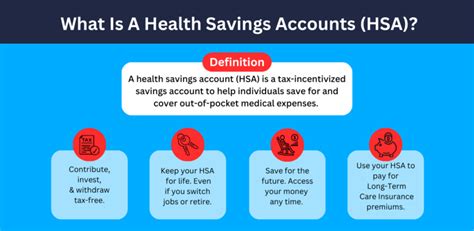

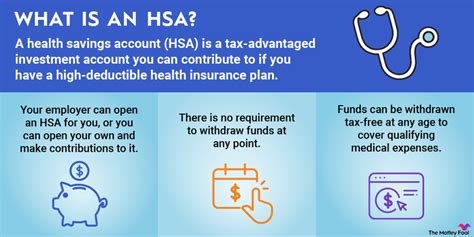

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses. The main purpose of an HSA is to provide a way for individuals to save for healthcare expenses while also reducing their taxable income. In this article, we will explore the benefits of Health Savings Accounts and how they can be a valuable tool for managing healthcare costs.

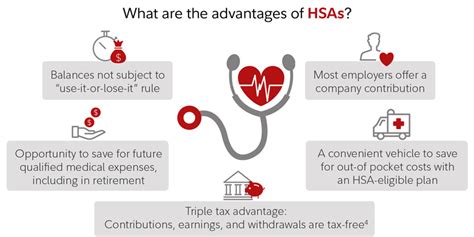

Benefits of Health Savings Accounts

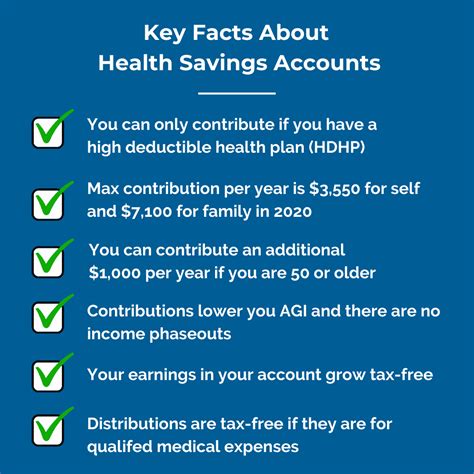

There are several benefits to having a Health Savings Account, including: * Tax benefits: Contributions to an HSA are tax-deductible, and the funds in the account grow tax-free. Additionally, withdrawals for qualified medical expenses are tax-free. * Flexibility: HSAs can be used to pay for a wide range of qualified medical expenses, including doctor visits, prescription medications, and hospital stays. * Portability: HSAs are portable, meaning that the account stays with the individual even if they change jobs or retire. * Investment opportunities: Many HSAs offer investment options, such as mutual funds or stocks, which can help the account grow over time. * No “use it or lose it” rule: Unlike Flexible Spending Accounts (FSAs), HSAs do not have a “use it or lose it” rule, which means that any unused funds in the account at the end of the year can be carried over to the next year.

How Health Savings Accounts Work

To be eligible for an HSA, an individual must have a high-deductible health plan (HDHP). The IRS sets the minimum deductible and maximum out-of-pocket expenses for HDHPs each year. For 2022, the minimum deductible for an HDHP is 1,400 for individual coverage and 2,800 for family coverage. The maximum out-of-pocket expenses for an HDHP are 7,050 for individual coverage and 14,100 for family coverage. Once an individual has an HDHP, they can open an HSA and start making contributions. The contributions can be made by the individual, their employer, or both. The contributions are tax-deductible, and the funds in the account can be used to pay for qualified medical expenses.

Qualified Medical Expenses

HSAs can be used to pay for a wide range of qualified medical expenses, including: * Doctor visits and hospital stays * Prescription medications and medical equipment * Dental and vision care * Mental health and substance abuse treatment * Over-the-counter medications and supplies The IRS publishes a list of qualified medical expenses each year, which can be found in Publication 502.

💡 Note: It's essential to keep receipts and records of all qualified medical expenses paid with HSA funds, as these may be required in the event of an audit.

Investment Options for Health Savings Accounts

Many HSAs offer investment options, such as mutual funds or stocks, which can help the account grow over time. The investment options vary depending on the HSA provider, but some common options include: * Stocks: Individual stocks or stock mutual funds * Bonds: Government or corporate bonds * Mutual funds: Diversified mutual funds that invest in a variety of assets * Exchange-traded funds (ETFs): Similar to mutual funds but trade on an exchange like stocks It’s essential to carefully consider the investment options and fees associated with an HSA before making investment decisions.

Comparison to Other Healthcare Savings Options

HSAs are often compared to other healthcare savings options, such as Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs). Here’s a brief comparison: * FSAs: FSAs are similar to HSAs but have a “use it or lose it” rule, which means that any unused funds in the account at the end of the year are forfeited. * HRAs: HRAs are employer-funded accounts that can be used to reimburse employees for qualified medical expenses. Unlike HSAs, HRAs are not portable, and the funds in the account are forfeited if the employee leaves the company.

| Account Type | Eligibility | Contribution Limits | Portability |

|---|---|---|---|

| HSA | HDHP required | $3,650 individual, $7,300 family (2022) | Portable |

| FSA | No HDHP required | $2,850 (2022) | Not portable |

| HRA | Employer-funded | No contribution limits | Not portable |

In summary, Health Savings Accounts offer a unique combination of tax benefits, flexibility, and investment opportunities that can help individuals manage healthcare costs. By understanding how HSAs work and the benefits they offer, individuals can make informed decisions about their healthcare savings options. The key points to remember are the tax benefits, flexibility, and investment opportunities that HSAs provide, as well as the importance of considering the investment options and fees associated with an HSA. Additionally, it’s crucial to keep receipts and records of all qualified medical expenses paid with HSA funds, as these may be required in the event of an audit. With the right information and planning, HSAs can be a valuable tool for managing healthcare costs and achieving long-term financial goals.

What is the main purpose of a Health Savings Account?

+

The main purpose of a Health Savings Account is to provide a way for individuals to save for healthcare expenses while also reducing their taxable income.

What are the benefits of having a Health Savings Account?

+

The benefits of having a Health Savings Account include tax benefits, flexibility, portability, and investment opportunities.

Can I use my Health Savings Account to pay for any medical expense?

+

No, you can only use your Health Savings Account to pay for qualified medical expenses, which are defined by the IRS.