HSA vs FSA: Which is Better

Introduction to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

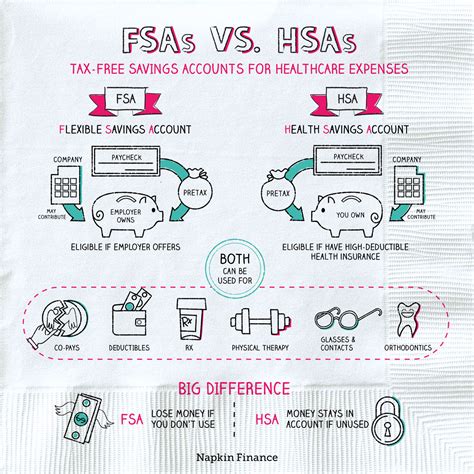

When it comes to saving for medical expenses, two popular options are Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Both are designed to help individuals set aside pre-tax dollars for healthcare costs, but they have distinct differences in terms of eligibility, contribution limits, and usage. In this article, we will delve into the details of HSAs and FSAs, exploring their benefits, drawbacks, and which one might be better suited for your needs.

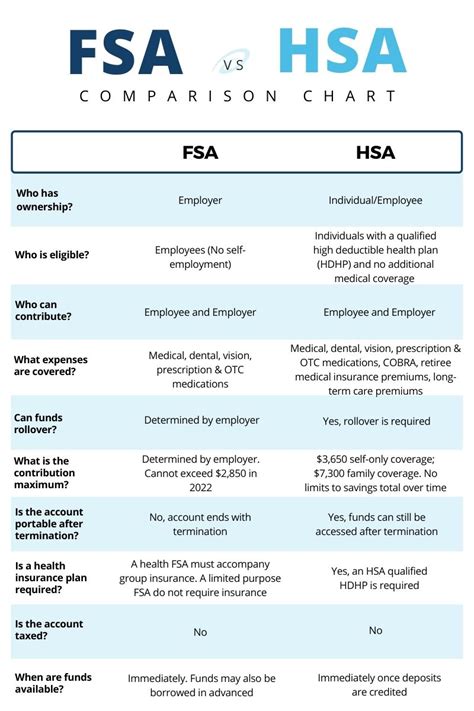

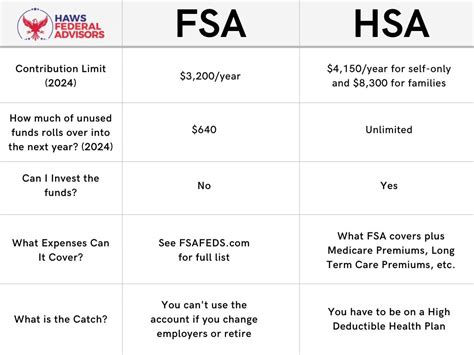

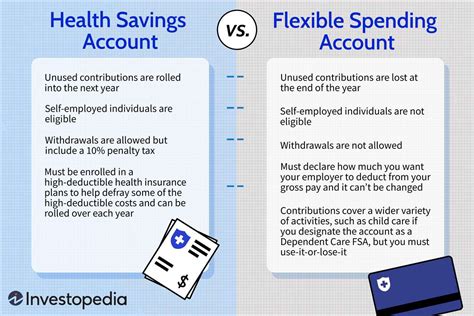

Eligibility and Contribution Limits

To be eligible for an HSA, you must have a high-deductible health plan (HDHP) that meets certain criteria, such as a minimum deductible amount and a maximum out-of-pocket expense limit. In 2022, the minimum deductible for an HDHP is 1,400 for individual coverage and 2,800 for family coverage. The maximum out-of-pocket expense limit is 7,050 for individual coverage and 14,100 for family coverage. The annual contribution limit for HSAs is 3,650 for individual coverage and 7,300 for family coverage.

On the other hand, FSAs are offered by employers as part of their benefits package, and eligibility is typically determined by the employer. The annual contribution limit for FSAs is $2,850 in 2022. It’s essential to note that FSA contributions are made on a pre-tax basis, reducing your taxable income.

Key Benefits and Drawbacks

HSAs offer several benefits, including: * Triple tax benefits: Contributions are made with pre-tax dollars, the account grows tax-free, and withdrawals for qualified medical expenses are tax-free. * Portability: HSAs are owned by the individual, so you can take the account with you if you change jobs or retire. * Investment options: HSAs can be invested in a variety of assets, such as stocks, bonds, and mutual funds, allowing the account to grow over time.

However, HSAs also have some drawbacks: * Eligibility restrictions: You must have an HDHP to be eligible for an HSA. * Penalty for non-medical withdrawals: If you withdraw funds from an HSA for non-medical expenses before age 65, you’ll be subject to a 20% penalty and income tax on the withdrawal.

FSAs, on the other hand, offer: * Convenience: FSAs are often easier to set up and manage, as they are typically administered by the employer. * No eligibility restrictions: Anyone can contribute to an FSA, regardless of their health plan.

But FSAs also have some drawbacks: * Use-it-or-lose-it rule: If you don’t use the funds in your FSA by the end of the plan year, you’ll forfeit the remaining balance. * Limited investment options: FSAs typically don’t offer investment options, so the account won’t grow over time.

Comparison of HSA and FSA

The following table summarizes the key differences between HSAs and FSAs:

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Must have an HDHP | Offered by employer, no restrictions |

| Contribution limit | 3,650 (individual), 7,300 (family) | $2,850 |

| Portability | Account is owned by individual | Typically tied to employer |

| Investment options | Yes, variety of assets | No, limited or no investment options |

| Use-it-or-lose-it rule | No | Yes |

Which is Better: HSA or FSA?

The decision between an HSA and an FSA depends on your individual circumstances and priorities. If you have an HDHP and want to save for medical expenses on a tax-free basis, an HSA might be the better choice. However, if you don’t have an HDHP or prefer a more straightforward, employer-administered plan, an FSA could be a better fit.

Consider the following factors when deciding between an HSA and an FSA: * Healthcare needs: If you have ongoing medical expenses, an HSA might be a better option, as you can use the funds for qualified medical expenses without penalty. * Employer contributions: If your employer contributes to your FSA, it might be a more attractive option, as you’ll receive additional funds to help cover medical expenses. * Investment goals: If you want to grow your savings over time, an HSA might be a better choice, as you can invest the funds in a variety of assets.

📝 Note: It's essential to review your individual circumstances and priorities before deciding between an HSA and an FSA. Consider consulting with a financial advisor or tax professional to determine the best option for your needs.

In summary, both HSAs and FSAs can be valuable tools for saving for medical expenses, but it’s crucial to understand the differences between the two and choose the one that best aligns with your needs and priorities.

What is the main difference between an HSA and an FSA?

+

The main difference between an HSA and an FSA is that an HSA is tied to a high-deductible health plan (HDHP) and offers more flexibility and portability, while an FSA is offered by an employer and has a use-it-or-lose-it rule.

Can I have both an HSA and an FSA?

+

Yes, you can have both an HSA and an FSA, but you’ll need to ensure that you’re eligible for an HSA and that your FSA is a limited-purpose FSA, which can only be used for certain expenses, such as dental or vision care.

How do I choose between an HSA and an FSA?

+

To choose between an HSA and an FSA, consider your individual circumstances, such as your healthcare needs, employer contributions, and investment goals. It’s also essential to review the eligibility requirements, contribution limits, and usage rules for each account type.

Related Terms:

- HSA vs FSA comparison chart

- FSA vs HSA eligible expenses

- HSA vs FSA reddit

- Fsa account

- FSA or HSA eligible Amazon

- Using health savings account