Health Savings Administrators Guide

Introduction to Health Savings Administrators

A Health Savings Administrator (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses. As a health savings administrator, it is essential to understand the rules and regulations surrounding HSAs, as well as the benefits and advantages they offer to individuals and employers. In this guide, we will provide an overview of HSAs, including how they work, the benefits they offer, and the rules and regulations that govern them.

How Health Savings Administrators Work

HSAs are designed to work in conjunction with HDHPs, which are health insurance plans that have a higher deductible than traditional health insurance plans. To be eligible for an HSA, an individual must have an HDHP and cannot be covered by any other health insurance plan that is not an HDHP. The individual must also not be eligible for Medicare or be claimed as a dependent on someone else’s tax return. Contributions to an HSA can be made by the individual, their employer, or both. The contributions are tax-deductible, and the money in the account grows tax-free. The individual can then use the money in the account to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays.

Benefits of Health Savings Administrators

HSAs offer several benefits to individuals and employers, including: * Tax benefits: Contributions to an HSA are tax-deductible, and the money in the account grows tax-free. * Flexibility: HSAs can be used to pay for a wide range of qualified medical expenses, including doctor visits, prescriptions, and hospital stays. * Portability: HSAs are portable, meaning that the individual can take the account with them if they change jobs or retire. * Investment opportunities: Some HSAs offer investment opportunities, such as mutual funds or stocks, which can help the account grow over time. * Reduced premiums: HDHPs, which are required to have an HSA, often have lower premiums than traditional health insurance plans.

Rules and Regulations Governing Health Savings Administrators

There are several rules and regulations that govern HSAs, including: * Eligibility: To be eligible for an HSA, an individual must have an HDHP and cannot be covered by any other health insurance plan that is not an HDHP. * Contribution limits: There are limits on the amount of money that can be contributed to an HSA each year. * Qualified medical expenses: HSAs can only be used to pay for qualified medical expenses, which are defined by the IRS. * Reporting requirements: Individuals with HSAs are required to file Form 8889 with their tax return each year to report their HSA contributions and distributions.

Types of Health Savings Administrators

There are several types of HSAs, including: * Individual HSAs: These are HSAs that are owned by an individual and are funded with contributions from the individual or their employer. * Family HSAs: These are HSAs that are owned by a family and are funded with contributions from the family members or their employer. * Employer-sponsored HSAs: These are HSAs that are sponsored by an employer and are funded with contributions from the employer or the employee.

How to Choose a Health Savings Administrator

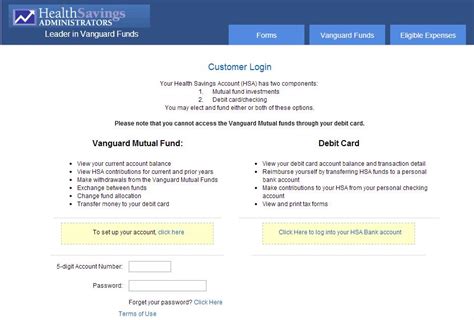

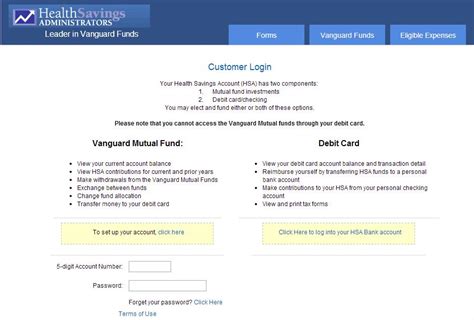

When choosing a health savings administrator, there are several factors to consider, including: * Fees: Look for an administrator that has low fees and minimal administrative costs. * Investment options: Consider an administrator that offers a range of investment options, such as mutual funds or stocks. * Customer service: Choose an administrator that has good customer service and is easy to work with. * Reputation: Research the administrator’s reputation and read reviews from other customers.

💡 Note: It's essential to carefully review the terms and conditions of an HSA before opening an account to ensure that it meets your needs and complies with the rules and regulations governing HSAs.

Best Practices for Health Savings Administrators

To get the most out of an HSA, it’s essential to follow best practices, including: * Contribute regularly: Make regular contributions to the HSA to take advantage of the tax benefits and to build up the account balance over time. * Invest wisely: Consider investing the money in the HSA to help it grow over time. * Keep track of expenses: Keep track of qualified medical expenses and save receipts and documentation to support the expenses. * Review and adjust: Regularly review the HSA and adjust the contributions and investments as needed.

| Year | Contribution Limit | Catch-up Contribution Limit |

|---|---|---|

| 2022 | $3,650 (individual), $7,300 (family) | $1,000 |

| 2023 | $3,850 (individual), $7,750 (family) | $1,000 |

In summary, health savings administrators play a crucial role in helping individuals and employers navigate the complex world of health savings accounts. By understanding the rules and regulations governing HSAs, as well as the benefits and advantages they offer, individuals and employers can make informed decisions about their health care and financial planning. Whether you’re an individual looking to save for medical expenses or an employer looking to offer a competitive benefits package, an HSA can be a valuable tool in achieving your goals.

What is a Health Savings Administrator?

+

A Health Savings Administrator is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses.

How do I contribute to a Health Savings Account?

+

Contributions to a Health Savings Account can be made by the individual, their employer, or both. The contributions are tax-deductible, and the money in the account grows tax-free.

What are the benefits of a Health Savings Account?

+

HSAs offer several benefits, including tax benefits, flexibility, portability, investment opportunities, and reduced premiums. They can be used to pay for a wide range of qualified medical expenses, and the account balance can be carried over from year to year.

Related Terms:

- Health savings Administrators Richmond VA

- Health equity adalah

- Health savings administrators login

- HSA Bank

- Health inequity

- Health Equity Indonesia