5 Savings Tips

Introduction to Savings

In today’s economy, saving money is more important than ever. With the rise of living costs and uncertainty about the future, having a safety net of savings can provide peace of mind and financial security. However, saving money can be challenging, especially when there are so many temptations to spend. In this article, we will discuss five savings tips that can help you achieve your financial goals.

Understanding the Importance of Savings

Before we dive into the savings tips, it’s essential to understand why saving money is crucial. Saving allows you to:

- Build an emergency fund to cover unexpected expenses

- Achieve long-term goals, such as buying a house or retiring comfortably

- Reduce financial stress and anxiety

- Take advantage of investment opportunities

Savings Tip 1: Create a Budget

The first step to saving money is to create a budget. A budget helps you track your income and expenses, making it easier to identify areas where you can cut back and allocate more funds to savings. To create a budget:

- Calculate your net income

- Track your expenses for a month to understand where your money is going

- Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies)

- Set financial goals and allocate a percentage of your income towards savings

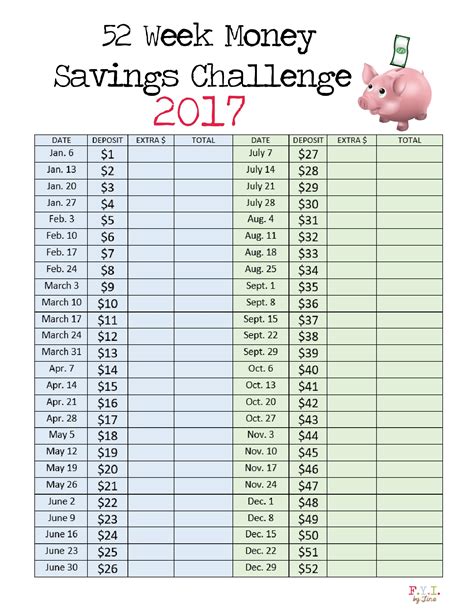

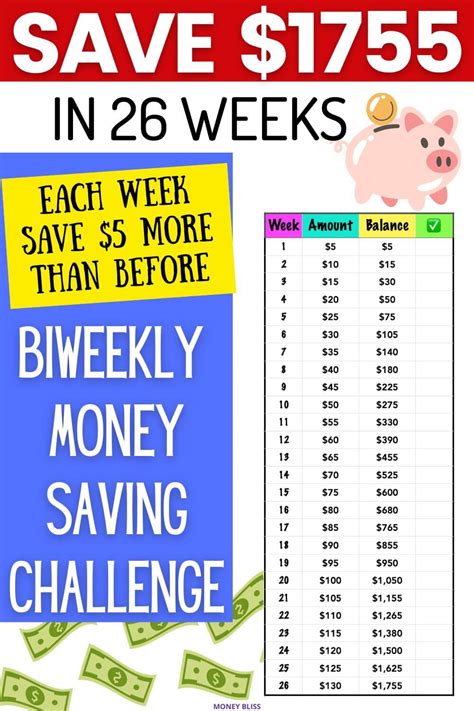

Savings Tip 2: Automate Your Savings

Automating your savings is a simple yet effective way to ensure that you save regularly. By setting up automatic transfers from your checking account to your savings or investment accounts, you can:

- Make saving easier and less prone to being neglected

- Take advantage of compound interest to grow your savings over time

- Reduce the temptation to spend money impulsively

Savings Tip 3: Cut Back on Unnecessary Expenses

Cutting back on unnecessary expenses is a great way to free up more money for savings. To do this:

- Identify areas where you can cut back, such as dining out or subscription services

- Find cheaper alternatives, such as cooking at home or canceling subscription services

- Use the 50/30/20 rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment

Savings Tip 4: Take Advantage of High-Yield Savings Accounts

High-yield savings accounts are a type of savings account that offers a higher interest rate than traditional savings accounts. By taking advantage of high-yield savings accounts, you can:

- Earn more interest on your savings over time

- Keep your money liquid and easily accessible

- Take advantage of low or no fees, depending on the account

Savings Tip 5: Avoid Lifestyle Inflation

Lifestyle inflation occurs when you increase your spending as your income increases. To avoid lifestyle inflation:

- Direct excess funds towards savings and debt repayment

- Avoid buying expensive items or upgrading to luxury brands

- Focus on saving and investing for the future, rather than indulging in present-day luxuries

💡 Note: Saving money requires discipline and patience, but the benefits are well worth the effort. By following these five savings tips, you can achieve financial stability and security, and enjoy a more peaceful and prosperous life.

In the end, saving money is a long-term process that requires commitment, discipline, and patience. By following these five savings tips and staying focused on your financial goals, you can achieve financial stability and security, and enjoy a more peaceful and prosperous life. Remember to always prioritize your savings, and don’t be afraid to seek help or advice when you need it.

What is the best way to start saving money?

+

The best way to start saving money is to create a budget and automate your savings. By tracking your income and expenses, you can identify areas where you can cut back and allocate more funds to savings. Setting up automatic transfers from your checking account to your savings or investment accounts can also make saving easier and less prone to being neglected.

How can I avoid lifestyle inflation?

+

To avoid lifestyle inflation, direct excess funds towards savings and debt repayment, and avoid buying expensive items or upgrading to luxury brands. Focus on saving and investing for the future, rather than indulging in present-day luxuries. By doing so, you can ensure that your savings grow over time and you achieve your long-term financial goals.

What is the benefit of using a high-yield savings account?

+

The benefit of using a high-yield savings account is that it offers a higher interest rate than traditional savings accounts, allowing you to earn more interest on your savings over time. High-yield savings accounts also keep your money liquid and easily accessible, and often come with low or no fees, depending on the account.