5 Health Savings Tips

Introduction to Health Savings

When it comes to managing our health, it’s easy to get caught up in the cost of medical expenses, insurance, and wellness programs. However, there are several ways to save money while still prioritizing our health. In this article, we will explore five health savings tips that can help you reduce your medical expenses and improve your overall well-being.

By implementing these tips, you can take control of your health and your finances, ensuring that you're getting the best value for your money. Whether you're looking to save on medical bills, reduce your insurance costs, or simply live a healthier lifestyle, these tips can help.

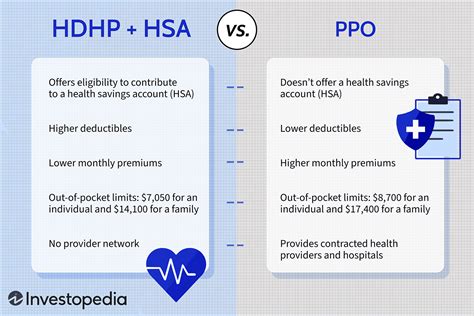

Tip 1: Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be overwhelming, but it’s crucial for saving money on medical expenses. When selecting a plan, consider the following factors:

- Premium costs: Calculate how much you’ll pay each month for your insurance premium.

- Deductible: Determine how much you’ll need to pay out-of-pocket before your insurance kicks in.

- Co-payments and co-insurance: Understand how much you’ll pay for doctor visits, prescriptions, and other medical services.

- Network providers: Make sure your primary care physician and any specialists you see are part of the plan’s network.

By carefully evaluating these factors, you can choose a plan that meets your needs and budget, helping you save money in the long run.

Tip 2: Take Advantage of Preventive Care

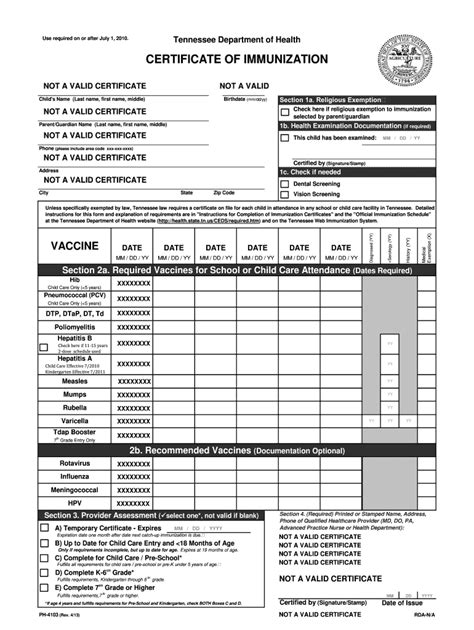

Preventive care is a crucial aspect of maintaining good health, and it can also help you save money. Many health insurance plans cover preventive services, such as:

- Annual physicals: Stay on top of your health with regular check-ups.

- Vaccinations: Protect yourself from illnesses like the flu, HPV, and COVID-19.

- Screenings: Get tested for conditions like diabetes, high blood pressure, and certain types of cancer.

- Mental health services: Prioritize your mental well-being with counseling and therapy sessions.

By taking advantage of these preventive services, you can catch potential health issues early on, reducing the need for costly treatments and medications.

Tip 3: Shop Around for Prescription Medications

Prescription medications can be expensive, but there are ways to save money. Here are a few tips:

- Compare prices: Check prices at different pharmacies to find the best deal.

- Use generics: Opt for generic versions of your medications, which are often cheaper than brand-name options.

- Look for discounts: Take advantage of discounts and coupons offered by pharmaceutical companies or online retailers.

- Consider mail-order pharmacies: Mail-order pharmacies can often provide lower prices and convenience.

By shopping around and exploring different options, you can save money on your prescription medications without compromising your health.

Tip 4: Prioritize Healthy Habits

Maintaining a healthy lifestyle is one of the best ways to save money on medical expenses. By prioritizing healthy habits, such as:

- Eating a balanced diet: Focus on whole foods, fruits, and vegetables to reduce your risk of chronic diseases.

- Exercising regularly: Aim for at least 30 minutes of moderate-intensity exercise per day.

- Getting enough sleep: Aim for 7-9 hours of sleep per night to help your body repair and recharge.

- Managing stress: Engage in stress-reducing activities like meditation, yoga, or deep breathing exercises.

By incorporating these healthy habits into your daily routine, you can reduce your risk of developing costly health conditions and improve your overall well-being.

Tip 5: Keep Track of Your Medical Expenses

Keeping track of your medical expenses can help you identify areas where you can cut back and save money. Consider using a:

| Category | Monthly Cost |

|---|---|

| Insurance premium | 200</td> </tr> <tr> <td>Co-payments</td> <td>50 |

| Prescription medications | 100</td> </tr> <tr> <td>Total</td> <td>350 |

By monitoring your expenses and staying on top of your finances, you can make informed decisions about your health care and save money in the long run.

💡 Note: It's essential to review your insurance plan and medical expenses regularly to ensure you're getting the best value for your money.

In summary, saving money on health expenses requires a combination of careful planning, smart decision-making, and healthy habits. By choosing the right insurance plan, taking advantage of preventive care, shopping around for prescription medications, prioritizing healthy habits, and keeping track of your medical expenses, you can reduce your medical bills and improve your overall well-being.

What is the most important factor to consider when choosing a health insurance plan?

+

The most important factor to consider when choosing a health insurance plan is your individual or family’s specific health needs and budget. Consider factors such as premium costs, deductible, co-payments, and network providers to ensure you’re getting the best value for your money.

How can I save money on prescription medications?

+

You can save money on prescription medications by comparing prices, using generics, looking for discounts, and considering mail-order pharmacies. Additionally, ask your doctor or pharmacist if there are any cheaper alternative medications available.

What are some healthy habits that can help reduce medical expenses?

+

Healthy habits such as eating a balanced diet, exercising regularly, getting enough sleep, and managing stress can help reduce your risk of developing costly health conditions. By prioritizing these habits, you can improve your overall well-being and reduce your medical expenses.

Related Terms:

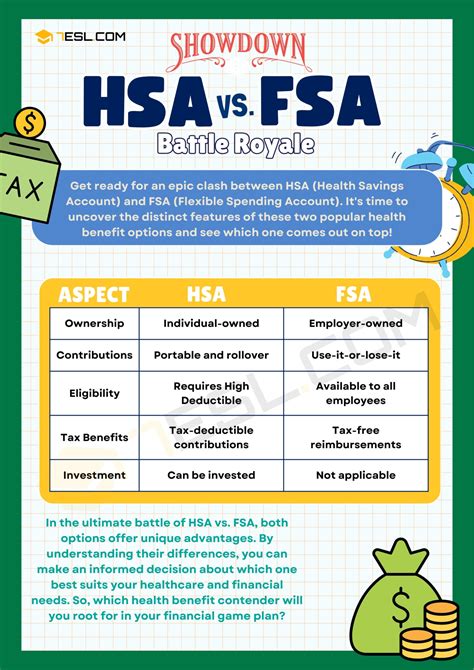

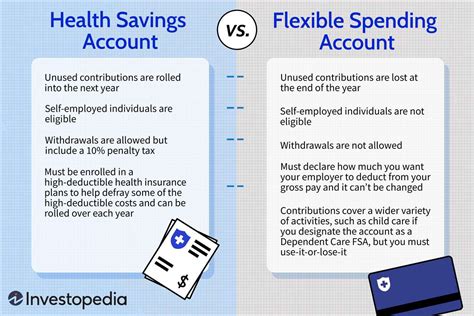

- FSA vs HSA eligible expenses

- FSA HSA Medicaid

- HSA vs PPO

- hsa fsa meaning

- HSA vs HRA

- health equity fsa